- United States

- /

- Software

- /

- NYSE:PATH

UiPath (PATH) Is Up 32.2% After Partnering with OpenAI, NVIDIA, Google, and Snowflake

Reviewed by Sasha Jovanovic

- In early October 2025, UiPath announced a series of high-profile partnerships with OpenAI, NVIDIA, Google, and Snowflake, integrating advanced AI capabilities, including conversational agents, data-driven automation, and enterprise-grade AI orchestration, across its Agentic Automation platform.

- These collaborations position UiPath to accelerate enterprise adoption of AI-powered automation, strengthening its role as a central solutions provider for organizations seeking to optimize processes and realize AI-driven operational gains.

- Let's explore how UiPath's integration of OpenAI's ChatGPT and NVIDIA's AI into automated workflows could impact its investment case.

Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

UiPath Investment Narrative Recap

UiPath’s investment story centers on its ability to drive long-term growth by enabling enterprises to automate complex workflows through AI-powered agentic automation. The recent surge in high-profile AI partnerships, such as with OpenAI, NVIDIA, Google, and Snowflake, has energized short-term enthusiasm. However, the biggest current catalyst remains successful adoption and monetization of these AI integrations, while the most important risk continues to be potential delays in enterprise deal closures as geopolitical and macroeconomic factors create uncertainty. Whether these new alliances are enough to offset caution around short-term revenue execution is yet to be seen.

Among the recent developments, UiPath’s collaboration with OpenAI to connect ChatGPT models with enterprise workflows stands out. By blending OpenAI’s generative AI with UiPath Maestro’s orchestration, the company is positioning itself to accelerate automation efforts and potentially boost customer stickiness, key to driving faster value realization from agentic automation, which underpins the company’s near-term growth thesis.

In contrast, investors should be especially aware that short-term revenue could still be impacted if...

Read the full narrative on UiPath (it's free!)

UiPath's narrative projects $1.9 billion in revenue and $243.6 million in earnings by 2028. This requires 8.6% yearly revenue growth and a $311.1 million increase in earnings from -$67.5 million currently.

Uncover how UiPath's forecasts yield a $13.44 fair value, a 21% downside to its current price.

Exploring Other Perspectives

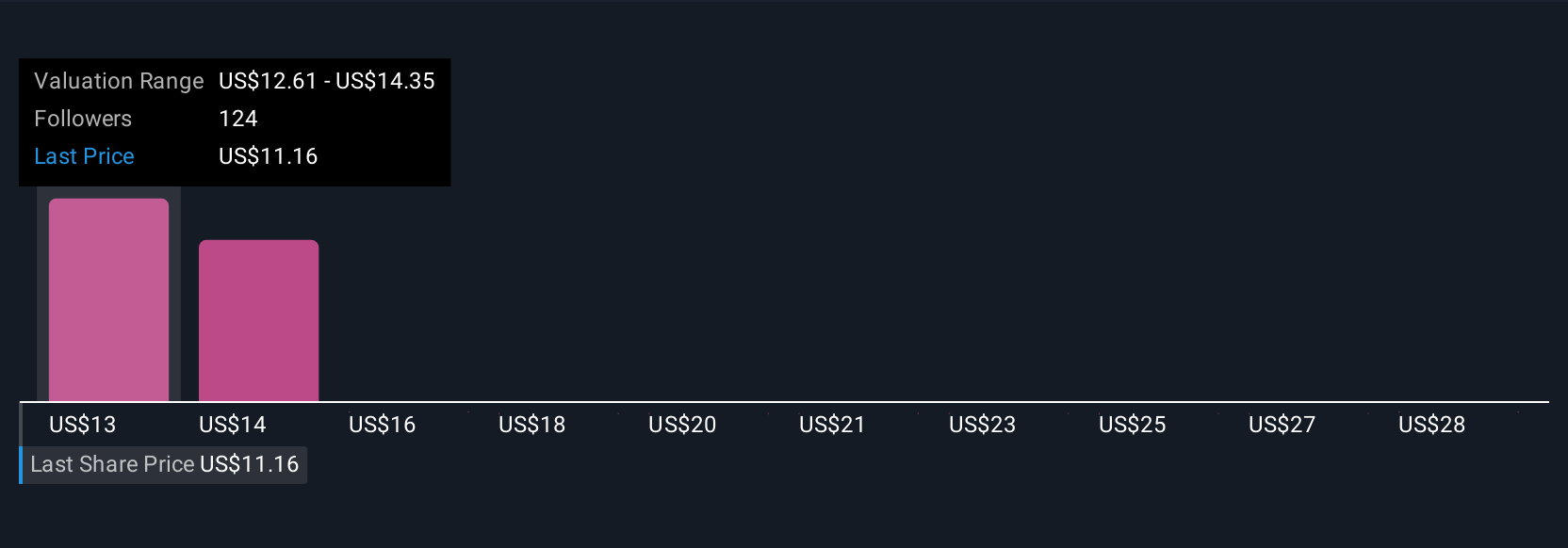

Private fair value estimates for UiPath from 11 members of the Simply Wall St Community range from US$12.61 to US$30. Despite this spread, macroeconomic volatility and uncertain customer budgets remain central concerns that could influence future revenue predictability. Discover how wide these viewpoints can be and weigh them against your own analysis.

Explore 11 other fair value estimates on UiPath - why the stock might be worth 26% less than the current price!

Build Your Own UiPath Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your UiPath research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

- Our free UiPath research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate UiPath's overall financial health at a glance.

Ready To Venture Into Other Investment Styles?

Opportunities like this don't last. These are today's most promising picks. Check them out now:

- Find companies with promising cash flow potential yet trading below their fair value.

- The latest GPUs need a type of rare earth metal called Terbium and there are only 35 companies in the world exploring or producing it. Find the list for free.

- AI is about to change healthcare. These 32 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:PATH

UiPath

Provides an end-to-end automation platform that offers a range of robotic process automation (RPA) solutions primarily in the United States, Romania, the United Kingdom, the Netherlands, and internationally.

Flawless balance sheet with acceptable track record.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Airbnb Stock: Platform Growth in a World of Saturation and Scrutiny

Adobe Stock: AI-Fueled ARR Growth Pushes Guidance Higher, But Cost Pressures Loom

Thomson Reuters Stock: When Legal Intelligence Becomes Mission-Critical Infrastructure

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

The AI Infrastructure Giant Grows Into Its Valuation

Trending Discussion