- United States

- /

- IT

- /

- NYSE:NET

Is Cloudflare (NYSE:NET) Using Debt Sensibly?

Warren Buffett famously said, 'Volatility is far from synonymous with risk.' It's only natural to consider a company's balance sheet when you examine how risky it is, since debt is often involved when a business collapses. Importantly, Cloudflare, Inc. (NYSE:NET) does carry debt. But the more important question is: how much risk is that debt creating?

When Is Debt Dangerous?

Generally speaking, debt only becomes a real problem when a company can't easily pay it off, either by raising capital or with its own cash flow. Ultimately, if the company can't fulfill its legal obligations to repay debt, shareholders could walk away with nothing. However, a more frequent (but still costly) occurrence is where a company must issue shares at bargain-basement prices, permanently diluting shareholders, just to shore up its balance sheet. Of course, plenty of companies use debt to fund growth, without any negative consequences. When we examine debt levels, we first consider both cash and debt levels, together.

Check out our latest analysis for Cloudflare

How Much Debt Does Cloudflare Carry?

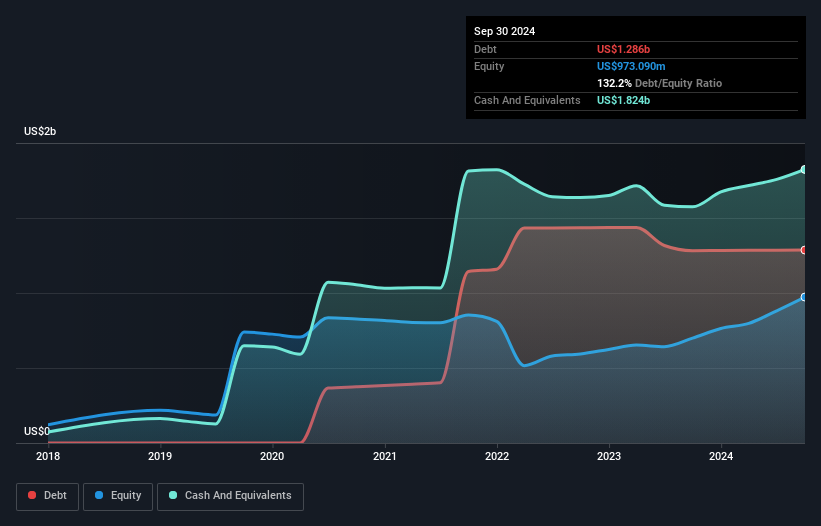

As you can see below, Cloudflare had US$1.29b of debt, at September 2024, which is about the same as the year before. You can click the chart for greater detail. However, it does have US$1.82b in cash offsetting this, leading to net cash of US$537.5m.

How Healthy Is Cloudflare's Balance Sheet?

The latest balance sheet data shows that Cloudflare had liabilities of US$641.6m due within a year, and liabilities of US$1.45b falling due after that. Offsetting this, it had US$1.82b in cash and US$266.4m in receivables that were due within 12 months. So these liquid assets roughly match the total liabilities.

This state of affairs indicates that Cloudflare's balance sheet looks quite solid, as its total liabilities are just about equal to its liquid assets. So while it's hard to imagine that the US$35.8b company is struggling for cash, we still think it's worth monitoring its balance sheet. Succinctly put, Cloudflare boasts net cash, so it's fair to say it does not have a heavy debt load! The balance sheet is clearly the area to focus on when you are analysing debt. But ultimately the future profitability of the business will decide if Cloudflare can strengthen its balance sheet over time. So if you're focused on the future you can check out this free report showing analyst profit forecasts.

In the last year Cloudflare wasn't profitable at an EBIT level, but managed to grow its revenue by 30%, to US$1.6b. With any luck the company will be able to grow its way to profitability.

So How Risky Is Cloudflare?

Although Cloudflare had an earnings before interest and tax (EBIT) loss over the last twelve months, it generated positive free cash flow of US$170m. So taking that on face value, and considering the net cash situation, we don't think that the stock is too risky in the near term. Keeping in mind its 30% revenue growth over the last year, we think there's a decent chance the company is on track. We'd see further strong growth as an optimistic indication. When analysing debt levels, the balance sheet is the obvious place to start. But ultimately, every company can contain risks that exist outside of the balance sheet. We've identified 2 warning signs with Cloudflare , and understanding them should be part of your investment process.

Of course, if you're the type of investor who prefers buying stocks without the burden of debt, then don't hesitate to discover our exclusive list of net cash growth stocks, today.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NYSE:NET

Cloudflare

Operates as a cloud services provider that delivers a range of services to businesses worldwide.

High growth potential with excellent balance sheet.

Similar Companies

Market Insights

Weekly Picks

An Undervalued 3.3Moz Gold Project in Canada

SoFi Technologies: The Apex Aggregator and the Infrastructure of the Modern Financial System

CSL: The Dip Is the Opportunity

DHT Holdings, inc: Strait of Hormuz Risk Amidst US-Israel vs Iran Tensions Spikes VLCC Rates.

Recently Updated Narratives

Basic-Fit: Why the Market Is Mispricing Europe’s Largest Low-Cost Gym Operator

DroneShield's Growth Will Drive Revenue Up by 25.39% Amidst New Success

UiPath Inc. (PATH): Agentic AI Pivot and Milestone Profits Set the Stage for Q4 Results

Popular Narratives

Nu holdings will continue to disrupt the South American banking market

Analyst Commentary Highlights Microsoft AI Momentum and Upward Valuation Amid Growth and Competitive Risks