- United States

- /

- Software

- /

- NYSE:ORCL

Oracle (NYSE:ORCL) Launches Innovative Cloud Services to Enhance Trade and Supply Chain Finance

Reviewed by Simply Wall St

Oracle (NYSE:ORCL) recently announced new cloud services for Trade Finance and Supply Chain Finance, targeting efficiency for banks. This move aligns with the company's broader success as reflected in its 50% price increase over the last quarter. Continued innovation, such as Oracle's partnership with Oracle Red Bull Racing and enhancements in the health sector, likely supported this uptrend. These developments occurred amid favorable market conditions, where major indexes like the S&P 500 and Nasdaq reached new highs, contributing to Oracle's upward momentum. The market's broader positive climate amplified Oracle's gains, while its solid financial performance added strength to its growth story.

Be aware that Oracle is showing 2 possible red flags in our investment analysis.

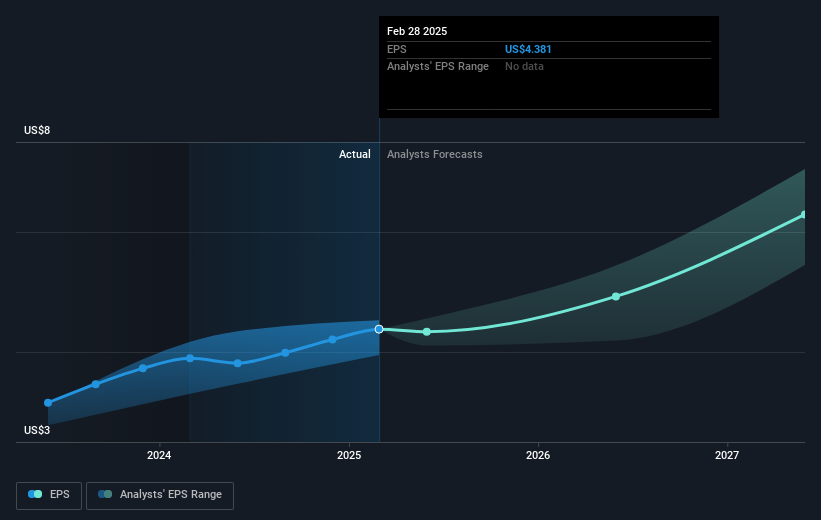

Oracle's recent introduction of new cloud services for Trade Finance and Supply Chain Finance aims to enhance efficiency for banks, and could bolster revenue and earnings forecasts. The company’s strategic partnerships and cloud region expansion support an optimistic outlook, especially given Oracle's strong quarterly price performance, highlighting a 50% rise. Over the past five years, Oracle's total shareholder return, including dividends, was a very large 304.71%. This substantial growth outpaces the overall market performance, underscoring Oracle's sustained long-term momentum.

In the past year, Oracle has outperformed both the U.S. Software industry and broader market, which returned 19.2% and 13.7% respectively. This robust performance could be tied to their aggressive cloud expansion and joint ventures with tech giants such as AWS and Google, expected to fuel future database migration and drive growth. The positive price movements reflect investor confidence, although Oracle's current share price of US$215.27 is slightly above the consensus analyst price target of US$212.16, indicating potential market expectations for continued outperformance despite a lesser 1.5% difference.

Get an in-depth perspective on Oracle's performance by reading our balance sheet health report here.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:ORCL

Oracle

Offers products and services that address enterprise information technology environments worldwide.

Solid track record with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives