- United States

- /

- IT

- /

- NYSE:KD

Is Kyndryl a Hidden Opportunity After Its Shares Dropped 22% in 2025?

Reviewed by Bailey Pemberton

If you have been watching Kyndryl Holdings pop up in your portfolio tracker, you are probably wondering if this is a hidden gem ready to break out, or simply a stock that has already had its run. After all, plenty of investors are reevaluating their strategies as tech and infrastructure companies weather shifting sentiment. While Kyndryl’s headline numbers might seem mixed at first glance, a deeper dive starts to reveal more potential than meets the eye.

Let’s talk about price action. Kyndryl shares currently sit at $27.60, which, despite a sharp 13.2% drop over the past month and a 22.3% decline year-to-date, still shows a 9.7% gain in the last year. If you step back even further, the big picture gets more compelling. Kyndryl’s three-year return stands at an impressive 191.1%. That is the kind of outperformance that grabs attention, and it hints at underlying changes in how investors view the business and the risks they are willing to tolerate.

But price alone rarely tells the whole story. Most investors want to know: is Kyndryl undervalued or properly priced? According to our valuation framework, which checks for undervaluation across six key measures, Kyndryl earns a solid value score of 4. This means it passes four out of six undervaluation checks, putting it firmly in ‘potential opportunity’ territory.

Next, we will break down the major valuation approaches and see how Kyndryl stacks up. As we walk through these time-tested methods, we will also explore why there may be an even sharper way of looking at value that most investors overlook.

Why Kyndryl Holdings is lagging behind its peers

Approach 1: Kyndryl Holdings Discounted Cash Flow (DCF) Analysis

The Discounted Cash Flow (DCF) model estimates what a business is worth today by projecting its future cash flows and then discounting them back to present value. This approach is particularly helpful for companies with predictable cash generation and growth outlooks, such as Kyndryl Holdings.

Kyndryl’s latest reported Free Cash Flow stands at $216.9 Million. Analysts project substantial growth over the next decade, with Free Cash Flow expected to climb to over $2.6 Billion by 2035. Notably, the company is forecast to achieve $406.9 Million in 2026, $1.26 Billion in 2029, and $2.27 Billion in 2033. After five years, these projections become even more ambitious, reflecting Simply Wall St’s extrapolations based on recent performance and industry trends.

