After the most significant pullback in the second half of 2021 (so far), Cloudflare, Inc.(NYSE: NET) recouped the losses in 2 intense sessions.

Despite the latest analyst downgrade, the market seems to be looking positively on the newest expansion.

View our latest analysis for Cloudflare

As the competition in the sector heats up, Cloudflare experienced a surprising downgrade by Oppenheimer. Their analyst, Timothy Horan, downgraded the stock to Perform from Outperform without a price target.

It is interesting to note that the CFO Thomas Seifert sold 20,000 shares at the prices of US$113-118. To a side observer, this might look like a "panic sell" at the bottom of the correction; however, this transaction was scheduled through Rule 10b5-1, allowing insiders of publicly traded corporations to sell a predetermined number of shares at a predetermined time. In this instance, we could conclude that Mr.Saifert was just unlucky.

Meanwhile, Cloudflare announced an expansion into email security, quoting prolonged demands from customers. The company is hoping to achieve success through 2 features: Cloudflare Email Routing and Email Security DNS Wizard, which are designed to give customers more control over their email and protect against pushing and spam.

Reviewing the Returns

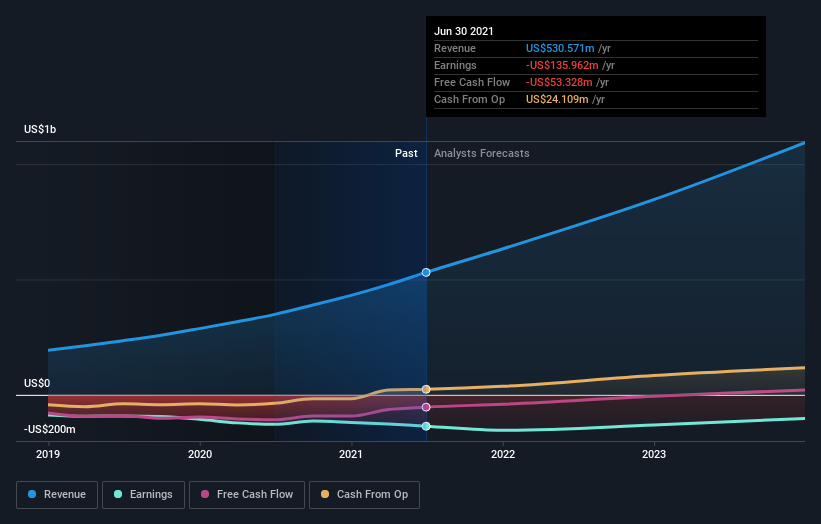

Because Cloudflare made a loss in the last twelve months, we think the market is probably more focused on revenue and revenue growth, at least for now. Generally speaking, companies without profits are expected to grow revenue every year, and at a good clip. As you can imagine, fast revenue growth, when maintained, often leads to rapid profit growth.

In the last year, Cloudflare saw its revenue grow by 52%. That's well above most other pre-profit companies. And the share price has responded, gaining 208%, as we previously mentioned. That sort of revenue growth is bound to attract attention, even if the company doesn't turn a profit. The substantial share price rise indicates optimism, so buyers may have a better opportunity as the hype fades a bit.

You can see how earnings and revenue have changed over time in the image below (click on the chart to see the exact values).

We're pleased to report that the CEO is remunerated more modestly than most CEOs at similarly capitalized companies. It's always worth keeping an eye on CEO pay, but a more critical question is whether the company will grow earnings throughout the years.

You can see what analysts are predicting for Cloudflare in this interactive graph of future profit estimates.

A Perspective Outlook

Cloudflare shareholders should be happy with the total gain of 208% over the last twelve months. The more recent returns have been as impressive as the longer-term returns, coming in at just 23%. However, this is primarily due to the strong rebound from the latest pullback.

It seems the market is simply waiting on more information because if the business delivers, so will the share price (eventually). While it is well worth considering the different impacts of market conditions on the share price, other factors are even more important.

Case in point: We've spotted 2 warning signs for Cloudflare you should be aware of.

Furthermore, you will not want to miss this free list of growing companies that insiders are buying.

Please note, the market returns quoted in this article reflect the market-weighted average returns of stocks that currently trade on US exchanges.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Simply Wall St analyst Stjepan Kalinic and Simply Wall St have no position in any of the companies mentioned. This article is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Stjepan Kalinic

Stjepan is a writer and an analyst covering equity markets. As a former multi-asset analyst, he prefers to look beyond the surface and uncover ideas that might not be on retail investors' radar. You can find his research all over the internet, including Simply Wall St News, Yahoo Finance, Benzinga, Vincent, and Barron's.

About NYSE:NET

Cloudflare

Operates as a cloud services provider that delivers a range of services to businesses worldwide.

Exceptional growth potential with excellent balance sheet.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Title: Market Sentiment Is Dead Wrong — Here's Why PSEC Deserves a Second Look

An amazing opportunity to potentially get a 100 bagger

Amazon: Why the World’s Biggest Platform Still Runs on Invisible Economics

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

Trending Discussion