- United States

- /

- Software

- /

- NYSE:ORCL

Oracle (NYSE:ORCL) Expands Cloud Marketplace And AI Infrastructure With Hammerspace And Global Innovators

Reviewed by Simply Wall St

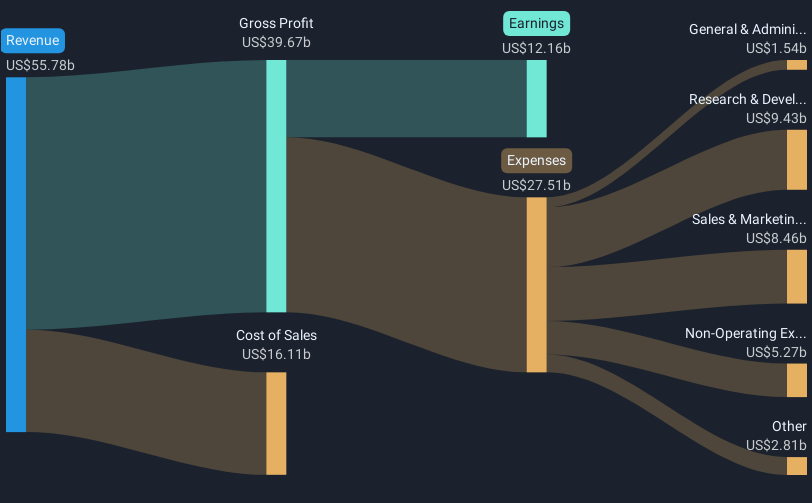

Oracle (NYSE:ORCL) recently saw a significant 38% increase in its share price over the last quarter, coinciding with several strategic developments. Key client announcements, such as the integration of Hammerspace solutions on Oracle Cloud Marketplace, and the adoption of OCI for AI infrastructure by renowned innovators, likely supported this upward momentum. A strong earnings report, boasting revenue and net income growth, further reinforced investor confidence. These events occurred against a backdrop of a generally flat market in recent weeks but aligned with broader annual market gains, adding weight to Oracle's robust performance relative to the average market trend.

We've identified 1 warning sign for Oracle that you should be aware of.

Uncover the next big thing with financially sound penny stocks that balance risk and reward.

Oracle's strategic developments, highlighted in recent news, have had a significant impact on its projected revenue and earnings trajectory. The integration of Hammerspace solutions and major AI infrastructure adoptions are poised to enhance Oracle's service offerings, potentially increasing demand and revenue as cloud and AI technologies continue to expand. Analysts anticipate that these partnerships will propel revenue growth, with Oracle's cloud region expansion and increased power capacity further supporting this upward trend.

Over a five-year period, Oracle's total shareholder return was 317.11%, reflecting strong performance. In comparison to the US Software industry, which returned 18.6% over the past year, Oracle's annual growth indicates competitive positioning. It also outperformed the broader US market, which saw a 9.9% return over the same timeframe. This performance underscores Oracle's ability to capitalize on technological advancements and strategic collaborations.

The current share price increase aligns with analyst expectations, though it remains slightly below the consensus price target of US$210.67. With anticipated revenue growth of 14% per year and earnings expected to increase by 16.73% annually, these developments could further adjust Oracle's market valuation. The combination of cloud partnerships and infrastructure investment positions Oracle to potentially exceed prior projections, though risks like currency volatility and cloud expansion delays could influence future outcomes.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:ORCL

Oracle

Offers products and services that address enterprise information technology environments worldwide.

Solid track record with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives