- United States

- /

- IT

- /

- NYSE:NET

Cloudflare (NET) Enhances Zero Trust Platform to Secure Generative AI Adoption

Reviewed by Simply Wall St

Cloudflare (NET) recently announced significant updates to its Zero Trust platform, enhancing capabilities to support generative AI applications securely. These updates focus on security and productivity, critical in a time when the market is closely monitoring AI-related advancements. Over the past quarter, Cloudflare's share price rose 21%, reflecting the company's proactive approach amidst broader market fluctuations, which have remained relatively flat short-term but are up 15% over the year. The launch of these security features likely added strength to Cloudflare’s stock performance, aligning with growing investor interest in tech-enabled security solutions. Overall, Cloudflare's developments complement the market’s focus on technological innovation in AI.

Every company has risks, and we've spotted 1 possible red flag for Cloudflare you should know about.

Uncover the next big thing with financially sound penny stocks that balance risk and reward.

Over the past five years, Cloudflare's shares achieved a total return of 392.90%, indicating a very large growth over this duration without dividends. This broad performance significantly outpaced the past year's results, where the stock surpassed both the US market and the US IT industry's returns. This context of substantial long-term growth highlights the company's potential as it continues to evolve.

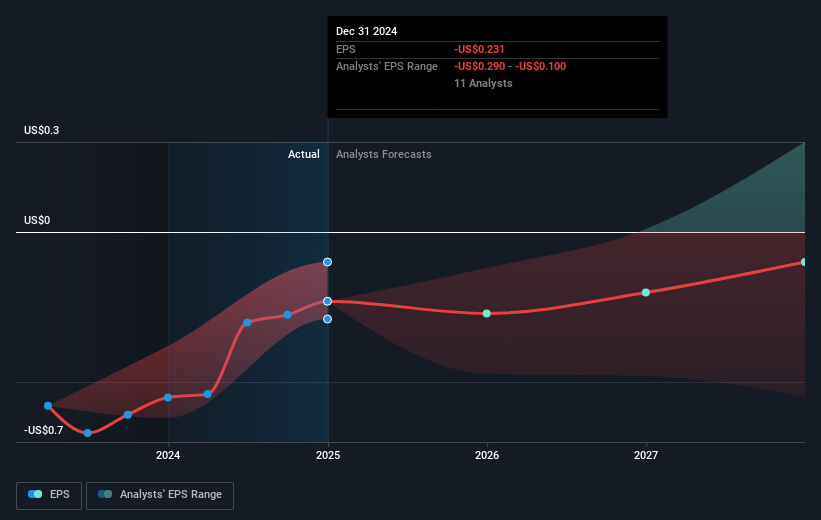

Cloudflare's recent advancements, especially in enhancing its Zero Trust platform for generative AI applications, could bolster revenue and earnings forecasts. The expected annual revenue growth of 20.3% surpasses the US market's 9.3% forecasted growth, while earnings are anticipated to expand by 46.12% annually. Furthermore, with the current share price at US$195.88, a 6.7% discount to the consensus price target of US$209.01 suggests potential room for future appreciation as Cloudflare continues to align its innovative security solutions with market demand.

Our expertly prepared valuation report Cloudflare implies its share price may be too high.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:NET

Cloudflare

Operates as a cloud services provider that delivers a range of services to businesses worldwide.

High growth potential with excellent balance sheet.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Micron Technology will experience a robust 16.5% revenue growth

Amazon will rebound as AI investments start paying off by late 2026

Inside Harvey Norman: Asset-Heavy Retail in an Online World

Popular Narratives

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

Trending Discussion