- United States

- /

- Software

- /

- NYSE:PATH

How Investors Are Reacting To UiPath (PATH) Ahead of Anticipated Earnings and AI Strategy Update

Reviewed by Sasha Jovanovic

- In recent weeks, investor attention on UiPath has increased as the company prepares to announce its earnings report on December 3, 2025, amid expectations for both revenue and earnings growth compared to the prior year.

- Amid sector volatility, UiPath has consistently surpassed consensus earnings estimates and continues to strengthen its fundamentals through cost discipline and new AI initiatives.

- We'll now consider how investor optimism about UiPath's upcoming earnings could influence its automation-focused investment story.

Find companies with promising cash flow potential yet trading below their fair value.

UiPath Investment Narrative Recap

To be a shareholder in UiPath, you need to believe in the company's vision for AI-driven automation, the rapid adoption of its platform, and its ability to sustain earnings momentum as sector volatility persists. The latest news highlights near-term optimism heading into the December 3 earnings report, but it does not materially shift the top short-term catalyst, upcoming earnings surprises, or the principal risk of near-term deal slippage and cautious customer budgets impacting future revenue visibility.

Among recent developments, UiPath's extended run of beating earnings estimates stands out as especially relevant. This track record supports the narrative that robust operational execution could be a significant catalyst for share price resilience, particularly as investors focus on profitability milestones, even if macroeconomic and sector headwinds linger.

On the other hand, investors should be aware that deal delays tied to client caution and shifting budgets could...

Read the full narrative on UiPath (it's free!)

UiPath's outlook anticipates $1.9 billion in revenue and $243.6 million in earnings by 2028. This is based on an expected 8.6% annual revenue growth and an increase in earnings of $311.1 million from the current level of -$67.5 million.

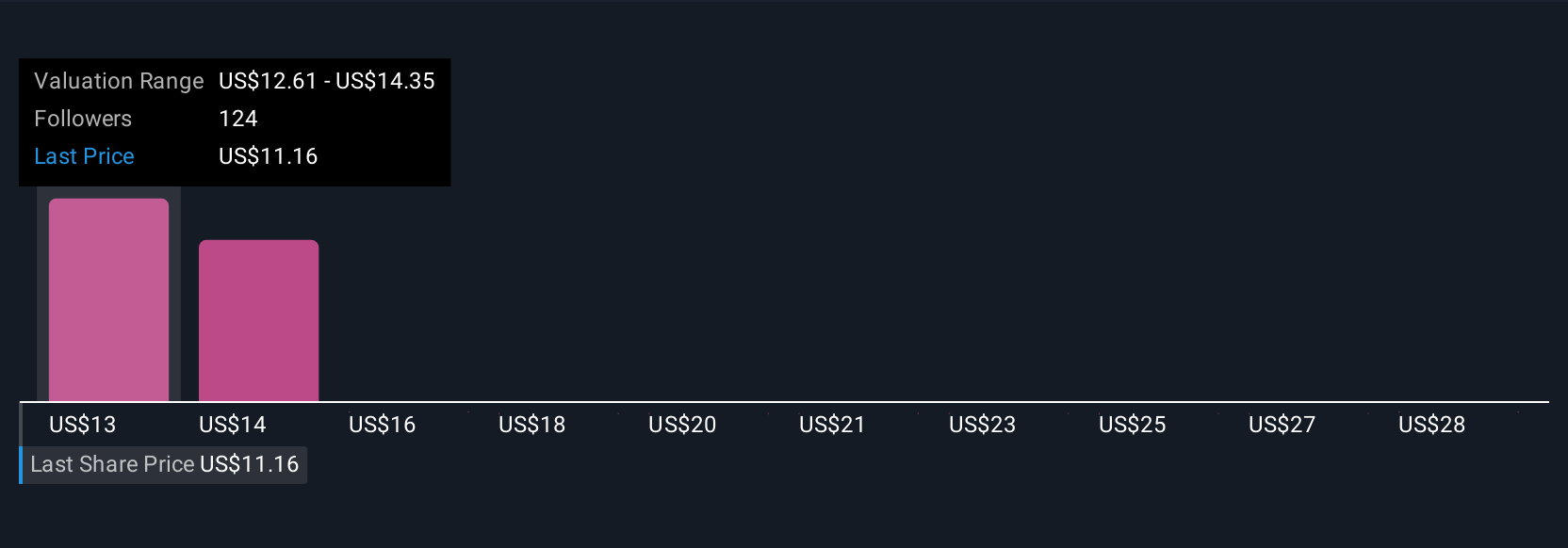

Uncover how UiPath's forecasts yield a $13.71 fair value, a 3% downside to its current price.

Exploring Other Perspectives

Thirteen members of the Simply Wall St Community assessed UiPath's fair value, with estimates spanning US$13.70 to US$30.00 per share. While many expect accelerating earnings growth, ongoing caution around revenue timing could impact outcomes, so consider exploring these diverse views as you form your own perspective.

Explore 13 other fair value estimates on UiPath - why the stock might be worth over 2x more than the current price!

Build Your Own UiPath Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your UiPath research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

- Our free UiPath research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate UiPath's overall financial health at a glance.

Interested In Other Possibilities?

Don't miss your shot at the next 10-bagger. Our latest stock picks just dropped:

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

- These 15 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- Outshine the giants: these 26 early-stage AI stocks could fund your retirement.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:PATH

UiPath

Provides an end-to-end automation platform that offers a range of robotic process automation (RPA) solutions primarily in the United States, Romania, the United Kingdom, the Netherlands, and internationally.

Flawless balance sheet and good value.

Similar Companies

Market Insights

Community Narratives