- United States

- /

- Software

- /

- NYSE:INFA

Informatica First Quarter 2025 Earnings: EPS: US$0.004 (vs US$0.031 in 1Q 2024)

Informatica (NYSE:INFA) First Quarter 2025 Results

Key Financial Results

- Revenue: US$403.9m (up 3.9% from 1Q 2024).

- Net income: US$1.34m (down 86% from 1Q 2024).

- Profit margin: 0.3% (down from 2.4% in 1Q 2024). The decrease in margin was driven by higher expenses.

- EPS: US$0.004 (down from US$0.031 in 1Q 2024).

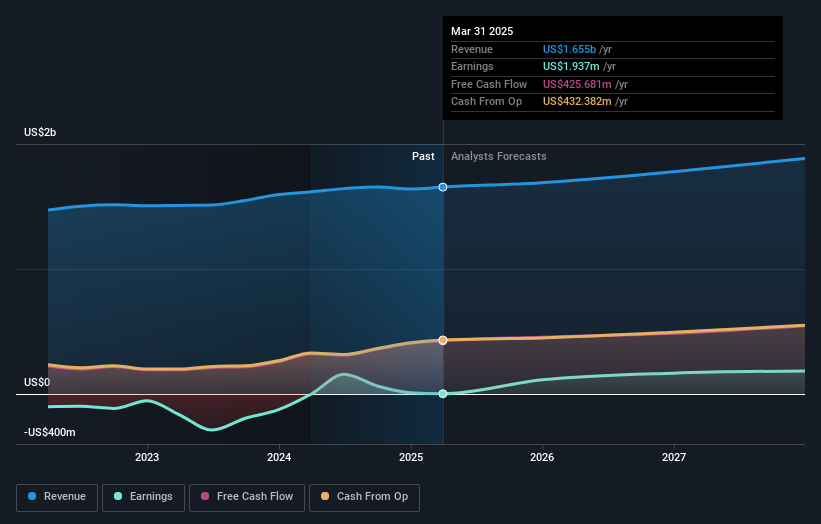

All figures shown in the chart above are for the trailing 12 month (TTM) period

Informatica Earnings Insights

Looking ahead, revenue is forecast to grow 5.1% p.a. on average during the next 3 years, compared to a 12% growth forecast for the Software industry in the US.

Performance of the American Software industry.

The company's shares are up 1.2% from a week ago.

Balance Sheet Analysis

While earnings are important, another area to consider is the balance sheet. We have a graphic representation of Informatica's balance sheet and an in-depth analysis of the company's financial position.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NYSE:INFA

Informatica

Develops an artificial intelligence-powered platform that connects, manages, and unifies data across multi-vendor, multi-cloud, and hybrid systems at enterprise scale worldwide.

Excellent balance sheet and fair value.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Airbnb Stock: Platform Growth in a World of Saturation and Scrutiny

Clarivate Stock: When Data Becomes the Backbone of Innovation and Law

Adobe Stock: AI-Fueled ARR Growth Pushes Guidance Higher, But Cost Pressures Loom

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

MicroVision will explode future revenue by 380.37% with a vision towards success

Trending Discussion