- United States

- /

- Software

- /

- NYSE:NOW

Growth Prospects look good for ServiceNow (NYSE:NOW) but Margins need to Improve

ServiceNow, Inc. (NYSE:NOW) announced a strong set of fourth quarter results on Wednesday, beating consensus estimates on the top and bottom line for the fourth consecutive quarter. Despite the share price opening 14% higher, it remains more than 20% below the recent highs.

Fourth quarter results at a glance:

-

EPS at $1.46, up 24.7% YoY and 3 cents ahead of consensus estimates

-

Revenue at $1.61 bln, up 28.8% YoY and $10 mln ahead of estimates.

-

Subscription sales (95% of total revenue) up 30%

-

Transactions with net new annual contract value over $1 mln up 52% YoY

-

1,359 customers paying more than $1 mln annually.

ServiceNow is one of the ten largest software companies in the world, but hasn't been in the news much in the last year or so. We decided to have a closer look to see if it may be offering an overlooked opportunity.

Check out our latest analysis for ServiceNow

What's the opportunity in ServiceNow?

When we estimate ServiceNow’s fair value based on analyst forecasts we come to a value of $667, which implies the stock is undervalued by 27.4%. This is just an estimate and is only as good as analyst forecasts, but it’s a good place to start.

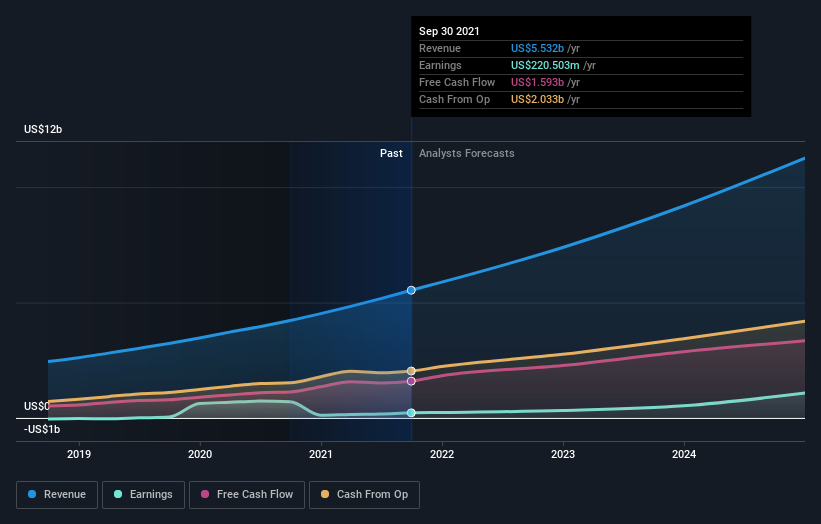

At first glance, the price-to-earnings ratio (P/E) of 437x looks ridiculously high. However, as the chart below indicates, cash flows are a lot higher than earnings. At 61x, the price-to-free cash flow ratio is a lot more reasonable - but not exactly cheap.

Can we expect growth from ServiceNow?

Future outlook is an important aspect when you’re looking at buying a stock, especially if you are an investor looking for growth in your portfolio. Buying a great company with a robust outlook at a cheap price is always a good investment, so let’s also take a look at the company's future expectations. With profit expected to more than double over the next couple of years, the future seems bright for ServiceNow. It looks like higher cash flow is on the cards for the stock, which should feed into a higher share valuation.

While growth prospects look quite good, the company’s net profit margin, at 4%, is a lot lower than its peers. If the margin remains low, comparable software stocks may appear more attractive. On the other hand, the low margin suggests there is more room for improvement which would feed into earnings growth.

What this means for you:

As mentioned, ServiceNow appears to be trading at a modest discount, and while the P/E ratio appears very high, the multiple looks more reasonable when you consider the cash flows. However, it’s worth noting that stock based compensation is high (hence the difference between cash flow and earnings) which may lead to shareholder dilution in the future.

ServiceNow’s growth prospects look good, but earnings growth may accelerate even more if the net profit margin widens. We will be keeping an eye on the net income margin over the next few quarters.

Although the valuation looks about right given the growth opportunity, there are other software companies to consider. When we compare the valuation to the other large software companies, ServiceNow appears to compare favorably with Intuit (Nasdaq: INTU), Shopify (NYSE: SHOP) and Snowflake (NYSE: SNOW) , is in line with SalesForce (NYSE:CRM), but richer than Adobe (Nasdaq: ADBE).

If you are no longer interested in ServiceNow, you can use our free platform to see our list of over 50 other stocks with a high growth potential.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Simply Wall St analyst Richard Bowman and Simply Wall St have no position in any of the companies mentioned. This article is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Richard Bowman

Richard is an analyst, writer and investor based in Cape Town, South Africa. He has written for several online investment publications and continues to do so. Richard is fascinated by economics, financial markets and behavioral finance. He is also passionate about tools and content that make investing accessible to everyone.

About NYSE:NOW

ServiceNow

Provides cloud-based solution for digital workflows in the North America, Europe, the Middle East and Africa, Asia Pacific, and internationally.

Flawless balance sheet with reasonable growth potential.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

Deep Value Multi Bagger Opportunity

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)