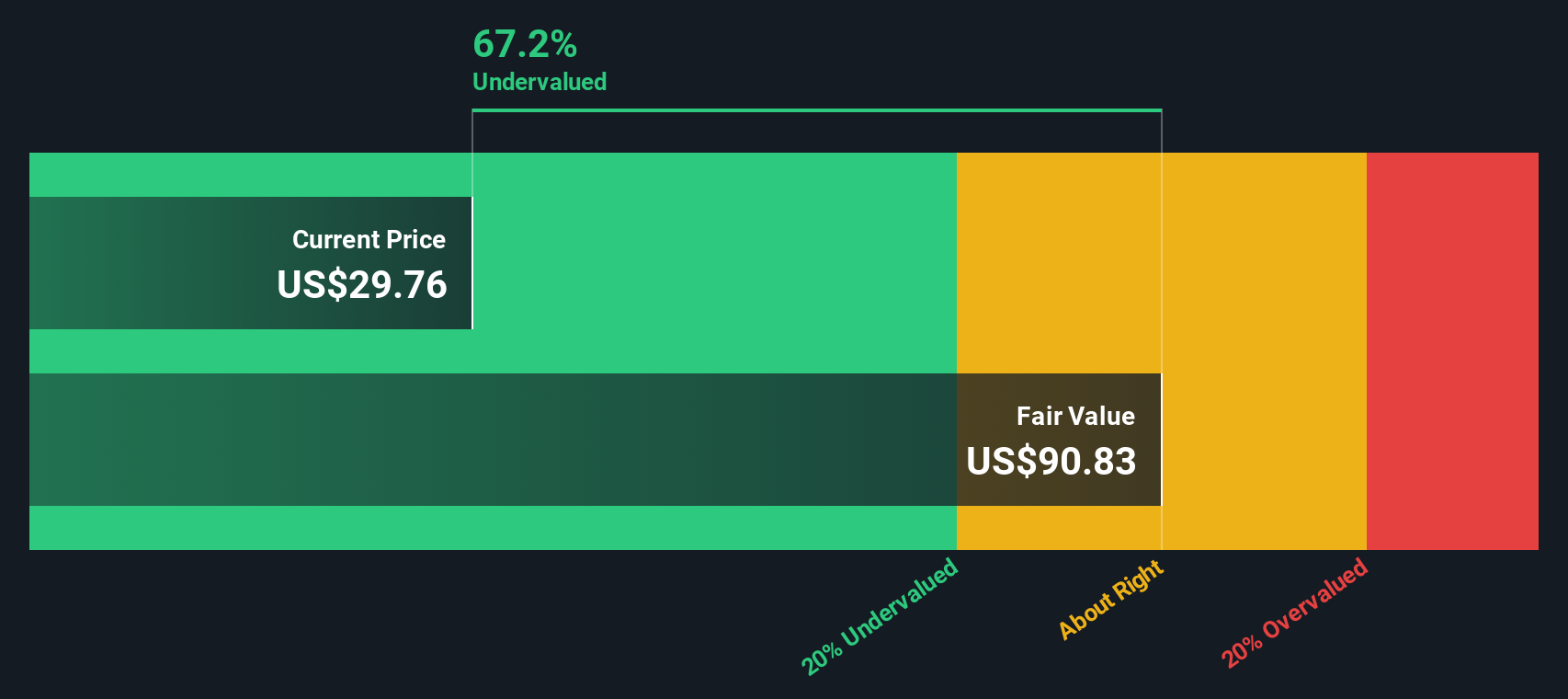

Based on these assumptions, the DCF calculation puts Kyndryl’s intrinsic value at $88.68 per share. With the current market price at $27.60, this equates to the stock trading at a steep 68.9% discount to its estimated fair value. This signals potential undervaluation according to this model.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Kyndryl Holdings is undervalued by 68.9%. Track this in your watchlist or portfolio, or discover more undervalued stocks.

Approach 2: Kyndryl Holdings Price vs Earnings (PE)

The Price-to-Earnings (PE) ratio is a popular way to value profitable companies because it directly links a company’s stock price to its earnings. For investors, the PE ratio acts as a shorthand for how much they are paying for each dollar of earnings, making it straightforward to compare companies that consistently generate profits.

However, the “normal” or “fair” PE is not just a random figure. Growth expectations and risk are important factors. Fast-growing companies can justify higher PE ratios since investors expect bigger profits in the future. In contrast, higher risk usually leads to a lower PE as investors want a margin for uncertainty.

