- United States

- /

- IT

- /

- NYSE:NET

Cloudflare (NYSE:NET) Partners With TekStream to Enhance Cybersecurity and Digital Resilience

Reviewed by Simply Wall St

Cloudflare (NYSE:NET) saw a notable price movement of 26% over the past month, potentially driven by recent strategic partnerships. The collaboration with TekStream on May 6 to enhance cybersecurity services could have positively influenced investor perception. Moreover, Cloudflare's alliance with Diligent and Qualys on April 29 and Rakuten Mobile on April 24 fortifies its position in cybersecurity and digital transformation. These developments coincide with a broader market that remained mixed amid anticipations of Federal Reserve interest rate decisions and ongoing trade discussions between the U.S. and China, indicating potential resilience against prevailing economic uncertainties.

We've spotted 1 possible red flag for Cloudflare you should be aware of.

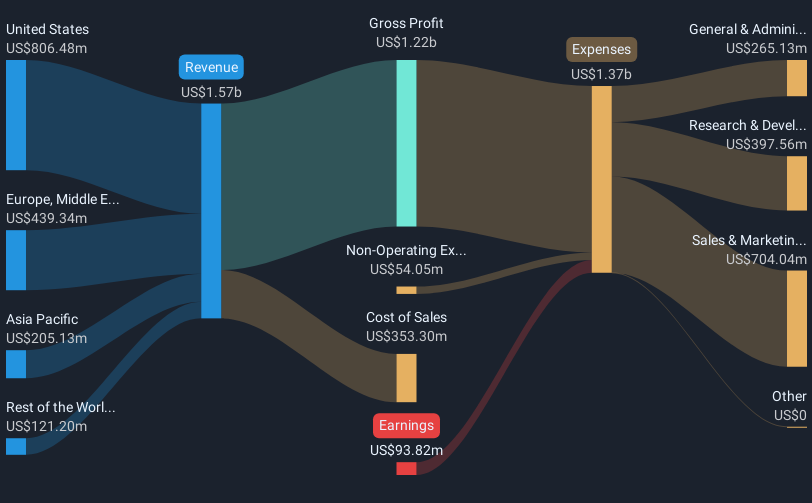

Cloudflare's shares have experienced a significant increase of 324.77% over the past five years, reflecting a robust total return that highlights substantial growth and investor confidence. Over the last year, Cloudflare has outperformed both the broader U.S. market and the U.S. IT industry, indicating strong resilience in its share price performance. This recent momentum is supported by its strategic alliances, which have the potential to enhance revenue growth prospects and solidify Cloudflare's position in cybersecurity and digital transformation.

The company's recent partnerships and collaborations are expected to bolster future revenue and earnings projections, as these initiatives are likely to expand its service offerings and market reach. Despite the encouraging advancements, Cloudflare remains expensive with a current share price that outstrips its estimated fair value, though its price target suggests there still might be room for growth. This juxtaposition with the price target implies cautious optimism among analysts regarding the company's value and future trajectory.

Take a closer look at Cloudflare's potential here in our financial health report.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:NET

Cloudflare

Operates as a cloud services provider that delivers a range of services to businesses worldwide.

High growth potential with excellent balance sheet.

Similar Companies

Market Insights

Community Narratives