- United States

- /

- Software

- /

- NYSE:IOT

Will Samsara’s (IOT) New AI Safety Tools Strengthen Its Competitive Edge in Fleet Management?

Reviewed by Sasha Jovanovic

- Earlier this week, Samsara Inc. announced a significant enhancement to its AI-powered safety platform, introducing features such as Weather Intelligence, Automated Coaching, and Worker Safety to help operational leaders reduce risk for both fleet vehicles and field personnel at scale.

- Notably, the inclusion of real-time weather risk tracking and instant in-cab driver alerts marks a substantial step in integrating environmental insights directly into daily fleet safety management.

- To understand how these advanced proactive safety tools could shape Samsara's trajectory, we'll explore their implications on the company's broader investment narrative.

This technology could replace computers: discover 26 stocks that are working to make quantum computing a reality.

Samsara Investment Narrative Recap

To own shares of Samsara, investors need to believe in the company’s ability to expand its footprint in fleet and field safety through continuous AI-driven platform enhancements, translating technology innovation into real, scalable revenue. The major safety platform upgrade this week is a clear signal of ongoing product investment, but on its own it does not immediately change the primary short-term catalyst: accelerating large enterprise customer wins, nor does it meaningfully diminish the biggest risk, which is the unpredictability of sales cycles among these customers.

Among recent announcements, the First Student partnership stands out as most relevant, since it is a concrete example of a large customer deploying Samsara’s technology fleet-wide for improved safety and operational efficiency. This supports the company’s near-term catalyst of growing annual recurring revenue by landing and expanding with large customers, a trend analysts view as central to Samsara’s investment appeal.

Yet, despite these advances, investors should be mindful that, as exciting as new tech features sound, the slow and complex sales cycles among big enterprise customers remain a key risk...

Read the full narrative on Samsara (it's free!)

Samsara's outlook anticipates $2.4 billion in revenue and $311.3 million in earnings by 2028. This implies a 21.2% annual revenue growth rate and an earnings increase of $432 million from current earnings of -$120.7 million.

Uncover how Samsara's forecasts yield a $48.20 fair value, a 27% upside to its current price.

Exploring Other Perspectives

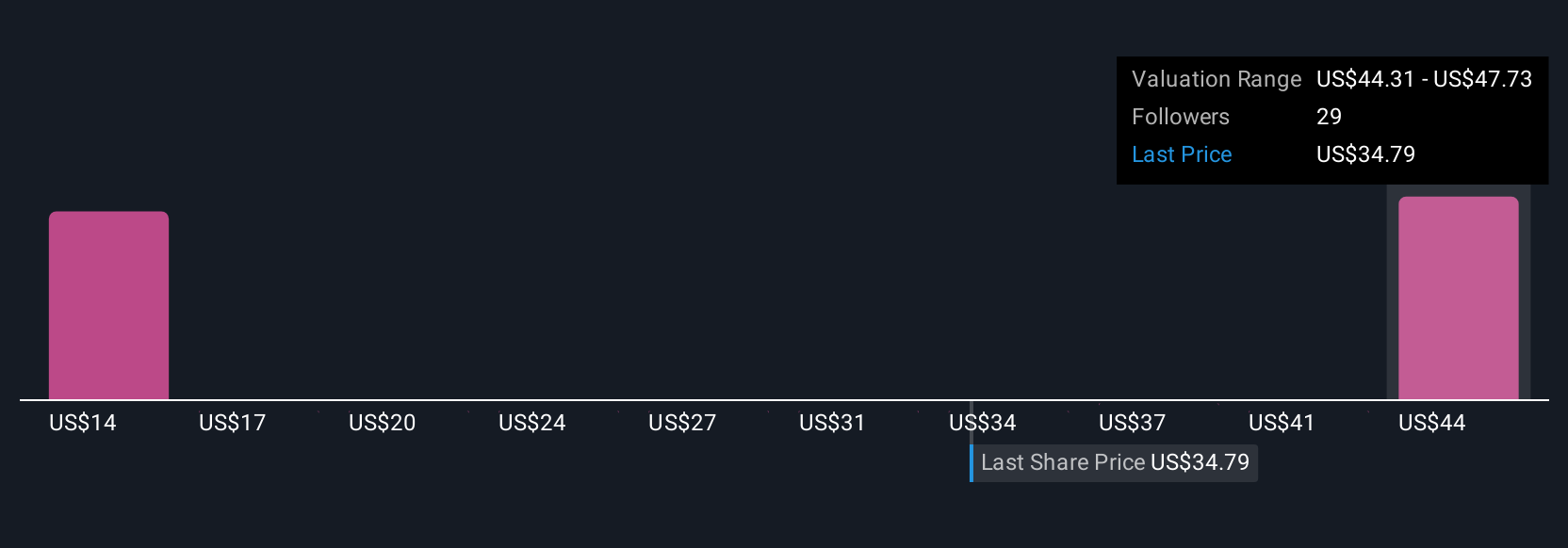

Simply Wall St Community members have set fair value estimates for Samsara ranging from US$13.51 to US$53 across 10 independent analyses. While opinions vary widely, many are watching how successfully Samsara can convert product innovation into broad customer adoption and predictable revenue, which may take longer to materialize than some expect.

Explore 10 other fair value estimates on Samsara - why the stock might be worth as much as 39% more than the current price!

Build Your Own Samsara Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Samsara research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Samsara research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Samsara's overall financial health at a glance.

Ready To Venture Into Other Investment Styles?

Right now could be the best entry point. These picks are fresh from our daily scans. Don't delay:

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- Find companies with promising cash flow potential yet trading below their fair value.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:IOT

Samsara

Provides solutions to connect physical operations data to its connected operations platform in the United States and internationally.

Flawless balance sheet with very low risk.

Similar Companies

Market Insights

Community Narratives