- United States

- /

- Software

- /

- NYSE:PCOR

A Look At Procore Technologies (PCOR) Valuation After FedRAMP Approval And Datagrid AI Acquisition

Procore Technologies (PCOR) has put fresh attention on its stock after its Procore for Government platform received FedRAMP Moderate Authorization and the company acquired Datagrid to deepen its AI capabilities in construction software.

See our latest analysis for Procore Technologies.

Despite the FedRAMP approval and the Datagrid acquisition, Procore's recent share price performance has been weak, with a 30 day share price return of a 31.27% decline and a 1 year total shareholder return of a 32.02% decline. This suggests momentum has been fading even as the company pursues new growth avenues.

If Procore's recent moves in construction tech have your attention, it could be a good moment to broaden your watchlist with 33 AI infrastructure stocks as potential next ideas to research.

With Procore shares down sharply over the past year, trading at a reported intrinsic discount of about 39% and a material gap to analyst targets, you have to ask yourself: is there real upside left here, or is the market already pricing in future growth?

Most Popular Narrative: 41.4% Undervalued

With Procore shares at $51.29 and the most followed narrative pointing to a fair value near $87.53, the gap in expectations is hard to ignore.

The demonstrated operating leverage from recent go to market changes and increased sales efficiency is already delivering improved operating margins, management's commitment to further expand margins (targeting 25% to 40% FCF margins long term) suggests future earnings and cash flow growth may be underestimated in current valuations.

Curious how that margin story translates into the $87.53 fair value? Revenue growth, profitability timing, and a rich future earnings multiple all sit at the core. Want to see exactly how those pieces fit together in the full narrative?

Result: Fair Value of $87.53 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, this upside story could easily be knocked off course if construction activity stays weak for longer or if new AI driven rivals start to pressure pricing and retention.

Find out about the key risks to this Procore Technologies narrative.

Another View: What The Sales Multiple Is Telling You

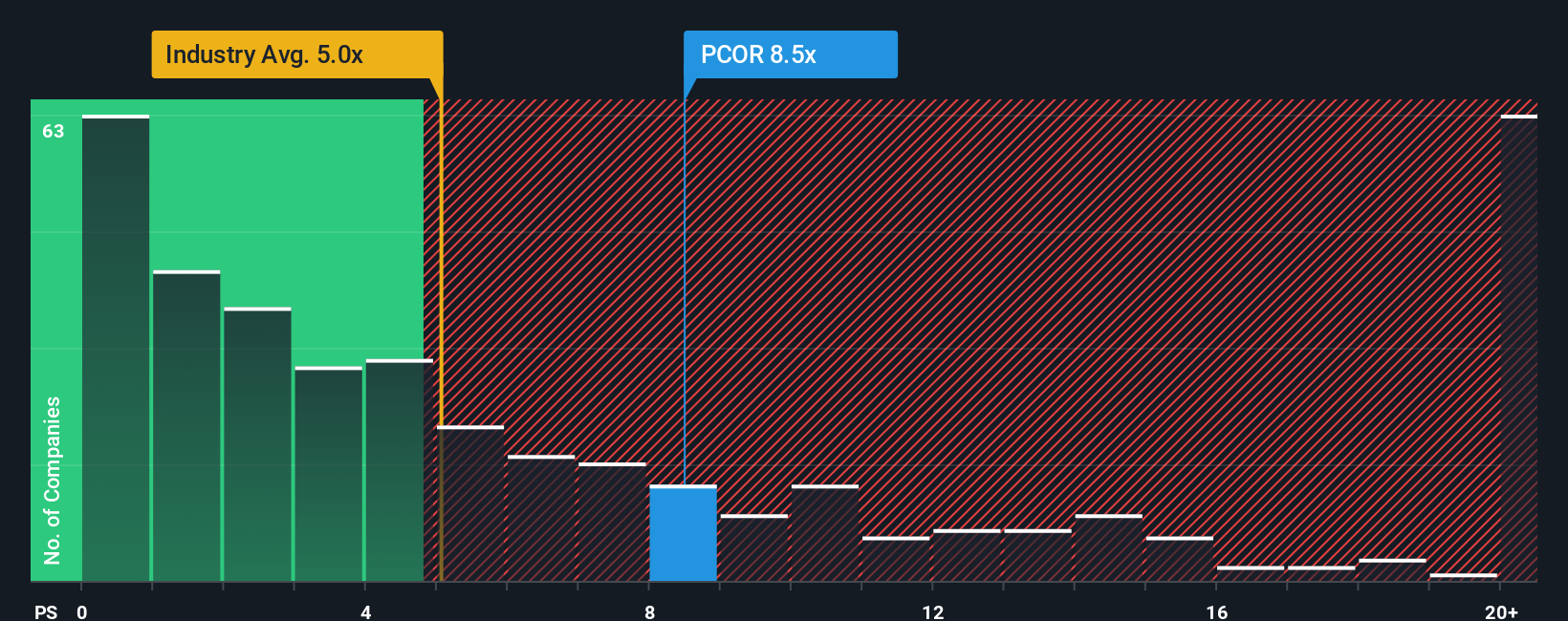

While our DCF model points to Procore trading about 39.4% below fair value at $84.69, the P/S ratio paints a tighter picture. At 6.3x sales, the stock sits slightly above its 6.1x fair ratio and well above the US Software average of 3.7x, yet below peer levels at 8.1x. So is this a margin of safety or a premium that still needs more proof?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Procore Technologies Narrative

If some of these conclusions do not sit right with you or you prefer to lean on your own work, you can quickly build a personalized view of Procore's numbers and story in just a few minutes using Do it your way.

A great starting point for your Procore Technologies research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

If Procore sits on your watchlist already, do not stop there; broaden your opportunity set with focused stock ideas shaped by clear fundamentals and risk profiles.

- Target long term value hunters by reviewing companies our screener flags as 53 high quality undervalued stocks that you might want to research next.

- Prioritize resilience and support peace of mind by scanning businesses in the 86 resilient stocks with low risk scores that score well on our risk checks.

- Spot potential early stage opportunities before the crowd by checking the 25 elite penny stocks with strong financials that pass our basic quality filters.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:PCOR

Procore Technologies

Provides a cloud-based construction management platform and related products and services in the United States and internationally.

Flawless balance sheet with high growth potential.

Similar Companies

Market Insights

Weekly Picks

Is Ubisoft the Market’s Biggest Pricing Error? Why Forensic Value Points to €33 Per Share

EU#4 - Turning Heritage into the World’s Strongest Luxury Empire

The "Easy Money" Is Gone: Why Alphabet Is Now a "Show Me" Story

Recently Updated Narratives

Future PE of 12.8x Shines Bright for FactSet Growth

BIPC: A strategic player in the energy crisis, a hybrid of Utility and Digital REIT.

Quintessential serial acquirer

Popular Narratives

Undervalued Key Player in Magnets/Rare Earth

Is Ubisoft the Market’s Biggest Pricing Error? Why Forensic Value Points to €33 Per Share

The "Sleeping Giant" Stumbles, Then Wakes Up

Trending Discussion

As a gamer, I would not touch this company now. They are hated by the community and have been releasing major flops on their AAA games during the last 5 years (for good reasons). It is true that the valuation is ridiculously low compared to what the licenses are worth, but if the trend continues the value of those will also decline. Management needs to almost make a 180° turnaround to get things right. I agree that a take-private deal before it is too late might be the best option for an investor entering today. We might also see a split sales of the different studios. It is a very risky play, but potentially with high reward.