- United States

- /

- IT

- /

- NYSE:NET

Is Cloudflare (NET) Pricing Fully Reflect Its Rapid Share Price Gains?

Reviewed by Bailey Pemberton

- If you are wondering whether Cloudflare's current share price lines up with its long term potential, you are not alone. This article is designed to help you think through that question clearly.

- The stock closed at US$186.96, with a 5.2% decline over the last week and a 10.5% decline over the last month. The 1 year return sits at 61.6% and the 3 year return is around 4x.

- Recent attention on Cloudflare has centered on its role in internet performance and security, including ongoing discussion of its global network footprint and customer adoption in areas like content delivery and zero trust security. These themes have kept the stock in focus for investors looking at longer term trends in how web traffic is routed and protected worldwide.

- Simply Wall St currently assigns Cloudflare a valuation score of 0/6. Next we will look at what different valuation approaches say about that figure, before finishing with a way of thinking about valuation that can give you an even clearer picture than the numbers alone.

Cloudflare scores just 0/6 on our valuation checks. See what other red flags we found in the full valuation breakdown.

Approach 1: Cloudflare Discounted Cash Flow (DCF) Analysis

A Discounted Cash Flow model projects the cash a company could generate in the future and then discounts those cash flows back to today, to estimate what the business might be worth right now.

For Cloudflare, the model uses a 2 Stage Free Cash Flow to Equity approach. The latest twelve month free cash flow is about $269.4 million. Analyst estimates and extrapolated projections used by Simply Wall St extend out to 2035, with free cash flow for 2030 projected at $1.6b. All of these cash flows are in US$ and are discounted back to today to account for the time value of money and risk.

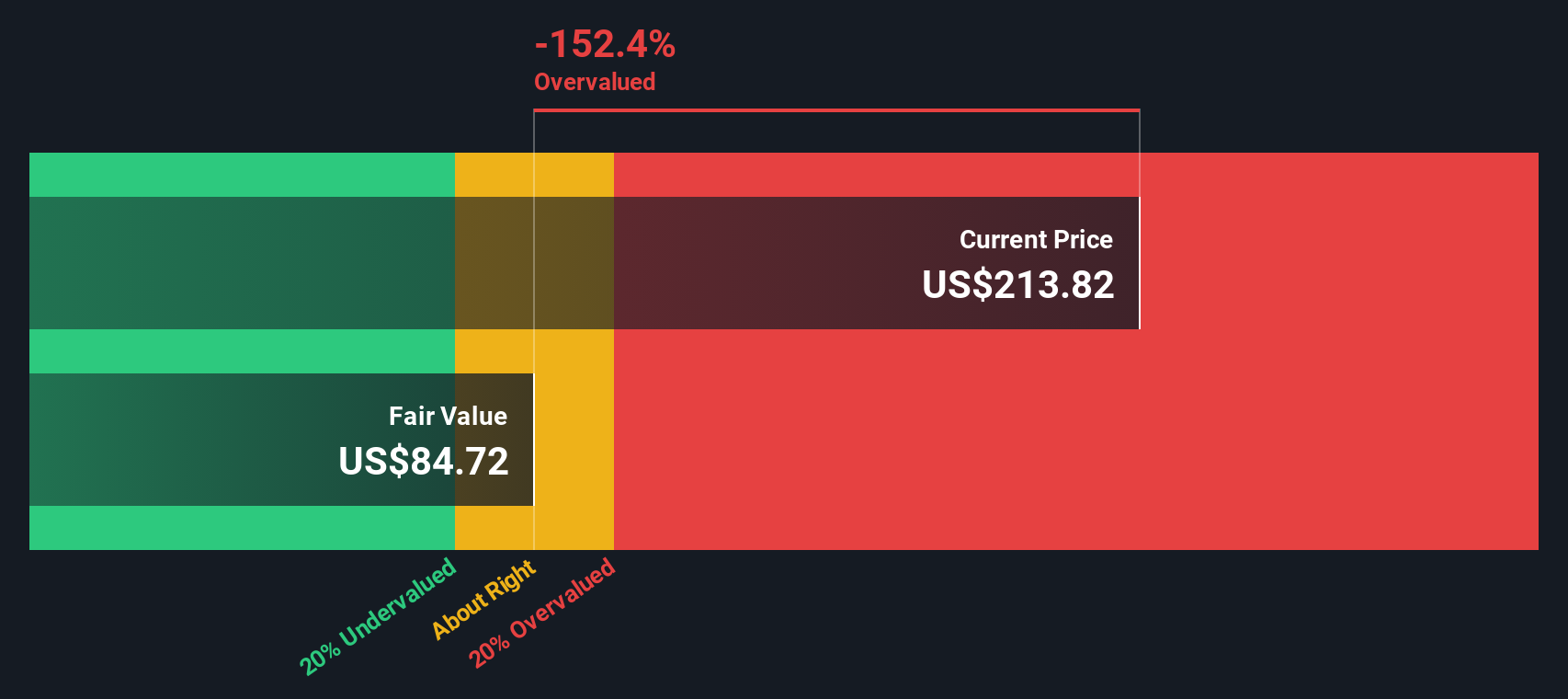

Based on these inputs, the DCF model arrives at an estimated intrinsic value of about $84.54 per share. Compared with the recent share price of $186.96, this implies the stock is 121.1% above the modelled value. This suggests that Cloudflare is trading at a premium relative to this cash flow based estimate.

Result: OVERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Cloudflare may be overvalued by 121.1%. Discover 879 undervalued stocks or create your own screener to find better value opportunities.

Approach 2: Cloudflare Price vs Sales

For companies where current profits are not the main focus, investors often look at revenue-based metrics, so the P/S ratio can be a useful way to compare what the market is paying for each dollar of sales.

