- United States

- /

- Software

- /

- NYSE:ORCL

Oracle Corporation (NYSE:ORCL) is Well-Positioned to Continue Delivering Value to its Shareholders

In post-earnings rallies, double-digit jumps are common for small and medium cap growth stocks but not often seen for large mature companies like Oracle Corporation (NYSE: ORCL), which moved up over 15% after the latest report.

Despite a big rally in 2021, the stock is still conservatively priced with a P/E ratio of 18.8.

Check out our latest analysis for Oracle

Second-quarter 2022 results

- EPS: -US$0.46 (down from US$0.82 profit in 2Q 2021).

- Revenue: US$10.4b (up 5.7% from 2Q 2021).

- Net loss: US$1.25b (down 151% from profit in 2Q 2021).

Revenue exceeded analyst estimates by 1.5%. Over the next year, revenue is forecast to grow 4.1%, compared to a 203% growth forecast for the industry in the US.

Over the last 3 years, on average, earnings per share have increased by 24% per year, but its share price has increased by 30% per year, which means it is tracking significantly ahead of earnings growth.

It is worth noting that the EPS loss that sticks out like a sore thumb relates to litigation-related charges as a one-off expense. While not specified, this likely refers to the legal battle with Hewlett-Packard that goes back over a decade.

Meanwhile, the company continues with an extensive stock buyback program that has been increased by an additional US$10b. CEO Safra Catz stated that the company repurchased US$7b worth of shares in the last quarter, with the number of shares outstanding now fallen by 47% over the last 10 years.

On the other hand, debt grew as well, reaching approx. 3x the adjusted EBITDA, while the interest is covered at 6.2x. Although leverage might raise some eyebrows, the stable earnings and high margins (especially in the cloud space segment) allow it.

Examining the Ownership post Buybacks

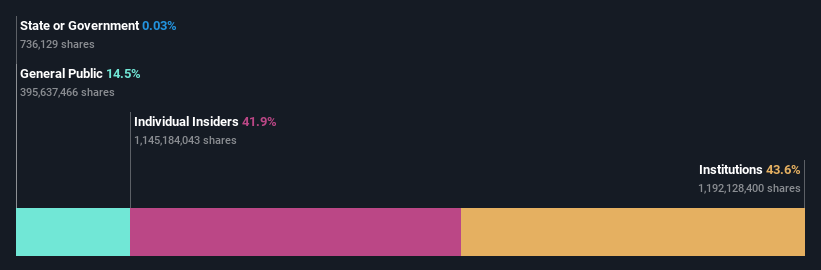

Oracle is a pretty big company. It has a market capitalization of US$281b. Normally institutions would own a significant portion of a company this size. Looking at our data on the ownership groups (below), it seems that institutions own shares in the company.

What Does The Institutional Ownership Tell Us About Oracle?

Institutional investors commonly compare their own returns to a commonly followed index. So they generally do consider buying larger companies included in the relevant benchmark index.

Oracle already has institutions on the share registry. Indeed, they own a respectable stake in the company. This implies the analysts working for those institutions have looked at the stock, and they like it. But just like anyone else, they could be wrong.

You can see Oracle's historical earnings and revenue below, but keep in mind there's always more to the story.

Hedge funds don't have many shares in Oracle. Our data suggest that Lawrence Ellison, the company's Top Key Executive, holds the most number of shares at 42%. Meanwhile, the second and third largest shareholders hold 5.3% and 4.3% of the shares outstanding, respectively.

To make our study more interesting, we found that the top 3 shareholders have majority ownership in the company, meaning that they are powerful enough to influence the company's decisions.

Insider Ownership Of Oracle

The definition of company insiders can be subjective and does vary between jurisdictions. Our data reflects individual insiders, capturing board members at the very least. The company management answer to the board, and the latter should represent the interests of shareholders. Notably, sometimes top-level managers are on the board themselves.

It seems insiders own a significant proportion of Oracle Corporation. Most would be pleased to see the board is investing alongside them. You may wish to access this free chart showing recent trading by insiders.

General Public Ownership

With a 14% ownership, the general public, mostly comprised of individual investors, has some sway over Oracle. While this group can't necessarily call the shots, it can certainly have a real influence on how the company is run.

Conclusion

By examining the ownership structure of Oracle, we have uncovered some interesting data.

First of all, the general public owns a fairly modest stake at just 14.5%, which is unusual given the stability of the business, not to mention a reliable dividend of 1.7% with a low payout ratio of 15% and considerable space for growth.

Furthermore, the largest individual stake, co-founder Larry Ellison's, grew to over 40%, likely due to a large buyback operation. However, it is important to observe that Oracle bought back shares at a large discount, as CEO Mrs.Catz pointed out - at an average price that is half the current share price. So far, the buyback operation has been a success.

Under these circumstances, we can envision 2 scenarios for the company. Either they continue aggressive buybacks and eventually go private; or they continue until the certain point of diminishing returns, where they can switch to paying off the debt, hiking the dividend, and making acquisitions.

To truly gain insight, we need to consider other information, too. For instance, we've identified 3 warning signs for Oracle (2 make us uncomfortable) that you should be aware of.

But ultimately, it is the future, not the past, that will determine how well the owners of this business will do. Therefore we think it advisable to look at this free report showing whether analysts are predicting a brighter future.

NB: Figures in this article are calculated using data from the last twelve months, which refer to the 12-month period ending on the last date of the month the financial statement is dated. This may not be consistent with full-year annual report figures.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Simply Wall St analyst Stjepan Kalinic and Simply Wall St have no position in any of the companies mentioned. This article is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Stjepan Kalinic

Stjepan is a writer and an analyst covering equity markets. As a former multi-asset analyst, he prefers to look beyond the surface and uncover ideas that might not be on retail investors' radar. You can find his research all over the internet, including Simply Wall St News, Yahoo Finance, Benzinga, Vincent, and Barron's.

About NYSE:ORCL

Oracle

Offers products and services that address enterprise information technology environments worldwide.

Exceptional growth potential with proven track record.

Similar Companies

Market Insights

Community Narratives