- United States

- /

- Software

- /

- NYSE:NOW

ServiceNow (NYSE:NOW) Unveils AI-Driven Innovations and Strategic Alliances at Knowledge 2025

Reviewed by Simply Wall St

ServiceNow (NYSE:NOW) has recently witnessed a significant price increase of 34% over the past month, driven by an array of impactful announcements and partnerships. Notably, the company's integration with major technology players, such as Zoom and NICE, promises enhancing customer service through advanced AI solutions and seamless platform experiences. In addition, ServiceNow's launch of new initiatives like ServiceNow University and the unveiling of its AI platform and AI Control Tower highlight its commitment to innovation and education. These developments complement broader market trends that have seen mixed activity, with investors watching interest rates and trade negotiations impacting tech stocks.

We've spotted 2 weaknesses for ServiceNow you should be aware of.

Rare earth metals are the new gold rush. Find out which 23 stocks are leading the charge.

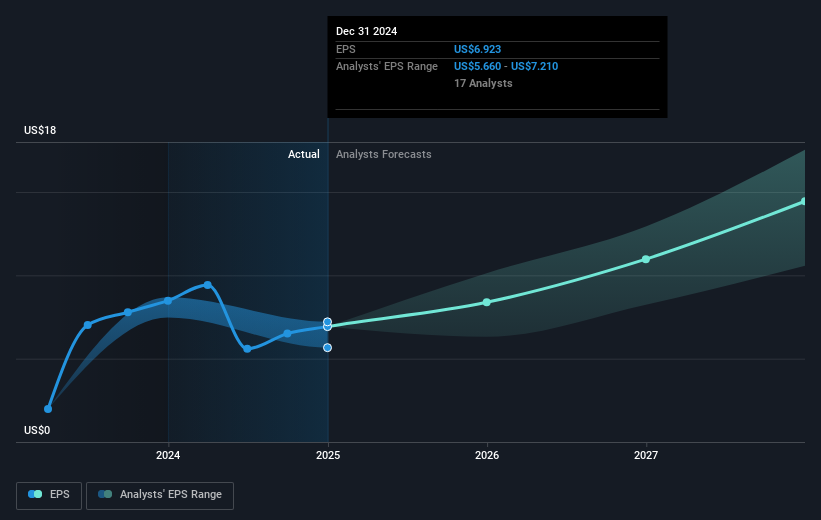

The recent surge in ServiceNow's share price, driven by significant market announcements and strategic partnerships, aligns with its commitment to enhance its AI offerings. These initiatives, while promising advancement in customer service, also suggest potential near-term challenges. The company's integration with major technology players and new education programs could amplify AI adoption, impacting revenue and earnings forecasts. However, the introduction of a hybrid pricing model and increased investment might slow immediate revenue recognition, affecting short-term financial visibility. Analysts project revenue and earnings growth over the next few years, suggesting a long-term outlook may be required to see these benefits fully unfold.

Over the past five years, ServiceNow's total shareholder return, including dividends, was 164.02%, demonstrating significant growth. The company's recent one-year performance also shows it exceeding the US Software industry's return of 14%. However, it's essential to consider that, despite the short-term price increase, ServiceNow's current share price of US$812.7 suggests a 10.1% discount to the bearish analysts' price target of US$904.36. This underscores potential challenges in achieving consensus analyst targets, considering the projected slow growth in revenue and net margins. Investors should carefully analyze these developments and market positions when considering future expectations.

Understand ServiceNow's track record by examining our performance history report.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:NOW

ServiceNow

Provides cloud-based solution for digital workflows in the North America, Europe, the Middle East and Africa, Asia Pacific, and internationally.

Flawless balance sheet with high growth potential.

Similar Companies

Market Insights

Community Narratives