- United States

- /

- Software

- /

- NYSE:NOW

ServiceNow (NYSE:NOW) Unleashes AI Agents And Enhanced Automation In Yokohama Platform Release

Reviewed by Simply Wall St

ServiceNow (NYSE:NOW) recently launched its Yokohama platform with significant AI enhancements aimed at improving business efficiency, governance, and automation. Despite these advancements, which could bolster the company’s growth, ServiceNow's stock fell by 7.93% over the last week. This stock movement coincided with broader market declines, as the Dow Jones and tech-heavy Nasdaq Composite also reflected downward trends, impacted by concerns over economic health and uncertainties related to government policies. During the same period, major technology companies such as Tesla and Adobe faced sharp price declines, which could have further influenced sentiment around tech stocks, including ServiceNow. The recent dip in ServiceNow's share price aligns with the market's overall decline by 4.4%, amidst volatility stemming from broader economic concerns, despite having risen 7.5% over the past year. The price action reflects the company's susceptibility to macroeconomic conditions and its role within the larger tech sector turbulence.

Evaluate ServiceNow's historical performance by accessing our past performance report.

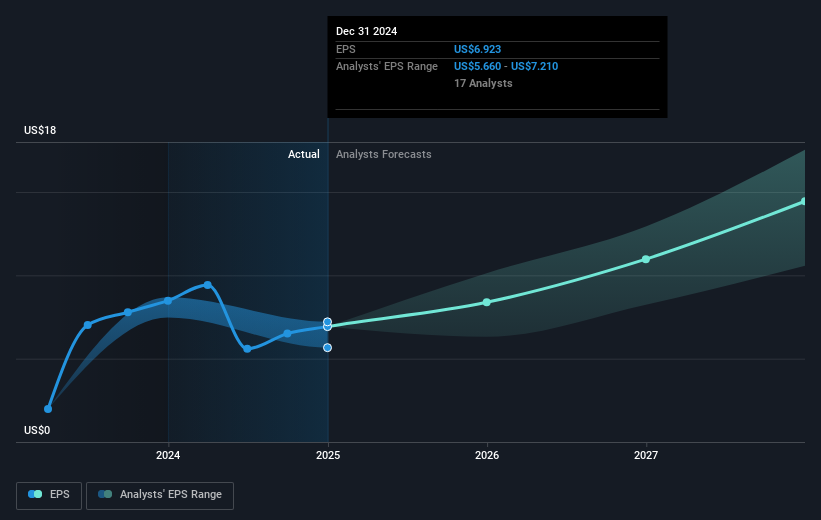

In the past five years, ServiceNow's total shareholder returns have reached 203.11%. This impressive performance can be linked to several key developments. The company's emphasis on artificial intelligence has been a major driver, highlighted by significant collaborations such as the partnership with Google Cloud announced in January 2025. The introduction of AI-driven solutions and new automation capabilities, particularly in telecom through NVIDIA partnerships, have enhanced its market position and operational efficiency. Additionally, ServiceNow's earnings have grown significantly, providing strong support for its stock.

Furthermore, ServiceNow's expansion of partnerships and acquisitions has strengthened its portfolio, with the recent enlargement of its share buyback plan to US$4.5 billion indicating strong confidence in future growth. The company's ability to outperform both the US Market and US Software industry over the past year showcases its resilience and growth amidst broader economic challenges and market volatility.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:NOW

ServiceNow

Provides cloud-based solution for digital workflows in the North America, Europe, the Middle East and Africa, Asia Pacific, and internationally.

Flawless balance sheet with high growth potential.

Similar Companies

Market Insights

Community Narratives