- United States

- /

- IT

- /

- NYSE:KD

Exploring High Growth Tech Stocks In The US Market

Reviewed by Simply Wall St

The United States market has shown a positive trend recently, climbing 1.6% in the last seven days and 12% over the past year, with earnings projected to grow by 14% annually in the coming years. In this context, identifying high growth tech stocks involves looking for companies that not only align with these upward trends but also possess strong fundamentals and innovative capabilities to sustain their momentum in an evolving market landscape.

Top 10 High Growth Tech Companies In The United States

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Super Micro Computer | 26.38% | 39.09% | ★★★★★★ |

| Mereo BioPharma Group | 53.63% | 66.57% | ★★★★★★ |

| Ardelyx | 20.78% | 59.46% | ★★★★★★ |

| Travere Therapeutics | 26.41% | 64.47% | ★★★★★★ |

| TG Therapeutics | 26.46% | 38.75% | ★★★★★★ |

| AVITA Medical | 27.20% | 60.67% | ★★★★★★ |

| Alkami Technology | 20.54% | 76.67% | ★★★★★★ |

| Alnylam Pharmaceuticals | 23.64% | 61.12% | ★★★★★★ |

| Ascendis Pharma | 35.15% | 60.20% | ★★★★★★ |

| Lumentum Holdings | 22.86% | 114.03% | ★★★★★★ |

Click here to see the full list of 227 stocks from our US High Growth Tech and AI Stocks screener.

Let's explore several standout options from the results in the screener.

Elastic (ESTC)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Elastic N.V. is a search artificial intelligence company that provides hosted and managed solutions for hybrid, public or private clouds, and multi-cloud environments globally, with a market cap of $9.12 billion.

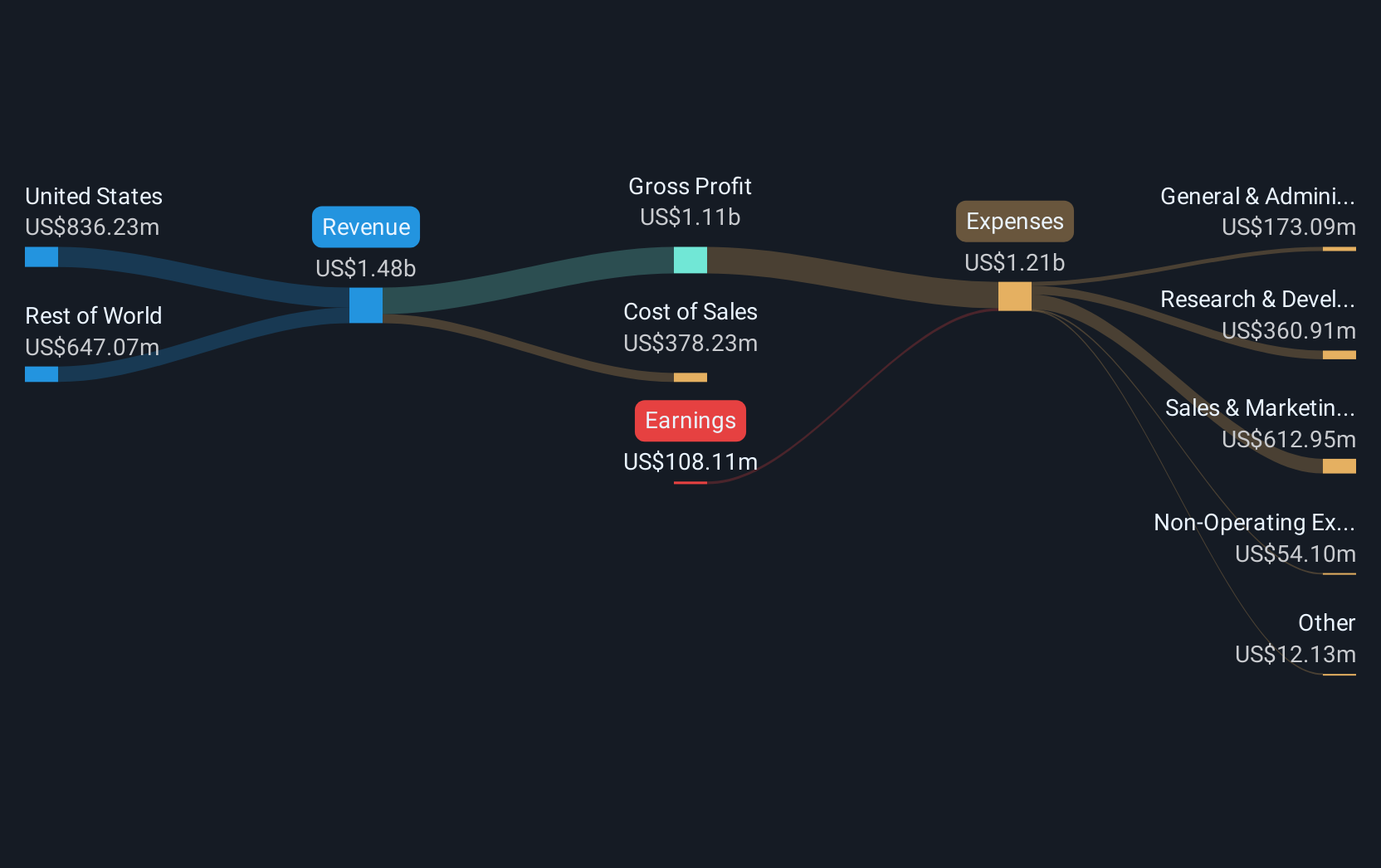

Operations: Elastic focuses on delivering search AI solutions through hosted and managed services across various cloud environments. The company generates revenue primarily from its Software & Programming segment, amounting to $1.48 billion.

