- United States

- /

- Software

- /

- NYSE:PAR

PAR Technology (PAR): Assessing Valuation After Refuel Partnership and Cloud Platform Expansion

Reviewed by Kshitija Bhandaru

PAR Technology (PAR) has just partnered with Refuel Operating Co. to launch a new platform designed to boost customer engagement and sales. This move underscores PAR’s evolving focus on integrated cloud-based food industry solutions.

See our latest analysis for PAR Technology.

While PAR Technology’s new partnership adds strategic momentum, recent share price returns have reflected some investor uncertainty. The one-month share price return is -17.76%, with a steeper 90-day drop of -47.51%. Despite these setbacks, its three-year total shareholder return remains positive, suggesting the company’s transformation could still offer long-term value for patient investors.

If PAR’s cloud pivot has sparked your curiosity, this could be the perfect time to uncover opportunities among fast growing stocks with high insider ownership.

Given PAR Technology’s recent volatility and its ongoing long-term transformation, the key question for investors is whether the current dip signals an undervalued entry point or if future growth is already fully reflected in today’s price.

Most Popular Narrative: 52% Undervalued

With PAR Technology’s narrative fair value of $76 versus the last close of $36.20, expectations for growth and transformation are running high. This narrative sets ambitious targets, pointing toward significant operational improvements and future milestones.

PAR's expanded, unified, cloud-native platform (including PAR OPS, Engagement Cloud, and AI-driven tools like Coach AI) is positioned to benefit from industry-wide modernization and demand for operational efficiency, automation, and actionable analytics, secular drivers that should support sustained ARR and earnings growth.

Want to know why this narrative expects a dramatic profit turnaround? The secret ingredient: a bold leap in margins and revenue growth projections beyond sector norms. Don’t miss the details that could change how you value PAR Technology’s stock. Find out what really underpins this ambitious outlook.

Result: Fair Value of $76 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, slower than expected rollouts or intensified competition could quickly shift the outlook and test the bullish narrative for PAR Technology’s future.

Find out about the key risks to this PAR Technology narrative.

Another View: Multiples Tell a Cautious Story

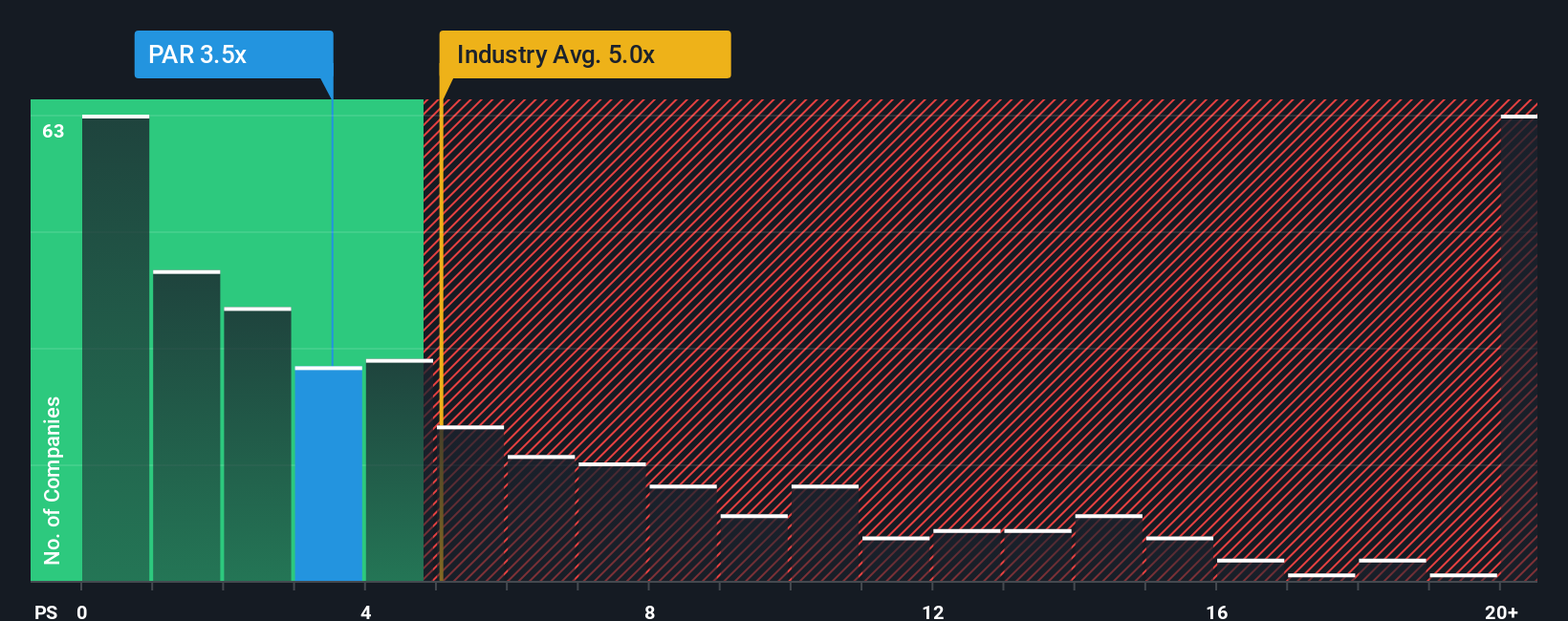

While PAR Technology appears undervalued based on fair value estimates, a look at its price-to-sales ratio paints a mixed picture. PAR trades at 3.5x sales, which is lower than the US software industry average of 5x and below its peer average of 3.7x. However, it remains higher than the fair ratio of 2.7x. This gap signals that, despite relative value, there is potential for price pressure if the market moves toward that fair ratio. Does this suggest hidden risks investors should weigh before calling it a bargain?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own PAR Technology Narrative

If you see things differently or want to chart your own course, you can dive into the numbers and construct a narrative yourself in just a few minutes. Do it your way.

A great starting point for your PAR Technology research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

Act now and take your portfolio to the next level. These hand-picked stock opportunities could be the edge you need, so don’t miss out:

- Tap into future healthcare breakthroughs by checking out these 33 healthcare AI stocks, which are pioneering medical AI and transforming patient care.

- Spot undervalued stocks poised for a comeback as you review these 891 undervalued stocks based on cash flows, with potential for solid returns based on strong cash flows.

- Ride the tech wave and see these 24 AI penny stocks, featuring explosive potential in AI innovation, automation, and next-generation analytics.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:PAR

PAR Technology

Provides omnichannel cloud-based hardware and software solutions to the worldwide.

Good value with adequate balance sheet.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Airbnb Stock: Platform Growth in a World of Saturation and Scrutiny

Adobe Stock: AI-Fueled ARR Growth Pushes Guidance Higher, But Cost Pressures Loom

Thomson Reuters Stock: When Legal Intelligence Becomes Mission-Critical Infrastructure

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

The AI Infrastructure Giant Grows Into Its Valuation

Trending Discussion