- United States

- /

- Software

- /

- NYSE:IOT

How Investors Are Reacting To Samsara (IOT) Expanding Its AI Safety Platform With New Fleet Features

Reviewed by Sasha Jovanovic

- In September 2025, Samsara Inc. unveiled a significant expansion to its AI-powered safety platform, introducing new features like Weather Intelligence, Automated Coaching, and comprehensive Worker Safety tools aimed at enhancing fleet safety and operational response to severe conditions.

- This update highlights Samsara’s push to integrate real-time data and AI-driven insights, aiming to give operational leaders faster, more contextual safety decision capabilities across their fleets and workforce.

- We’ll explore how Samsara’s launch of advanced safety features leveraging AI could influence the company’s growth narrative and sector positioning.

Outshine the giants: these 24 early-stage AI stocks could fund your retirement.

Samsara Investment Narrative Recap

To believe in Samsara as a shareholder, you need to see value in its ability to win large enterprise clients and expand usage of its AI-driven platform across under-penetrated markets, all while successfully converting innovation into recurring revenue. The recent AI-powered safety platform launch showcases continued product evolution, but does not materially change the most important near-term catalyst: revenue growth from product adoption. The largest risk remains the complexity and unpredictability of long enterprise sales cycles, which can impact revenue consistency.

Of the recent announcements, the expanded partnership with First Student (equipping a 46,000 vehicle fleet with Samsara’s technology) directly ties to the new safety platform. This underscores how feature launches and customer wins may reinforce each other as catalysts for growth, but adoption timelines and contract ramp-ups still add uncertainty.

However, investors should also keep in mind that sales cycles with major enterprise customers can present challenges to revenue predictability when...

Read the full narrative on Samsara (it's free!)

Samsara's narrative projects $2.4 billion revenue and $311.3 million earnings by 2028. This requires 21.2% yearly revenue growth and a $432 million increase in earnings from the current level of -$120.7 million.

Uncover how Samsara's forecasts yield a $48.20 fair value, a 23% upside to its current price.

Exploring Other Perspectives

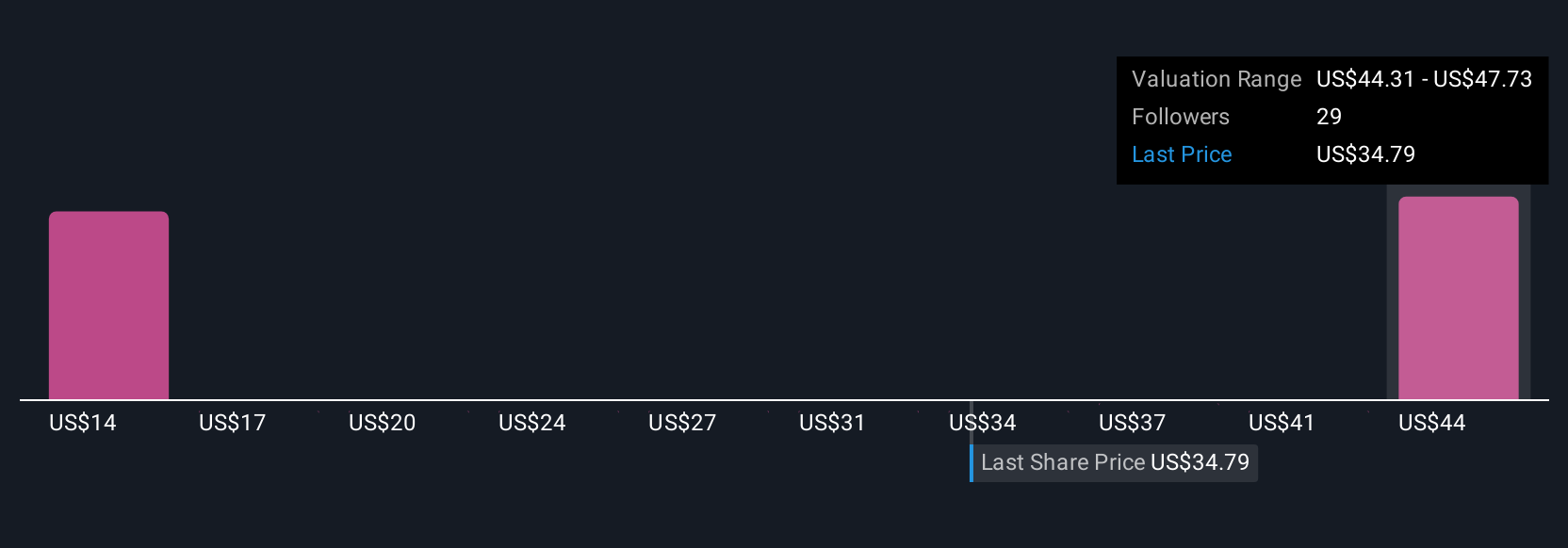

Ten individual fair value estimates from the Simply Wall St Community range from US$13.51 to US$50 per share. With such varied outlooks, consider how long sales cycles and delayed revenue realization might impact Samsara’s path to sustained growth.

Explore 10 other fair value estimates on Samsara - why the stock might be worth less than half the current price!

Build Your Own Samsara Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Samsara research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Samsara research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Samsara's overall financial health at a glance.

Seeking Other Investments?

Opportunities like this don't last. These are today's most promising picks. Check them out now:

- These 13 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- Find companies with promising cash flow potential yet trading below their fair value.

- The end of cancer? These 28 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:IOT

Samsara

Provides solutions to connect physical operations data to its connected operations platform in the United States and internationally.

Flawless balance sheet with very low risk.

Similar Companies

Market Insights

Community Narratives