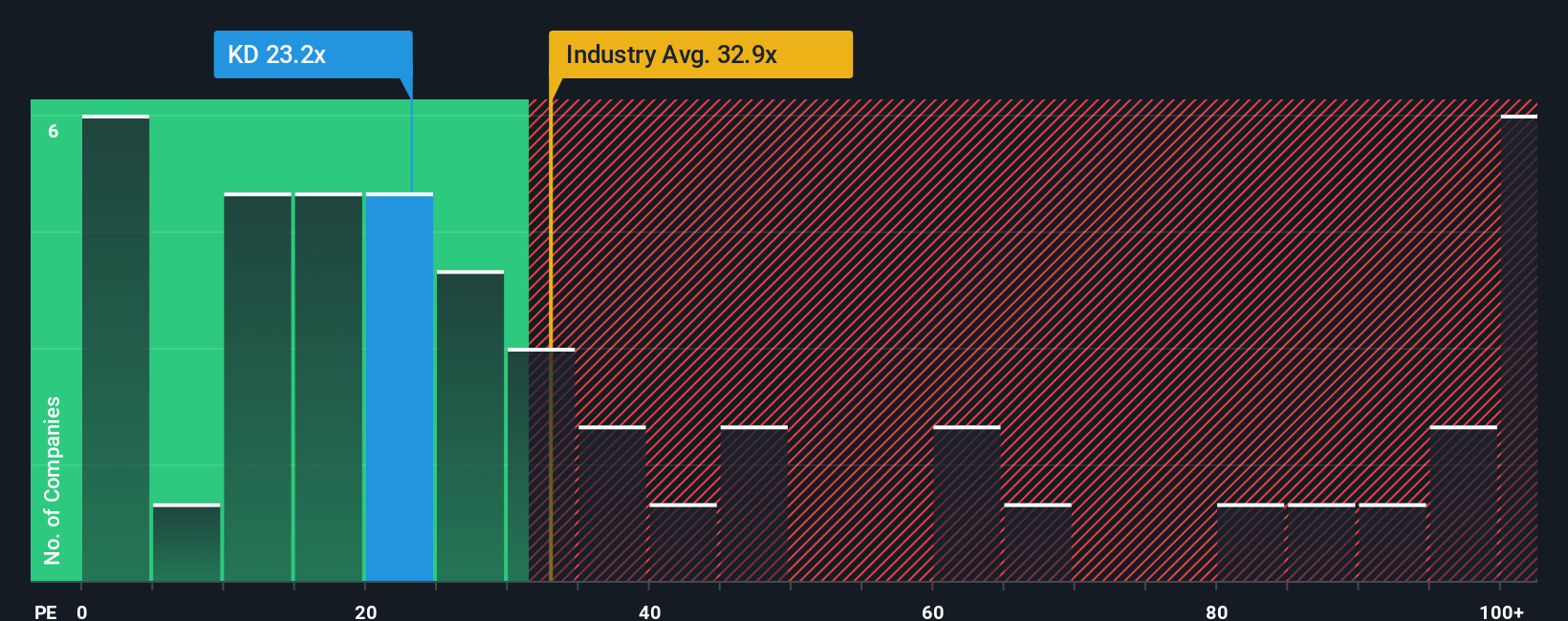

For Kyndryl Holdings, the current PE ratio is 21.48x. Compared to the IT industry average of 31.71x and a peer group average of 14.25x, Kyndryl seems reasonably positioned. However, benchmarks only tell part of the story.

This is where Simply Wall St’s “Fair Ratio” comes in. The Fair Ratio (53.20x for Kyndryl) is calculated based on factors including the company’s earnings growth, profit margins, industry characteristics, market cap, and risk profile. This dynamic approach goes beyond simple peer or industry comparisons and gives a more tailored view of what valuation is justified specifically for Kyndryl.

Since Kyndryl’s actual PE ratio (21.48x) is below its Fair Ratio (53.20x), this suggests that the market is pricing the stock below what its fundamentals would warrant, indicating undervaluation at current levels.

Result: UNDERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Kyndryl Holdings Narrative

Earlier we mentioned that there is an even better way to understand valuation, so let us introduce you to Narratives. A Narrative is your story behind the numbers, linking your view of Kyndryl Holdings’ business, where it is heading, its opportunities and risks, to specific projections for future revenue, earnings, and profit margins, which then leads to your fair value estimate for the stock.

Instead of relying solely on traditional models, Narratives let you connect what makes Kyndryl unique to financial forecasts that matter. This makes it simple to see how your perspective stacks up. Narratives are an interactive tool on Simply Wall St’s Community page, available to millions of investors, helping you visualize the fair value based on your assumptions and easily compare it with today’s price to decide when to buy or sell.

What sets Narratives apart is that they are always up to date, automatically adjusting whenever new information, such as earnings releases or industry news, is published. For example, some investors see Kyndryl as a future winner in digital transformation and set a fair value estimate over $55 per share, reflecting optimism around AI and recurring revenues. More cautious users focus on transition risks and legacy contracts, supporting targets closer to $40. This flexibility helps you invest with conviction, on your own terms.

Do you think there's more to the story for Kyndryl Holdings? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Kyndryl Holdings might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:KD

Kyndryl Holdings

Operates as a technology services company and IT infrastructure services provider in the United States, Japan, and internationally.

Good value with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives