- United States

- /

- Software

- /

- NYSE:PATH

UiPath (PATH): Is the Latest Share Price Swing Justified by Current Valuation?

Reviewed by Simply Wall St

UiPath (PATH) caught the attention of investors this week after experiencing modest shifts in its share price. With the stock showing a dip over the past month but gains in the past 3 months, many are taking a closer look at what is driving these movements.

See our latest analysis for UiPath.

UiPath’s share price swung lower over the last month but remains well above its spring lows. A 28% gain over the past three months signals renewed investor interest. Looking over the past year, the 13.4% total shareholder return hints at both volatility and underlying growth potential as the automation sector evolves.

If UiPath's momentum has you thinking bigger, this could be your signal to broaden your search and discover fast growing stocks with high insider ownership

With UiPath boasting recent gains but already trading near analyst price targets, investors must decide if the current valuation represents an attractive entry point or if the market has already priced in future growth prospects.

Most Popular Narrative: 2% Overvalued

UiPath’s narrative-driven fair value of $13.71 edges below its latest closing price of $14.03, putting the stock slightly above consensus expectations. With analyst projections driving the current market conversation, investors face a split between anticipated growth and the price already being paid.

UiPath's commitment to cloud offerings, with over $975 million in cloud ARR, positions the company to capitalize on AI-driven products and services, which could contribute to revenue growth and improved gross margins.

Curious how a deep bet on automation, AI products, and cloud may shape UiPath’s future? The real surprise is the ambitious financial turnaround hidden in the narrative. Find out what growth assumption propels this valuation now.

Result: Fair Value of $13.71 (OVERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, ongoing macroeconomic volatility and delays in customer deal closures could quickly undermine even robust automation growth projections for UiPath.

Find out about the key risks to this UiPath narrative.

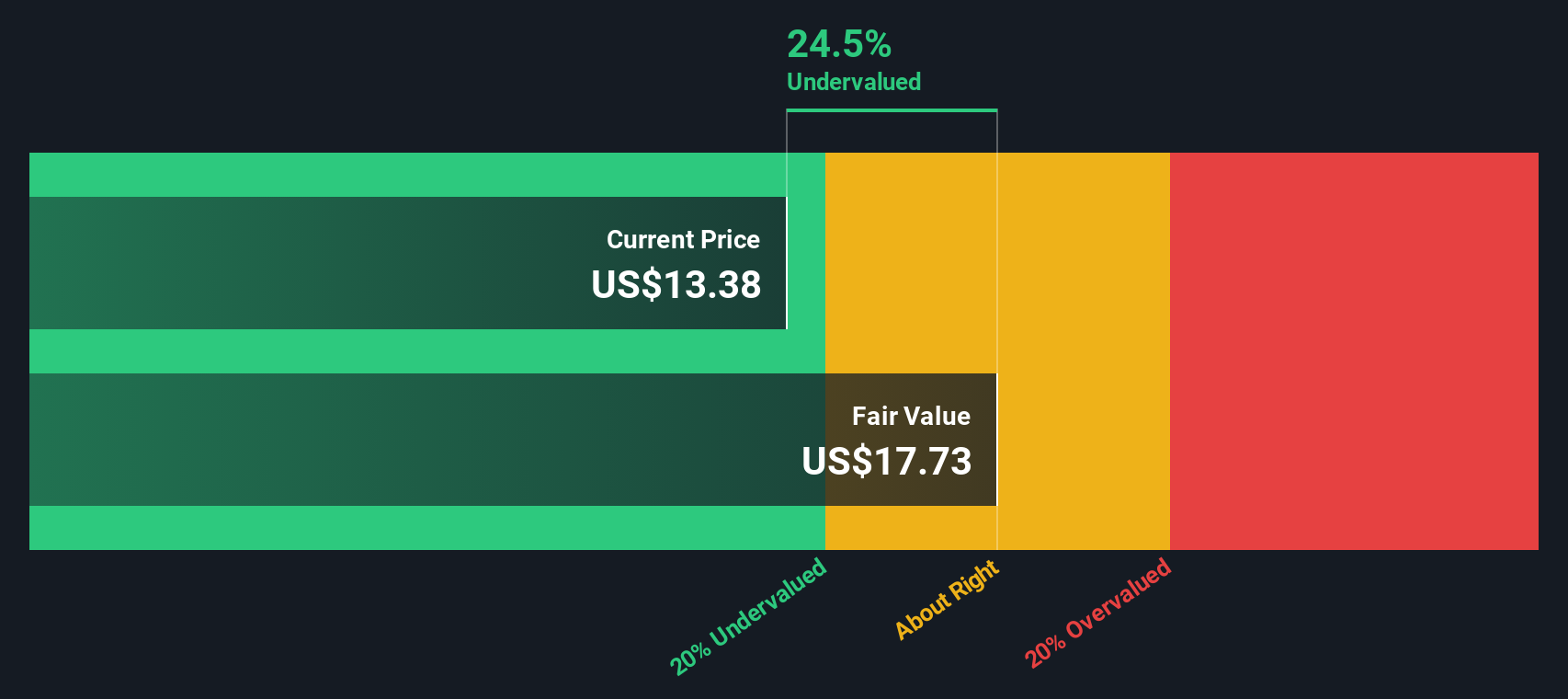

Another View: Discounted Cash Flow Says Undervalued

While the narrative-driven valuation sees UiPath as slightly overvalued, our DCF model offers a strikingly different picture. It suggests UiPath shares are currently trading about 23% below their calculated fair value. How can one stock appear overvalued and undervalued at the same time?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out UiPath for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 879 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own UiPath Narrative

If you want a different perspective or prefer analyzing the numbers yourself, it takes less than three minutes to craft your own approach with Do it your way

A great starting point for your UiPath research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

Don’t wait for the crowd to catch on. Simply Wall Street’s screener is your ticket to stocks with untapped potential, unique trends, and smarter opportunities.

- Catch income opportunities and secure steady returns when you check out these 16 dividend stocks with yields > 3% with above-average payouts for investors who value consistency.

- Unlock the next breakthroughs in AI by following these 25 AI penny stocks to discover companies that are set to shape industries, transform businesses, and generate tomorrow’s winners.

- Capitalize on hidden value by seeking out these 879 undervalued stocks based on cash flows that are identified through cash flow analysis and strong financials.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:PATH

UiPath

Provides an end-to-end automation platform that offers a range of robotic process automation (RPA) solutions primarily in the United States, Romania, the United Kingdom, the Netherlands, and internationally.

Flawless balance sheet and good value.

Similar Companies

Market Insights

Community Narratives