- United States

- /

- Software

- /

- NYSE:NEWR

Can You Imagine How New Relic's (NYSE:NEWR) Shareholders Feel About The 53% Share Price Increase?

New Relic, Inc. (NYSE:NEWR) shareholders might understandably be very concerned that the share price has dropped 44% in the last quarter. But that shouldn't obscure the pleasing returns achieved by shareholders over the last three years. In fact, the company's share price bested the return of its market index in that time, posting a gain of 53%.

View our latest analysis for New Relic

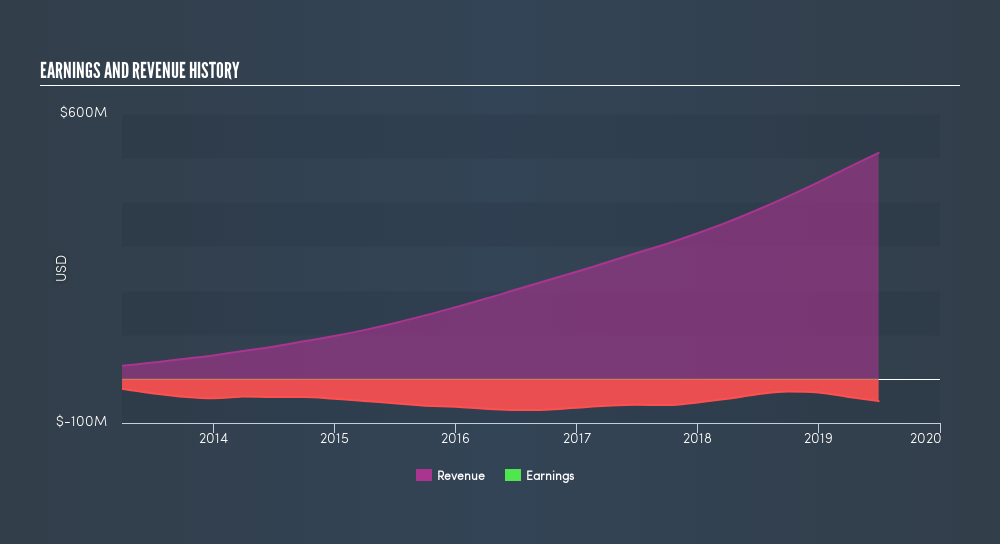

Given that New Relic didn't make a profit in the last twelve months, we'll focus on revenue growth to form a quick view of its business development. Shareholders of unprofitable companies usually expect strong revenue growth. As you can imagine, fast revenue growth, when maintained, often leads to fast profit growth.

New Relic's revenue trended up 30% each year over three years. That's well above most pre-profit companies. The share price rise of 15% per year throughout that time is nice to see, and given the revenue growth, that gain seems somewhat justified. If that's the case, now might be the time to take a close look at New Relic. A window of opportunity may reveal itself with time, if the business can trend to profitability.

New Relic is a well known stock, with plenty of analyst coverage, suggesting some visibility into future growth. If you are thinking of buying or selling New Relic stock, you should check out this free report showing analyst consensus estimates for future profits.

A Different Perspective

The last twelve months weren't great for New Relic shares, which cost holders 42%, while the market was up about 0.8%. Of course the long term matters more than the short term, and even great stocks will sometimes have a poor year. Investors are up over three years, booking 15% per year, much better than the more recent returns. Sometimes when a good quality long term winner has a weak period, it's turns out to be an opportunity, but you really need to be sure that the quality is there. Before spending more time on New Relic it might be wise to click here to see if insiders have been buying or selling shares.

Of course New Relic may not be the best stock to buy. So you may wish to see this free collection of growth stocks.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on US exchanges.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.

About NYSE:NEWR

New Relic

New Relic, Inc., a software-as-a-service company, delivers a software platform for customers to collect telemetry data and derive insights from that data in a unified front-end application.

Flawless balance sheet with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives