- United States

- /

- Software

- /

- NYSE:ORCL

Oracle (NYSE:ORCL) Expands U.S. Government Cloud Capabilities with New Phoenix Regions for Microsoft Azure

Reviewed by Simply Wall St

Oracle (NYSE:ORCL) recently announced the launch of its Interconnect for Microsoft Azure, enhancing multicloud capabilities for U.S. government clients, which may have positively influenced its stock movement with a modest 0.5% increase last month. Within the same period, Oracle introduced AI agents in both its HCM and SCM platforms, aimed at improving productivity and operational efficiency through automation. Additionally, Oracle's issuance of $8.25 billion in notes reflects its strategic financial management, potentially influencing investor sentiment. Despite a generally challenging market, with the Nasdaq down over 5% in February, Oracle's steadying developments helped maintain investor confidence. This is notable considering the broader economic context of easing inflation pressures and fluctuating tech stocks, including a major dip in Nvidia. Oracle’s performance, amidst market volatility, highlights its resilience and adaptability in its cloud services expansion and technological advancements.

Click to explore a detailed breakdown of our findings on Oracle.

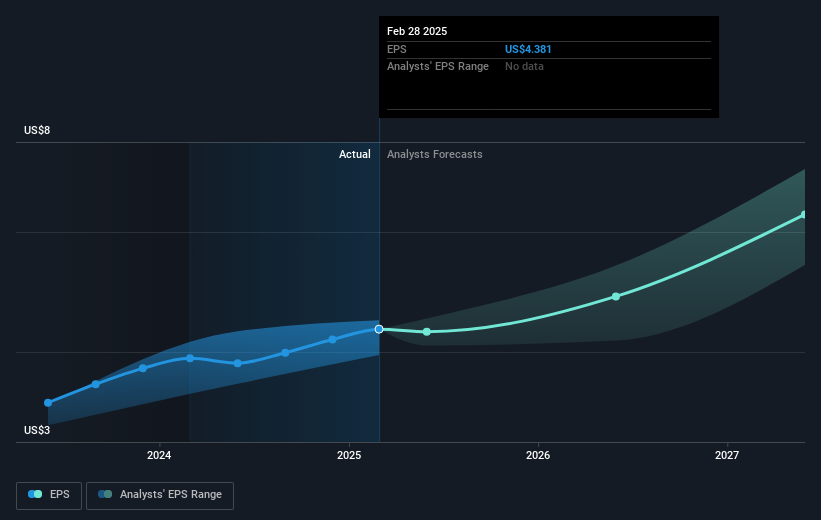

Over the past five years, Oracle has delivered a total shareholder return of 270.05%. This performance was significantly influenced by several key developments. Oracle's successful strategic partnerships, such as with Microsoft, have enhanced its cloud offerings, bolstering its competitiveness in this sector. The company's expansion into new cloud regions has also supported its growth, meeting increasing global demand for cloud infrastructure. Additionally, Oracle's commitment to product innovation is evident with the launch of MySQL HeatWave and enhancements to the Oracle Cloud Infrastructure, which have improved business application performance.

Financially, Oracle's consistent dividends and share buybacks have contributed to shareholder returns, reflecting a prudent approach to capital management. The issuance of significant debt at favorable interest rates provided the financial flexibility needed for these initiatives. Over the past year, Oracle's total return outpaced both the US market and the software industry, demonstrating its robust positioning against market fluctuations.

- Unlock the insights behind Oracle's valuation and discover its true investment potential

- Understand the uncertainties surrounding Oracle's market positioning with our detailed risk analysis report.

- Got skin in the game with Oracle? Elevate how you manage them by using Simply Wall St's portfolio, where intuitive tools await to help optimize your investment outcomes.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:ORCL

Oracle

Offers products and services that address enterprise information technology environments worldwide.

Exceptional growth potential with proven track record.

Similar Companies

Market Insights

Community Narratives