Elastic N.V. has demonstrated resilience and adaptability in a challenging tech landscape, reporting a significant reduction in net loss from $41.1 million to $16.38 million year-over-year for Q4 2025, alongside a revenue increase to $388.43 million from $335 million. The company's strategic collaboration with AWS aims to enhance AI-driven applications, signaling robust future prospects in AI integration and cloud services. This partnership is poised to streamline operations and foster innovation, leveraging AWS's extensive capabilities to amplify Elastic's technological offerings and market reach, particularly as they project revenue growth of up to 14% year-over-year for the upcoming quarter. With R&D expenses consistently fueling advancements—evidenced by recent product integrations like hybrid search capabilities with Microsoft’s Semantic Kernel—Elastic is strategically investing in areas that promise high returns on innovation.

Kyndryl Holdings (KD)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Kyndryl Holdings, Inc. is a technology services company that provides IT infrastructure services across the United States, Japan, and globally, with a market capitalization of approximately $9.28 billion.

Operations: Kyndryl Holdings generates revenue through IT infrastructure services, with key segments including the United States ($3.88 billion), Japan ($2.36 billion), Principal Markets ($5.21 billion), and Strategic Markets ($3.62 billion). The company's market presence spans globally, focusing on delivering technology services across various regions.

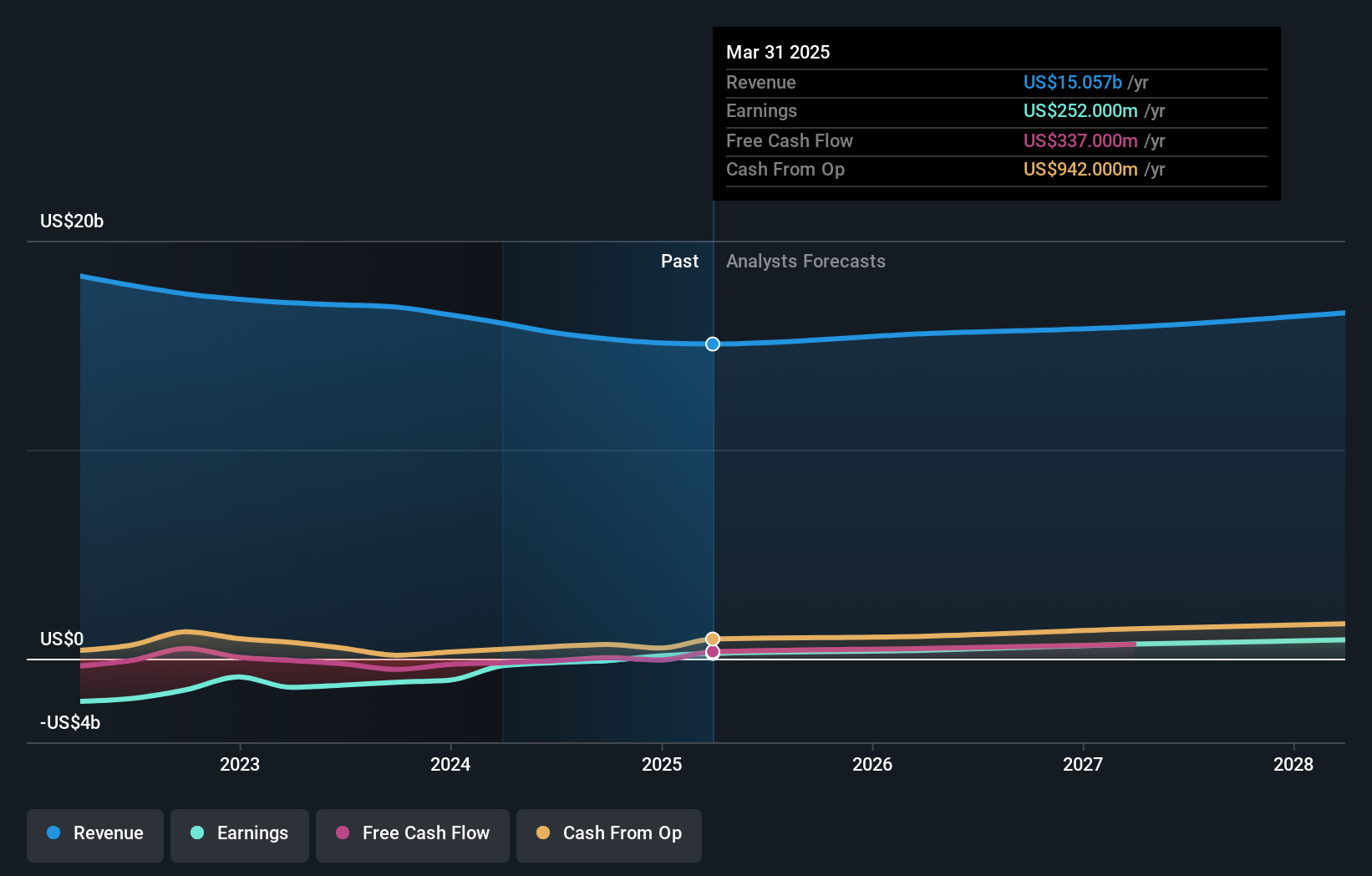

Kyndryl Holdings has pivoted effectively in the tech landscape, evidenced by a strategic alliance with Databricks to enhance AI and data capabilities, crucial for digital transformations. This partnership is expected to modernize IT frameworks significantly, integrating advanced AI across systems which could be transformative for Kyndryl’s service offerings. Moreover, the company's recent shift towards profitability with a net income of $68 million from a previous net loss highlights improving operational efficiency. Their R&D focus remains robust, aligning with industry demands for innovative tech solutions. With these strategic moves and an annual earnings growth forecast at 39.6%, Kyndryl is positioning itself as a resilient contender in the evolving tech sector despite slower revenue growth projections of 2.9% per year.

- Navigate through the intricacies of Kyndryl Holdings with our comprehensive health report here.

Assess Kyndryl Holdings' past performance with our detailed historical performance reports.

