- United States

- /

- IT

- /

- NYSE:NET

Cloudflare (NET) Valuation Check As AI Data Push And Security Focus Expand Growth Story

Reviewed by Simply Wall St

Cloudflare (NET) has moved deeper into the AI economy by acquiring Human Native, an AI data marketplace. The company is also rolling out tools to block unauthorized AI crawlers and has published its 2026 App Innovation Report on modernization and security.

See our latest analysis for Cloudflare.

Despite the flurry of AI focused announcements, Cloudflare’s recent share price has cooled, with a 30 day share price return of a 6.8% decline and a 90 day share price return of a 12.3% decline. However, the 1 year total shareholder return of 60.4% and 3 year total shareholder return of over 3x still point to strong longer term momentum.

If Cloudflare’s AI push has your attention, it could be a good moment to scan for other high growth tech names by checking out high growth tech and AI stocks.

So with Cloudflare delivering strong multi year shareholder returns while near term performance cools, is the current US$184 share price leaving meaningful upside on the table, or is the market already assuming plenty of future growth?

Most Popular Narrative: 24.1% Undervalued

Cloudflare’s most followed narrative points to a fair value of US$242.46 per share, which sits well above the last close of US$184.14 and frames the current debate around how much future growth is already reflected in the price.

Ongoing expansion and cross-selling of Cloudflare's platform, especially through high-value pool-of-funds and multi-product deals, have led to increasing penetration into large enterprises, all-time-high net sales productivity, and a rising proportion of revenue from large customers. These trends are expected by analysts to support both revenue and earnings growth.

Curious what kind of revenue trajectory, margin lift, and future earnings multiple sit behind that fair value estimate and long term enterprise push? The full narrative lays out the specific growth rates, profitability swing, and valuation assumptions that need to line up for this price target to make sense.

Based on this narrative, analysts are projecting brisk top line expansion over the next few years, a turn from current losses to positive earnings, and a meaningfully higher profit margin than today, all discounted back at 9.07%.

Those assumptions add up to a fair value estimate of US$242.46 per share, which implies a sizeable gap to the current share price if the revenue growth, margin improvement, and future earnings level are all achieved as outlined.

Result: Fair Value of $242.46 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, this hinges on Cloudflare keeping large enterprise customers on side and successfully turning newer AI and Act 4 projects into clear and durable revenue streams.

Find out about the key risks to this Cloudflare narrative.

Another Angle: Multiples Point To A Rich Price

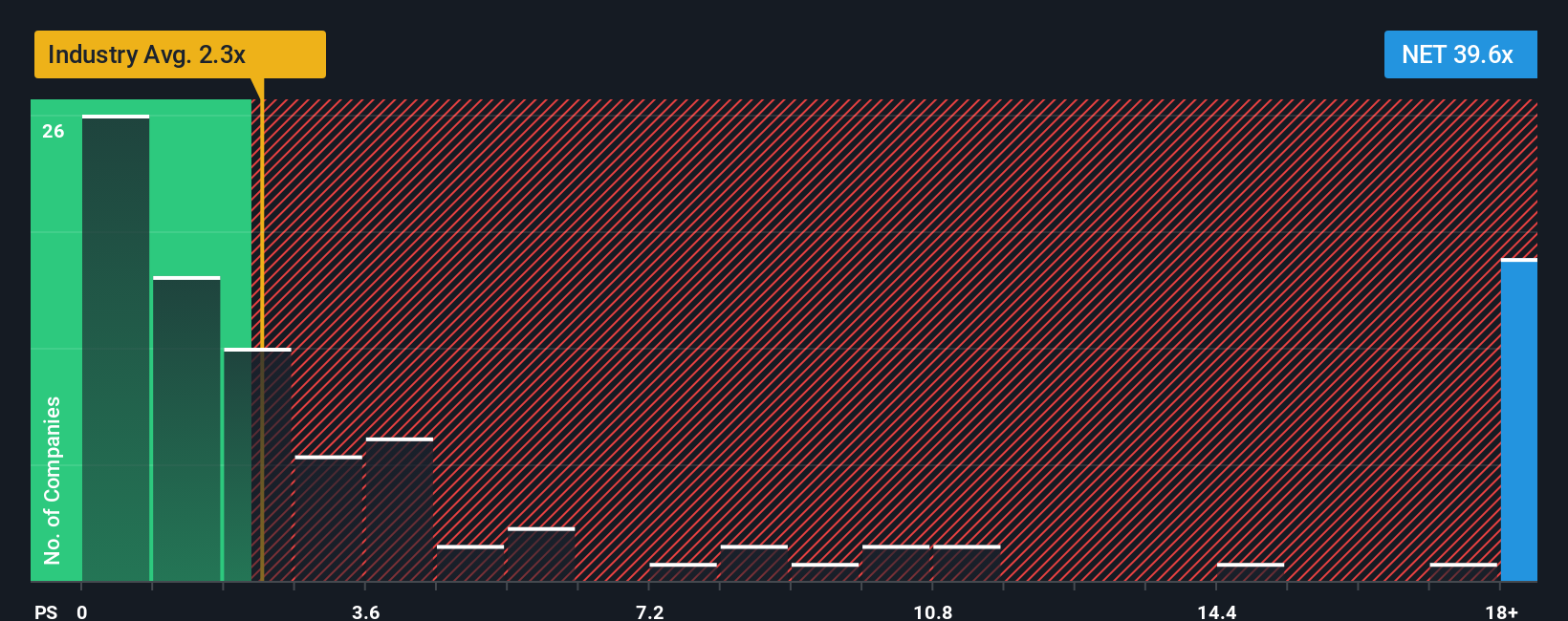

That 24.1% undervaluation story contrasts sharply with how the market is pricing Cloudflare against sales today. The stock trades on a P/S of 32x, versus a peer average of 15.8x, the US IT industry at 2.4x, and a fair ratio of 14.7x. That gap suggests meaningful valuation risk if expectations ease. Which signal do you put more weight on?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Cloudflare Narrative

If you see the story differently, or prefer to test the numbers yourself, you can build your own view in a few minutes with Do it your way.

A great starting point for your Cloudflare research is our analysis highlighting 1 key reward and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

If Cloudflare is already on your radar, do not stop there. The screener can surface other opportunities that might fit your style even better.

- Spot potential value by scanning these 868 undervalued stocks based on cash flows that currently trade below what their cash flows suggest they could be worth.

- Target future growth themes by reviewing these 24 AI penny stocks shaping the next wave of AI driven businesses.

- Lean into income potential by checking out these 12 dividend stocks with yields > 3% that might suit a yield focused approach.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:NET

Cloudflare

Operates as a cloud services provider that delivers a range of services to businesses worldwide.

High growth potential with excellent balance sheet.

Similar Companies

Market Insights

Weekly Picks

Ferrari's Intrinsic and Historical Valuation

Investment Thesis: Costco Wholesale (COST)

Undervalued Key Player in Magnets/Rare Earth

Recently Updated Narratives

The silent giant behind virtually every advanced chip powering AI, smartphones, and modern infrastructure.

Booking Holdings: Why Ground-Level Travel Trends Still Favor the Platform Giants

Looking to be second time lucky with a game-changing new product

Popular Narratives

The "Sleeping Giant" Stumbles, Then Wakes Up

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026