Growth expectations and risk both matter here, because a higher anticipated revenue growth rate or a more resilient business can justify a higher P/S ratio, while slower expected growth or higher uncertainty can point to a lower, more cautious multiple.

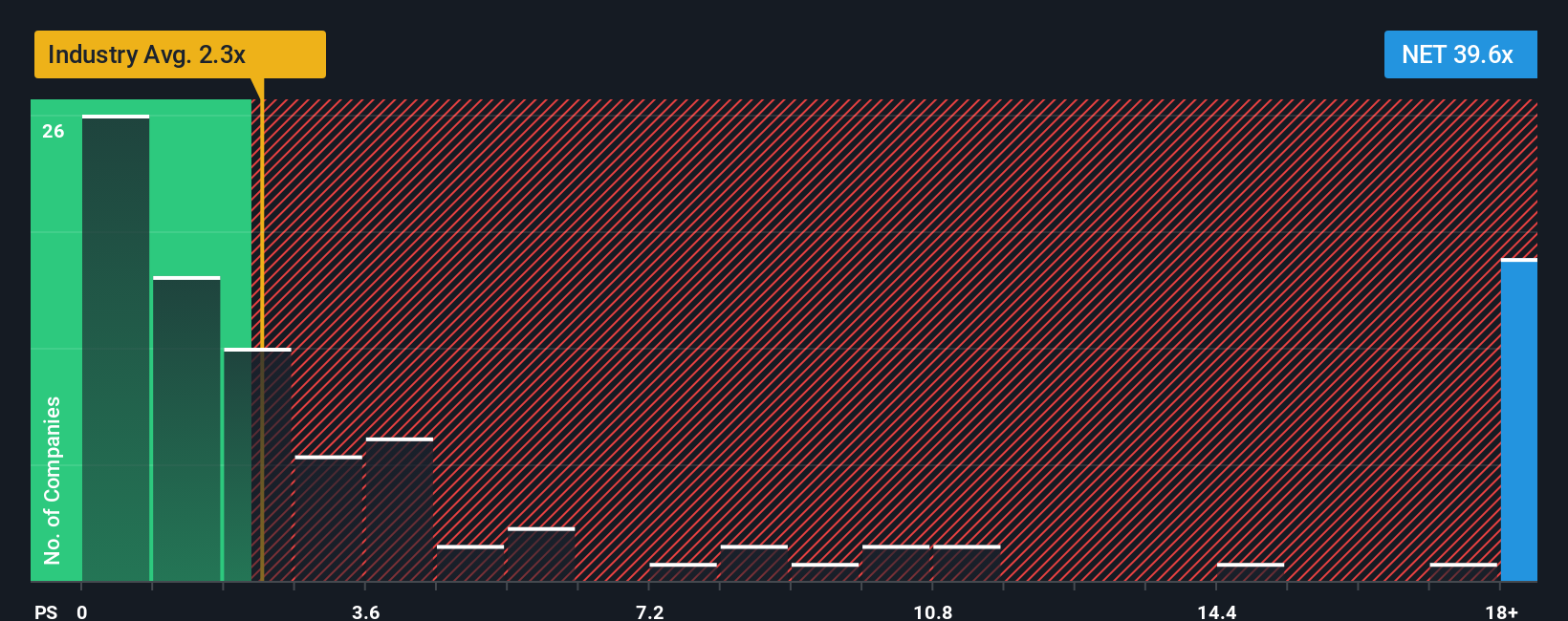

Cloudflare is trading on a P/S ratio of 32.53x. That sits well above the broader IT industry average of 2.41x and above the peer group average of 14.18x.

Simply Wall St also provides a Fair Ratio of 15.06x. This is a proprietary estimate of what P/S might make sense for Cloudflare, after considering factors like its earnings growth profile, profit margins, industry, market capitalization and specific risks.

Because the Fair Ratio adjusts for these company-specific features, it can give you a more tailored reference point than a simple comparison with peers or the industry as a whole.

Set against this Fair Ratio, Cloudflare's current P/S of 32.53x looks high, which points to the shares trading above that adjusted benchmark.

Result: OVERVALUED

P/S ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1444 companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Cloudflare Narrative

Earlier we mentioned that there is an even better way to understand valuation, so let us introduce you to Narratives. These are simple stories you create about Cloudflare that link your view of its business to a forecast for revenue, earnings and margins, then to a fair value. All of this happens within the Simply Wall St Community page used by millions of investors, where you can see how your own fair value compares with the current share price to frame buy or sell decisions. Those Narratives update automatically when new information like earnings or news arrives. For example, one investor might build a Cloudflare Narrative around a fair value of about US$242.46 per share based on assumptions similar to the analyst consensus. Another might lean closer to the most cautious view implied by a US$90.00 price target. A more optimistic investor might sit near the US$255.00 end of the range, each with a different but clearly articulated story behind their numbers.

Do you think there's more to the story for Cloudflare? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:NET

Cloudflare

Operates as a cloud services provider that delivers a range of services to businesses worldwide.

High growth potential with excellent balance sheet.

Similar Companies

Market Insights

Weekly Picks

Ferrari's Intrinsic and Historical Valuation

Investment Thesis: Costco Wholesale (COST)

Undervalued Key Player in Magnets/Rare Earth

Recently Updated Narratives

Broadcom - A Fundamental and Historical Valuation

Hims & Hers Health aims for three dimensional revenue expansion

A Tale of Two Engines: Coca-Cola HBC (EEE.AT)

Popular Narratives

The "Sleeping Giant" Stumbles, Then Wakes Up

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026