- United States

- /

- Software

- /

- NYSE:ORCL

Oracle (ORCL): Rethinking Valuation After a Strong Recent Share Price Run

Reviewed by Simply Wall St

Oracle (ORCL) has quietly outpaced the broader software sector over the past year, and with shares near $198 investors are asking a simple question: is the recent run justified or stretched?

See our latest analysis for Oracle.

That question is more than fair given the backdrop, with a strong 7 day share price return and a solid year to date share price gain sitting alongside an impressive multi year total shareholder return that suggests long term momentum is still very much intact, even if shorter term swings reflect changing views on Oracle s growth and cloud risk profile.

If Oracle s move has you rethinking your tech exposure, it could be a useful moment to scout other high growth opportunities across high growth tech and AI stocks.

With earnings still growing at a healthy clip, a rich cloud narrative, and the stock trading at a steep discount to analyst targets, the core debate is simple: Is Oracle still undervalued, or is future growth already fully priced in?

Most Popular Narrative: 49.1% Undervalued

Oracle last closed at $198.38, while the most popular narrative argues its fair value sits far higher, implying substantial upside if those assumptions play out.

This strategic shift, defined by massive infrastructure investment, a landmark partnership with OpenAI, and the rise of colossal superclusters, has driven an unprecedented surge in its contract backlog, fundamentally reshaping Oracle’s long term growth trajectory and competitive landscape.

Want to see what justifies that kind of upside gap? The narrative focuses on aggressive revenue expansion, surging infrastructure demand, and a bold profit trajectory that recasts Oracle as hypergrowth. Curious how those moving parts combine into a near doubled fair value claim? Explore the full blueprint behind that call.

Result: Fair Value of $389.81 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, this bullish setup could unravel if Oracle stumbles on data center build out execution, or if AI infrastructure demand proves more cyclical than expected.

Find out about the key risks to this Oracle narrative.

Another Lens On Value

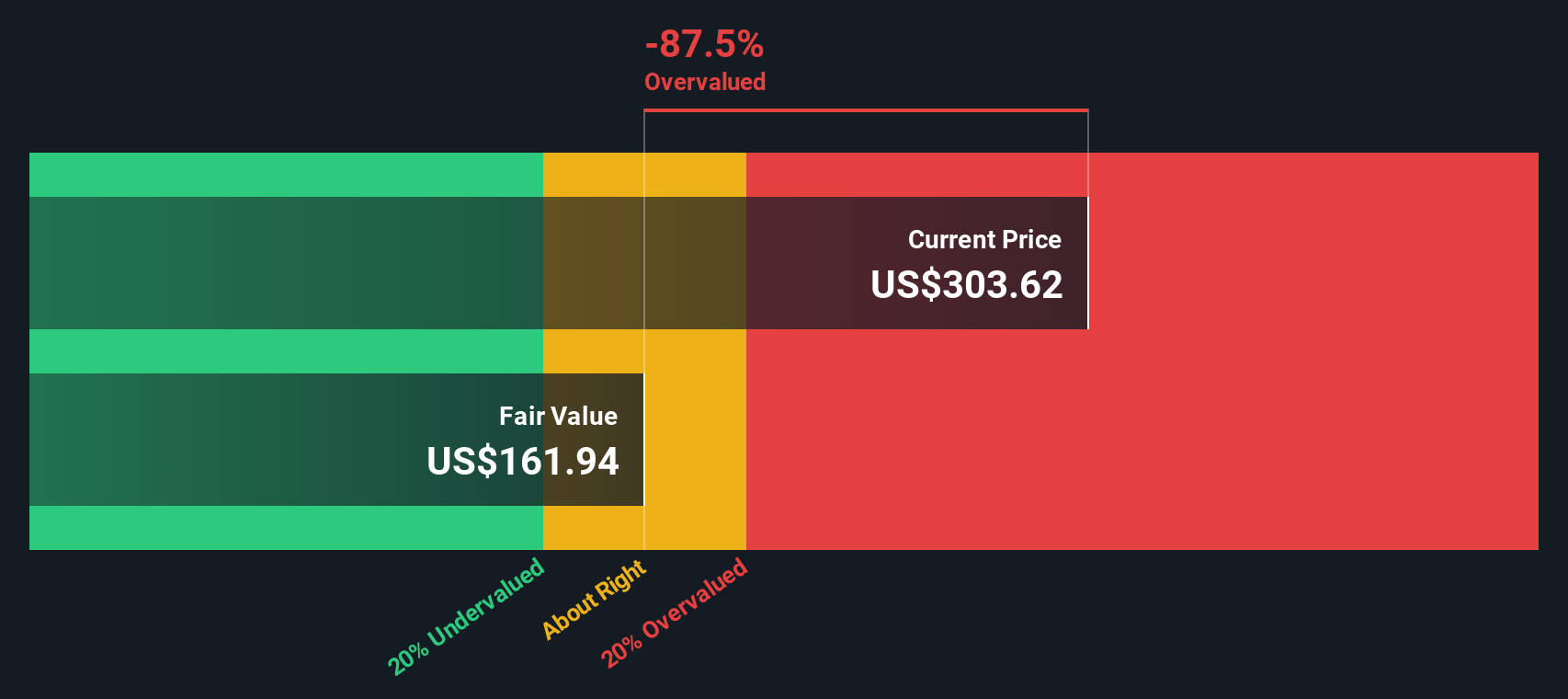

That bullish narrative collides with a very different signal from our SWS DCF model, which puts fair value nearer $164.47, implying Oracle is actually overvalued at today s $198.38 price. If cash flows say one thing and the growth story another, which do you trust more?

Look into how the SWS DCF model arrives at its fair value.

Build Your Own Oracle Narrative

If you see the story differently or want to stress test the assumptions with your own work, you can craft a fresh view in minutes: Do it your way.

A great starting point for your Oracle research is our analysis highlighting 2 key rewards and 3 important warning signs that could impact your investment decision.

Ready for your next investing move?

Do not stop at Oracle, sharpen your edge by scanning fresh opportunities across hand picked stock ideas on Simply Wall St before the market prices them in.

- Capture powerful value opportunities early by targeting companies trading below intrinsic worth through these 898 undervalued stocks based on cash flows tailored to fundamental strength.

- Position yourself at the forefront of innovation by focusing on these 24 AI penny stocks shaping the next wave of intelligent automation and data driven business models.

- Secure growing income streams by filtering for reliable payers via these 10 dividend stocks with yields > 3% that prioritize sustainable, above average yields.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:ORCL

Oracle

Offers products and services that address enterprise information technology environments worldwide.

Exceptional growth potential with proven track record.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Automotive Electronics Manufacturer Consistent and Stable

Airbnb Stock: Platform Growth in a World of Saturation and Scrutiny

Adobe Stock: AI-Fueled ARR Growth Pushes Guidance Higher, But Cost Pressures Loom

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

The AI Infrastructure Giant Grows Into Its Valuation

Trending Discussion