ServiceNow (NOW)

Simply Wall St Growth Rating: ★★★★★☆

Overview: ServiceNow, Inc. offers cloud-based solutions for digital workflows across various regions globally and has a market capitalization of $213.72 billion.

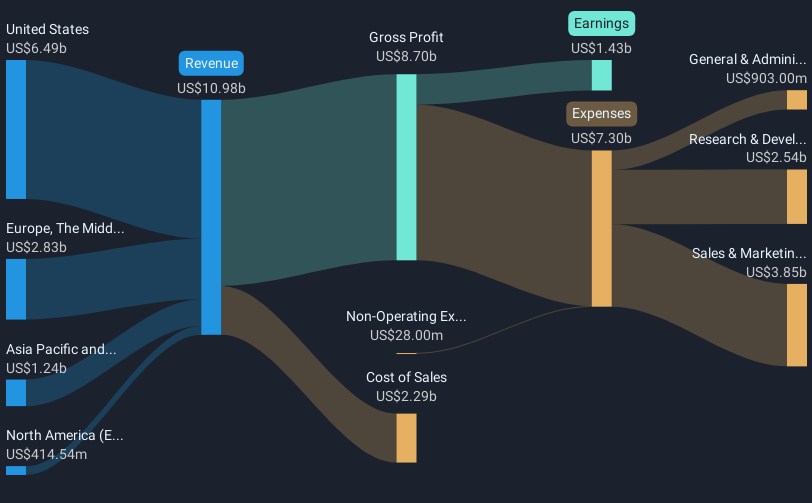

Operations: The company generates revenue primarily from its Internet Software & Services segment, totaling $11.47 billion. Its cloud-based solutions facilitate digital workflows across multiple regions, enhancing operational efficiency for businesses worldwide.

ServiceNow's recent strategic moves, including its integration with Black Kite and the launch of CTRL WRK on its platform, underscore its commitment to expanding its AI capabilities and enhancing cybersecurity and operational risk management. These initiatives are part of a broader strategy to capitalize on a $275 billion market opportunity through 2026. The company's focus on developing robust partner ecosystems and innovative AI solutions not only strengthens its market position but also enhances the functionality of its offerings, making them indispensable tools for enterprise risk assessment and management. This approach is likely to continue driving ServiceNow's relevance in high-growth tech sectors where security and efficiency are paramount.

- Click here and access our complete health analysis report to understand the dynamics of ServiceNow.

Evaluate ServiceNow's historical performance by accessing our past performance report.

Seize The Opportunity

- Click this link to deep-dive into the 227 companies within our US High Growth Tech and AI Stocks screener.

- Hold shares in these firms? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

- Streamline your investment strategy with Simply Wall St's app for free and benefit from extensive research on stocks across all corners of the world.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechValuation is complex, but we're here to simplify it.

Discover if Kyndryl Holdings might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:KD

Kyndryl Holdings

Operates as a technology services company and IT infrastructure services provider in the United States, Japan, and internationally.

Undervalued with reasonable growth potential.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Title: Market Sentiment Is Dead Wrong — Here's Why PSEC Deserves a Second Look

An amazing opportunity to potentially get a 100 bagger

Amazon: Why the World’s Biggest Platform Still Runs on Invisible Economics

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

Trending Discussion