- United States

- /

- IT

- /

- NYSE:NET

Cloudflare (NYSE:NET) Partners With Diligent To Enhance Cyber Risk Reporting

Reviewed by Simply Wall St

Cloudflare (NYSE:NET) saw its share price increase by 14% over the past week, a notable movement potentially influenced by strategic partnerships. Cloudflare's collaboration with Diligent and Qualys, announced on April 29, 2025, introduces a Cyber Risk Report combining threat intelligence and insights, enhancing communication of cyber risks at the board level. Meanwhile, a separate partnership with Rakuten Mobile focuses on providing Zero Trust solutions as a managed service in Japan. These advancements align with the broader market's upward momentum, which climbed 5.2% amidst economic signals such as weak U.S. GDP data and fluctuating tech stock earnings.

Over the past five years, Cloudflare's total shareholder return was extremely high at over 300%. This remarkable performance reflects strong investor support and comes in contrast to its more moderate price movement over the past week. Over the last year, Cloudflare's return exceeded the US market, which returned 9.9% during the same period, demonstrating its solid outperformance.

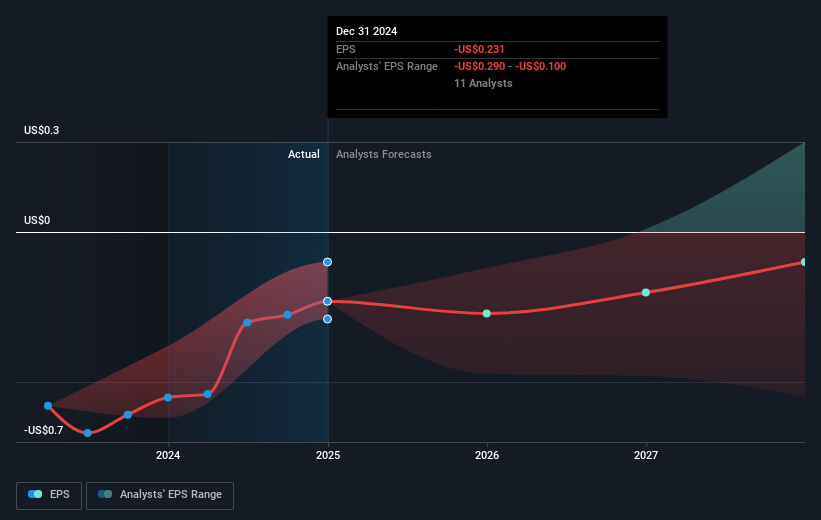

The collaborations with Diligent, Qualys, and Rakuten Mobile, discussed in the introduction, could positively influence Cloudflare's future revenue and earnings forecasts. The integration of new technologies and partnerships may bolster its market position and financial results over time. Currently, the stock is trading at a discount of approximately 13.73% to the consensus analyst price target of US$139.01. This pricing suggests that there is potential for share price appreciation if the company's execution aligns with analyst expectations and if favorable conditions persist.

Review our historical performance report to gain insights into Cloudflare's track record.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:NET

Cloudflare

Operates as a cloud services provider that delivers a range of services to businesses worldwide.

High growth potential with excellent balance sheet.

Similar Companies

Market Insights

Community Narratives