- United States

- /

- Software

- /

- NYSE:IOT

Samsara (IOT) Turns Q3 EPS Positive, Testing Bearish Valuation Narratives

Reviewed by Simply Wall St

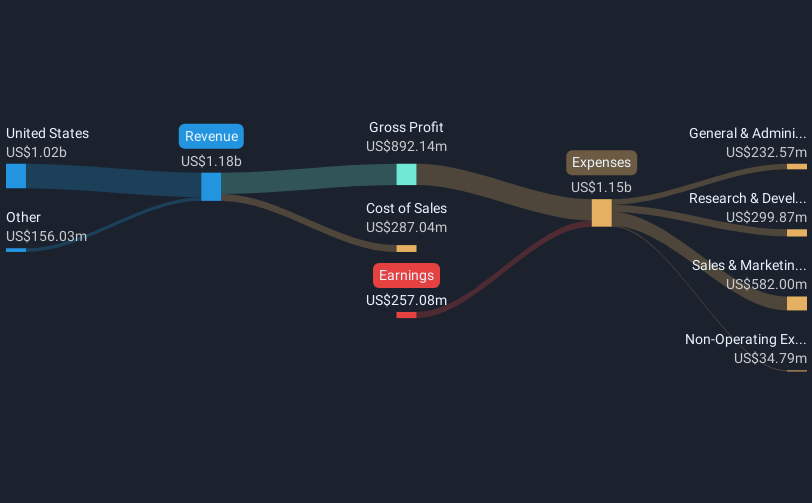

Samsara (IOT) just posted Q3 2026 numbers with revenue of $416 million and Basic EPS of $0.01, marking a rare quarter in the black with net income of about $7.8 million. The company has seen revenue move from $300 million in Q2 2025 to $416 million in Q3 2026, while quarterly EPS shifted from a loss of about $0.09 to a modest profit as losses narrowed over time, and that margin progress is now front and center for investors dissecting this print.

See our full analysis for Samsara.With the latest quarter in hand, the next step is to compare these results with the dominant narratives around Samsara's growth, profitability path, and risk profile to see which stories still hold up and which need a rethink.

See what the community is saying about Samsara

Losses Shrink On A Trailing Basis

- On a trailing twelve month basis, net loss narrowed from about $264.8 million in Q2 2025 to $42.4 million by Q3 2026, while total revenue over the same period grew from roughly $1.1 billion to $1.5 billion.

- What stands out for the bullish view is that multi year loss reduction of roughly 18.3 percent a year sits alongside strong revenue expansion, yet the business is still unprofitable today and forecasts say it will stay that way for at least the next three years.

- Trailing twelve month Basic EPS improved from about negative $0.48 in Q2 2025 to negative $0.07 by Q3 2026, which backs the idea of operating progress even though the company has not yet crossed into sustained profitability.

- At the same time, trailing twelve month revenue rose from roughly $1.1 billion to $1.5 billion, reinforcing the growth angle that bulls emphasize while also showing that scale alone has not yet pushed margins into consistently positive territory.

Fast Revenue Growth Meets Rich Pricing

- Revenue is forecast to grow at about 16.7 percent per year, but the stock trades on a price to sales ratio of roughly 17.1 times versus a peer average around 9.2 times and a US software industry average near 5 times.

- Critics highlight that this premium valuation is hard to reconcile with ongoing losses and a DCF fair value of about $33.66, which both sit below the current share price near $45.22.

- The DCF fair value of $33.66 is more than $10 below the current price of $45.22, a gap that bears use to argue expectations already bake in a lot of future success.

- With the business still unprofitable on a trailing twelve month basis despite $1.5 billion of revenue, the combination of high growth and high multiples is exactly the trade off that more cautious investors focus on.

From Deep Red To Near Break Even

- Quarterly net income excluding extra items has swung from a loss of about $49.6 million in Q2 2025 to a profit of roughly $7.8 million in Q3 2026, while quarterly revenue over that span climbed from around $300 million to $416 million.

- Consensus narrative notes that this kind of improvement, combined with strong annual recurring revenue growth and larger enterprise wins, supports a bullish case for long term expansion, but the fact that the trailing twelve month EPS is still negative and profitability is not expected within three years keeps the cautious narrative in play.

- The move from negative Basic EPS of about $0.09 in Q2 2025 to slightly positive EPS near $0.01 in Q3 2026 lines up with views that the platform is scaling, yet does not contradict forecasts that full year profitability is still some distance away.

- Strong growth in larger enterprise customers and platform usage from the consensus narrative sits against recent significant insider selling over the last three months, which some investors will weigh as they judge how durable this margin progress really is.

Next Steps

To see how these results tie into long-term growth, risks, and valuation, check out the full range of community narratives for Samsara on Simply Wall St. Add the company to your watchlist or portfolio so you'll be alerted when the story evolves.

See the numbers in a different light, and turn that view into a personalised narrative in just a few minutes with Do it your way.

A great starting point for your Samsara research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

Explore Alternatives

Samsara still carries ongoing losses, rich valuation multiples, and insider selling, which together raise questions about how much upside is left at today’s price.

If this setup feels too stretched, use our these 906 undervalued stocks based on cash flows to quickly zero in on pre screened names where current prices better reflect underlying cash flow strength and potential.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:IOT

Samsara

Provides solutions to connect physical operations data to its connected operations platform in the United States and internationally.

Flawless balance sheet with very low risk.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

ADNOC Gas future shines with a 21.4% revenue surge

Watch Pulse Seismic Outperform with 13.6% Revenue Growth in the Coming Years

Significantly undervalued gold explorer in Timmins, finally getting traction

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026