- United States

- /

- Professional Services

- /

- NYSE:PAYC

Does Paycom Software (NYSE:PAYC) Deserve A Spot On Your Watchlist?

For beginners, it can seem like a good idea (and an exciting prospect) to buy a company that tells a good story to investors, even if it completely lacks a track record of revenue and profit. Unfortunately, high risk investments often have little probability of ever paying off, and many investors pay a price to learn their lesson.

If, on the other hand, you like companies that have revenue, and even earn profits, then you may well be interested in Paycom Software (NYSE:PAYC). Now, I'm not saying that the stock is necessarily undervalued today; but I can't shake an appreciation for the profitability of the business itself. In comparison, loss making companies act like a sponge for capital - but unlike such a sponge they do not always produce something when squeezed.

See our latest analysis for Paycom Software

How Fast Is Paycom Software Growing Its Earnings Per Share?

Over the last three years, Paycom Software has grown earnings per share (EPS) like young bamboo after rain; fast, and from a low base. So I don't think the percent growth rate is particularly meaningful. As a result, I'll zoom in on growth over the last year, instead. Over twelve months, Paycom Software increased its EPS from US$2.67 to US$2.90. That's a modest gain of 8.6%.

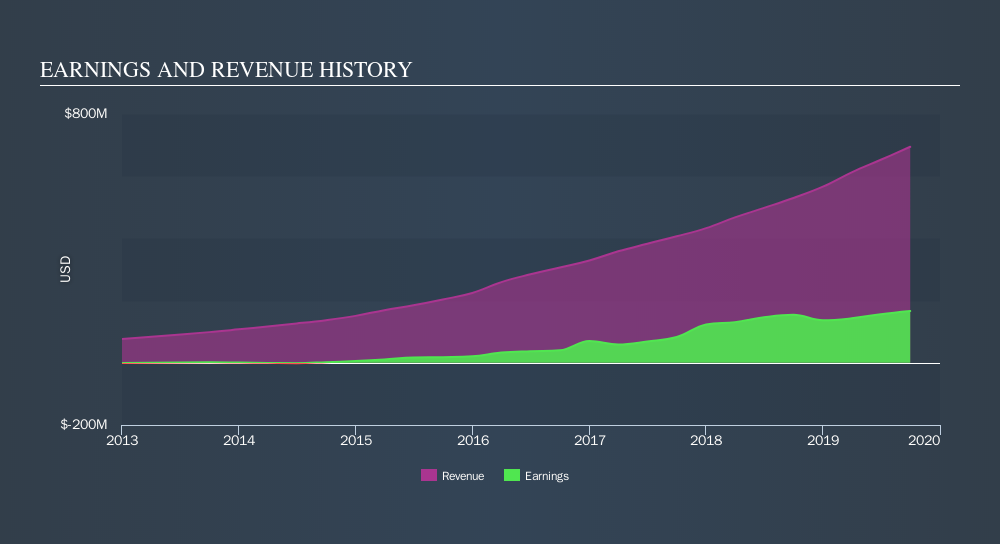

One way to double-check a company's growth is to look at how its revenue, and earnings before interest and tax (EBIT) margins are changing. Paycom Software maintained stable EBIT margins over the last year, all while growing revenue 31% to US$695m. That's progress.

You can take a look at the company's revenue and earnings growth trend, in the chart below. For the actual numbers consult this detailed graph.

The trick, as an investor, is to find companies that are going to perform well in the future, not just in the past. To that end, right now and today, you can check our visualization of consensus analyst forecasts for future Paycom Software EPS 100% free.

Are Paycom Software Insiders Aligned With All Shareholders?

Since Paycom Software has a market capitalization of US$13b, we wouldn't expect insiders to hold a large percentage of shares. But we do take comfort from the fact that they are investors in the company. Indeed, they have a glittering mountain of wealth invested in it, currently valued at US$1.2b. This suggests to me that leadership will be very mindful of shareholders' interests when making decisions!

Does Paycom Software Deserve A Spot On Your Watchlist?

One important encouraging feature of Paycom Software is that it is growing profits. Just as polish makes silverware pop, the high level of insider ownership enhances my enthusiasm for this growth. The combination sparks joy for me, so I'd consider keeping the company on a watchlist. If you think Paycom Software might suit your style as an investor, you could go straight to its annual report, or you could first check our discounted cash flow (DCF) valuation for the company.

You can invest in any company you want. But if you prefer to focus on stocks that have demonstrated insider buying, here is a list of companies with insider buying in the last three months.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.

About NYSE:PAYC

Paycom Software

Provides cloud-based human capital management (HCM) solution delivered as software-as-a-service for small to mid-sized companies in the United States.

Flawless balance sheet and slightly overvalued.

Similar Companies

Market Insights

Community Narratives