- United States

- /

- Software

- /

- NYSE:KVYO

Klaviyo (KVYO): Assessing Valuation After $195 Million Follow-On Equity Offering

Reviewed by Simply Wall St

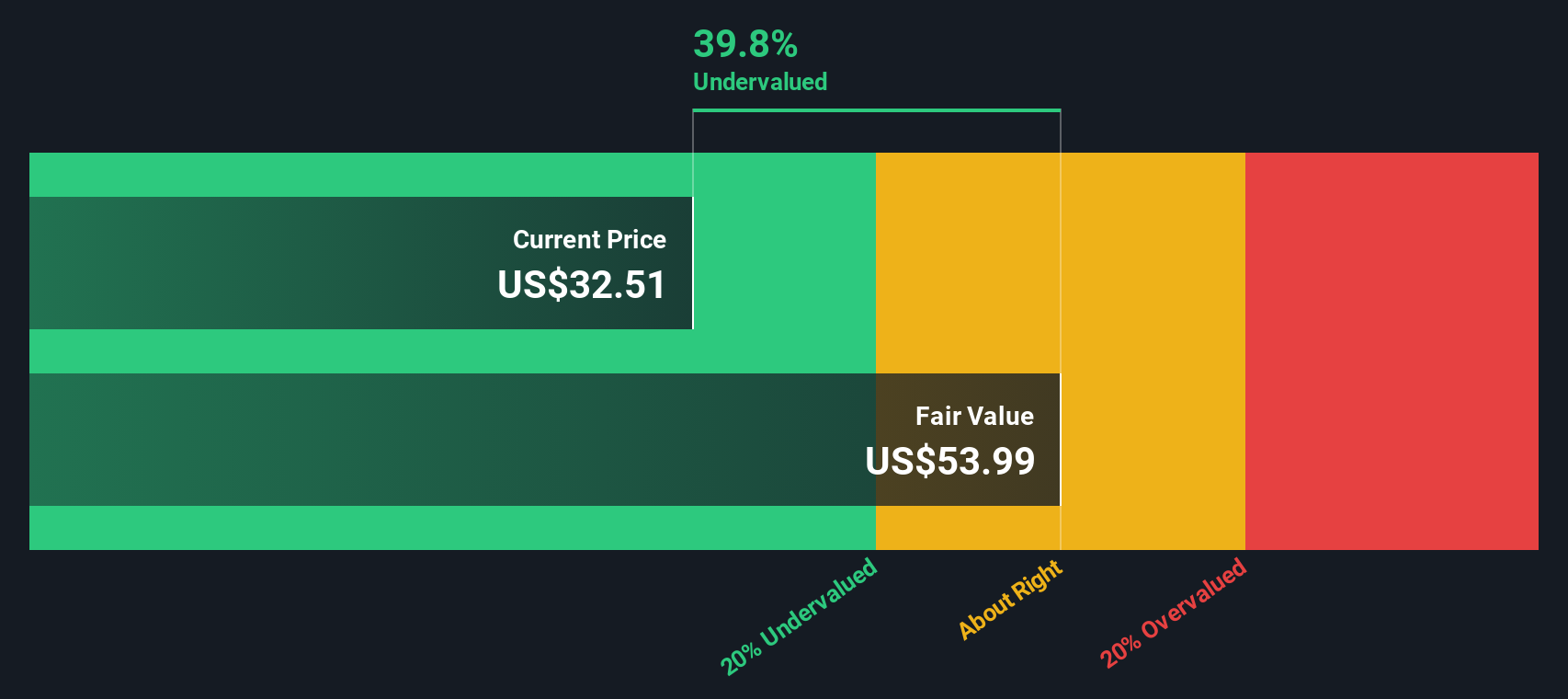

Most Popular Narrative: 29.6% Undervalued

According to the community narrative, Klaviyo’s current share price is well below fair value, suggesting significant upside potential if bullish forecasts are realized.

Growing international expansion, supported by new language rollouts, local channel integrations (e.g., WhatsApp), and localization efforts, is driving strong topline growth (for example, 42% international revenue growth year-over-year). Further penetration of both SMB and enterprise segments is likely to expand future revenue and earnings.

Think Klaviyo’s global moves could trigger a new wave of growth? The factors behind this undervaluation are rapid product rollouts and ambitious financial targets that could reshape its future earnings if they are achieved. Curious about the boldest forecast influencing this valuation? The deeper story is hiding in the numbers.

Result: Fair Value of $46.53 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.However, persistent margin pressures or uncertainty around the success of new AI products could quickly change Klaviyo's future valuation path.

Find out about the key risks to this Klaviyo narrative.Another View: Caution from the SWS DCF Model

While some see Klaviyo as undervalued based on market multiples, a different picture emerges when using the SWS DCF model. This approach also suggests the stock is undervalued, but it brings its own assumptions and sensitivity to future cash flows. Could this alternative method reveal deeper risks or opportunities ahead?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Klaviyo for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Klaviyo Narrative

If you think there is more to Klaviyo's story or want to test your own research, you can build your own view in under three minutes and do it your way.

A good starting point is our analysis highlighting 3 key rewards investors are optimistic about regarding Klaviyo.

Looking for More Winning Investment Ideas?

Step ahead of the market by targeting strategies that match your ambitions. With so many opportunities available, it pays to pursue more than just one story. Get a jump on the smartest opportunities today and steer your portfolio toward the next big outperformance with these hand-picked ideas:

- Supercharge your income by tapping into high-yield investments. Check out dividend stocks with yields > 3% to spot stocks delivering yields above 3%, so your portfolio works harder for you.

- Uncover the future’s standouts by zeroing in on companies driving AI innovation. Seize early gains with picks from the AI penny stocks and ride the next wave of tech breakthroughs.

- Boost your returns with underappreciated opportunities. Target shares trading below their true value using the undervalued stocks based on cash flows and position yourself for potential upside as the market catches on.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Klaviyo might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:KVYO

Klaviyo

A technology company, provides a software-as-a-service platform in the United States, other Americas, the Asia-Pacific, Europe, the Middle East, and Africa.

Flawless balance sheet and undervalued.

Similar Companies

Market Insights

Community Narratives