- United States

- /

- Software

- /

- NasdaqGS:PANW

Palo Alto Networks (NYSE:PANW) Continues to Outperform, Despite Stubbornly Remaining Unprofitable

Palo Alto Networks, Inc. ( NYSE: PANW ) just reached a new all-time high after posting a surprising result. While the company remains unprofitable by generally accepted accounting principles (GAAP), this obviously doesn't stop it from generating returns for its investors.

In this article, we will look at the latest developments around the company and the total returns of the last 5-year period.

Fiscal 4th Quarter Earnings Results

- Non-GAAP EPS: US$1.60 (beat by US$0.16)

- GAAP EPS: -US$1.23 (miss by US$0.07)

- Revenue: US$1.22b (beat by US$50m)

- Revenue Y/Y: +28.4%

You can catch up on the latest numbers by reading our company report .

The guidance for 2022 is now set at US$6.60b to US$6.65b, representing y/y growth of 21-22%, with the total revenue in the range of US$5.275b-5.235b, vs. a consensus of US5.02b.

CEO Nikesh Arora quoted increased cyber security attacks in recent months as a driver behind the demand for the company's technology. This doesn't come as a surprise after T-Mobile disclosed a network hack impacting tens of millions of customers just last week.

Upon the news, the stock has soared more than 20% in 4 straight positive sessions, making a new all-time high at US$461.28.

Meanwhile, the Board of Directors has authorized additional share repurchases , increasing the repurchasing plan to US$1b by the end of 2022.

Given the high growth prospects in the low-interest-rate environment, share repurchasing seems like a reasonable idea.

Since the stock has added US$9.1b to its market cap in the past week alone, let's see if underlying performance has been driving long-term returns.

Check out our latest analysis for Palo Alto Networks

Palo Alto Networks still isn't profitable, so most analysts would look to revenue growth to understand how fast the underlying business is growing.Shareholders of unprofitable companies usually expect strong revenue growth.As you can imagine, fast revenue growth, when maintained, often leads to fast profit growth.

In the last 5 years, Palo Alto Networks saw its revenue grow at 21% per year.Even measured against other revenue-focused companies, that's a good result.So it's not entirely surprising that the share price reflected this performance by increasing at a rate of 26% per year in that time.So it seems likely that buyers have paid attention to the strong revenue growth.

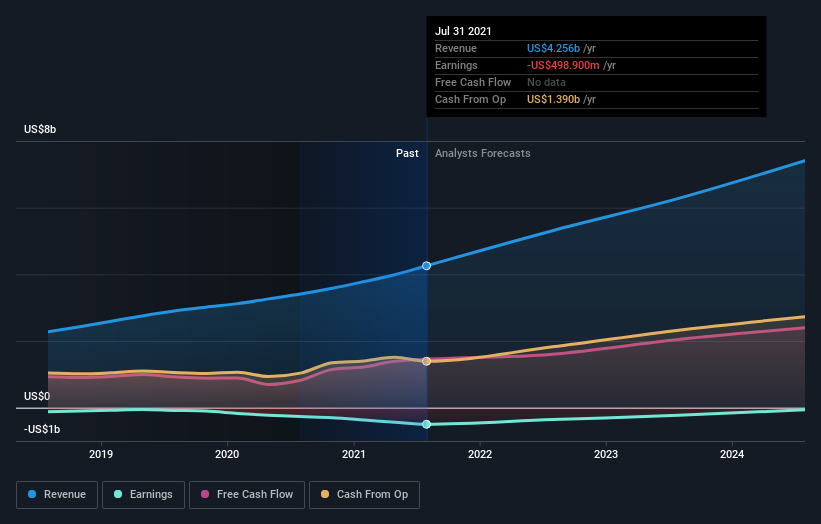

The graphic below depicts how earnings and revenue have changed over time (unveil the exact values by clicking on the image).

We're pleased to report that the CEO is remunerated more modestly than most at similarly capitalized companies.It's always worth keeping an eye on CEO pay, but a more important question is whether the company will grow earnings throughout the years. You can see what analysts predict for Palo Alto Networks in this interactive graph of future profit estimates .

A Different Perspective

It's good to see that Palo Alto Networks has rewarded shareholders with a total shareholder return of 81% in the last twelve months. Furthermore, 5-year gain now stands at 218%, significantly outperforming S&P500 that delivered "only" 107% in the same period.

That's better than the annualized return of 26% over half a decade, implying that the company is doing better recently.Someone with an optimistic perspective could view the recent improvement in TSR as indicating that the business itself is getting better with time.It's always interesting to track share price performance over the longer term. But to understand Palo Alto Networks better, we need to consider many other factors.Consider, for instance, the ever-present specter of investment risk.

We've identified 3 warning signs with Palo Alto Networks , and understanding them should be part of your investment process.

If you are interested in more opportunities, you may wish to see this free collection of growth stocks.

Please note, the market returns quoted in this article reflect the market-weighted average returns of stocks that currently trade on US exchanges.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Simply Wall St analyst Stjepan Kalinic and Simply Wall St have no position in any of the companies mentioned. This article is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Stjepan Kalinic

Stjepan is a writer and an analyst covering equity markets. As a former multi-asset analyst, he prefers to look beyond the surface and uncover ideas that might not be on retail investors' radar. You can find his research all over the internet, including Simply Wall St News, Yahoo Finance, Benzinga, Vincent, and Barron's.

About NasdaqGS:PANW

Palo Alto Networks

Provides cybersecurity solutions the Americas, Europe, the Middle East, Africa, the Asia Pacific, and Japan.

Reasonable growth potential with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives