- United States

- /

- Professional Services

- /

- NYSE:PAYC

Is Paycom Software, Inc.'s(NYSE:PAYC) Recent Stock Performance Tethered To Its Strong Fundamentals?

Paycom Software (NYSE:PAYC) has had a great run on the share market with its stock up by a significant 38% over the last three months. Given that the market rewards strong financials in the long-term, we wonder if that is the case in this instance. Specifically, we decided to study Paycom Software's ROE in this article.

Return on equity or ROE is an important factor to be considered by a shareholder because it tells them how effectively their capital is being reinvested. In short, ROE shows the profit each dollar generates with respect to its shareholder investments.

Check out our latest analysis for Paycom Software

How To Calculate Return On Equity?

The formula for ROE is:

Return on Equity = Net Profit (from continuing operations) ÷ Shareholders' Equity

So, based on the above formula, the ROE for Paycom Software is:

21% = US$169m ÷ US$792m (Based on the trailing twelve months to June 2021).

The 'return' is the yearly profit. Another way to think of that is that for every $1 worth of equity, the company was able to earn $0.21 in profit.

What Has ROE Got To Do With Earnings Growth?

We have already established that ROE serves as an efficient profit-generating gauge for a company's future earnings. Based on how much of its profits the company chooses to reinvest or "retain", we are then able to evaluate a company's future ability to generate profits. Assuming everything else remains unchanged, the higher the ROE and profit retention, the higher the growth rate of a company compared to companies that don't necessarily bear these characteristics.

Paycom Software's Earnings Growth And 21% ROE

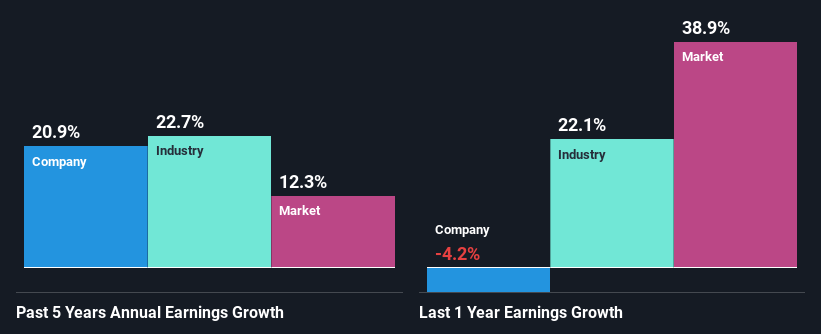

At first glance, Paycom Software seems to have a decent ROE. On comparing with the average industry ROE of 12% the company's ROE looks pretty remarkable. This probably laid the ground for Paycom Software's significant 21% net income growth seen over the past five years. We believe that there might also be other aspects that are positively influencing the company's earnings growth. Such as - high earnings retention or an efficient management in place.

Next, on comparing Paycom Software's net income growth with the industry, we found that the company's reported growth is similar to the industry average growth rate of 23% in the same period.

The basis for attaching value to a company is, to a great extent, tied to its earnings growth. The investor should try to establish if the expected growth or decline in earnings, whichever the case may be, is priced in. This then helps them determine if the stock is placed for a bright or bleak future. If you're wondering about Paycom Software's's valuation, check out this gauge of its price-to-earnings ratio, as compared to its industry.

Is Paycom Software Efficiently Re-investing Its Profits?

Paycom Software doesn't pay any dividend currently which essentially means that it has been reinvesting all of its profits into the business. This definitely contributes to the high earnings growth number that we discussed above.

Summary

Overall, we are quite pleased with Paycom Software's performance. Specifically, we like that the company is reinvesting a huge chunk of its profits at a high rate of return. This of course has caused the company to see substantial growth in its earnings. That being so, the latest analyst forecasts show that the company will continue to see an expansion in its earnings. To know more about the latest analysts predictions for the company, check out this visualization of analyst forecasts for the company.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About NYSE:PAYC

Paycom Software

Provides cloud-based human capital management (HCM) solution delivered as software-as-a-service for small to mid-sized companies in the United States.

Flawless balance sheet and undervalued.

Similar Companies

Market Insights

Weekly Picks

An Undervalued 3.3Moz Gold Project in Canada

Coca-Cola’s Enduring Moat in a Health-Conscious World: Steady Compounder Poised for 5-10% Annual Returns Through Emerging Market Dominance

Xero: Growth Was Priced In — Execution Is Not

Nu holdings will continue to disrupt the South American banking market

Recently Updated Narratives

The NVIDIA Phenomenon

Take Two Interactive Software TTWO Valuation Analysis

Recursion Pharmaceuticals! WTH is going on?

Popular Narratives

Is Ubisoft the Market’s Biggest Pricing Error? Why Forensic Value Points to €33 Per Share

Analyst Commentary Highlights Microsoft AI Momentum and Upward Valuation Amid Growth and Competitive Risks

Nu holdings will continue to disrupt the South American banking market

Trending Discussion