- United States

- /

- IT

- /

- NYSE:KD

Kyndryl Holdings (NYSE:KD) Reports US$68 Million Net Income In Fourth Quarter

Reviewed by Simply Wall St

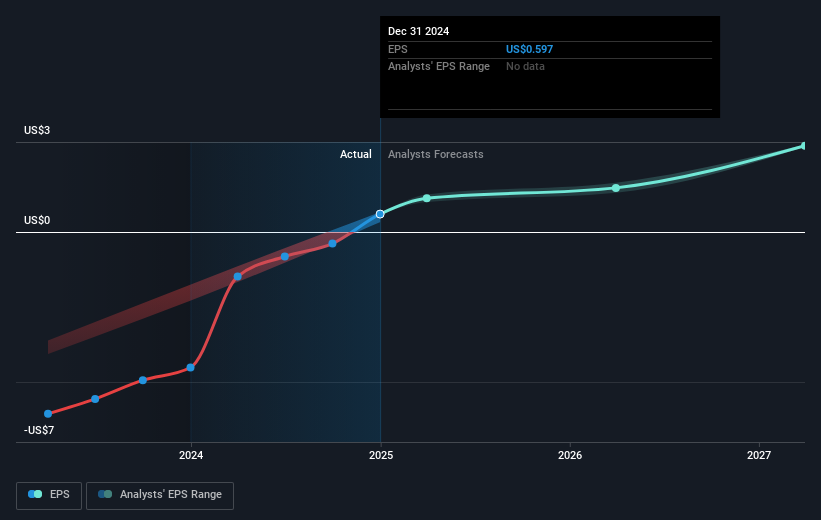

Kyndryl Holdings (NYSE:KD) recently reported positive financial results for the fourth quarter, with a turnaround to a net income of $68 million compared to a prior loss, alongside several strategic product announcements. The launch of their AI Private Cloud Services and the Data Security Posture Management, in particular, align with market trends emphasizing AI readiness and data management. These developments likely bolstered investor confidence, contributing to the company's 26% share price increase over the last month. Despite a generally flat market, Kyndryl's activities and announcements supported its notable outperformance in the market context.

We've identified 2 warning signs for Kyndryl Holdings that you should be aware of.

Uncover the next big thing with financially sound penny stocks that balance risk and reward.

Kyndryl Holdings' recent positive financial performance and strategic advancements, such as the launch of AI Private Cloud Services and Data Security Posture Management, could significantly influence their business trajectory. These initiatives are likely to enhance revenue growth and earnings, given the increasing market emphasis on AI and data management. Analysts expect Kyndryl's earnings to grow substantially, with forecasts reaching US$844 million by 2028. This aligns with the consensus price target of US$43.15, which is 24.4% above the current share price of US$32.64, reflecting market optimism about the company's potential to capitalize on these opportunities.

Over the past three years, Kyndryl's total returns, including share price gains and dividends, surged by a very large 226.65%, underscoring significant long-term investor gains. Comparatively, in the last year, the company's shares have outperformed both the US IT industry, which returned 21.6%, and the broader market's 8.1% increase. The impressive three-year return indicates solid market performance and investor confidence in Kyndryl's growth prospects and strategic initiatives.

The company's recent financial advancements and strategic alliances are anticipated to solidify revenue streams and bolster net income. This momentum might enhance future earnings margins, although challenges like currency volatility and contractual obligations with IBM could impose financial headwinds. The company's expanded service portfolio and alliances are pivotal, with analysts predicting a 1% annual revenue decline yet an increase in profit margins to 5.4% within three years. Such outcomes could justify the expected PE ratio adjustment from 55x to 16x by 2028, affirming the analyst consensus and further supporting share price appreciation.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Kyndryl Holdings might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:KD

Kyndryl Holdings

Operates as a technology services company and IT infrastructure services provider worldwide.

Reasonable growth potential and fair value.

Similar Companies

Market Insights

Community Narratives