- United States

- /

- IT

- /

- NYSE:IBM

The Bull Case for IBM (IBM) Could Change Following Strategic Airtel Partnership for India’s AI Market

Reviewed by Sasha Jovanovic

- Bharti Airtel recently announced a strategic partnership with IBM to enhance Airtel Cloud, enabling Indian enterprises in regulated sectors to access IBM's AI-ready servers, hybrid cloud infrastructure, and advanced software solutions.

- This collaboration highlights IBM's expanding presence in India's enterprise technology landscape, with a focus on delivering secure, data-resident, and scalable AI capabilities for critical industries.

- Next, we'll explore how IBM's deepened alliance with a leading Indian telecom operator could influence its long-term growth narrative.

Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

International Business Machines Investment Narrative Recap

To be a shareholder in IBM, you have to believe in the company's continued progress in hybrid cloud, AI, and enterprise partnerships as structural long-term drivers, while understanding the risks of macroeconomic uncertainty and the reliance on consumption-based software revenue. The recent Bharti Airtel alliance positions IBM to deepen its reach in India's regulated sectors, but is unlikely to meaningfully alter the most important near-term catalysts, such as enterprise software adoption, or to substantially reduce exposure to macro-driven project delays, which remain IBM's largest risk for now.

The TD SYNNEX announcement is particularly relevant, as it expands IBM's cloud management and cost governance footprint through partners, helping the company accelerate high-value software adoption among enterprises. This speaks directly to IBM's push for greater software revenue and highlights the importance of its ecosystem in driving short-term performance, especially as software and cloud solutions are key catalysts for growth in a competitive environment.

But before you take that as a green light, remember that investors should be aware of the persistent risk that clients could delay or cut discretionary projects if economic uncertainty increases...

Read the full narrative on International Business Machines (it's free!)

International Business Machines' outlook anticipates $74.4 billion in revenue and $10.5 billion in earnings by 2028. This projection relies on a 5.1% annual revenue growth rate and an increase in earnings of $4.6 billion from the current $5.9 billion level.

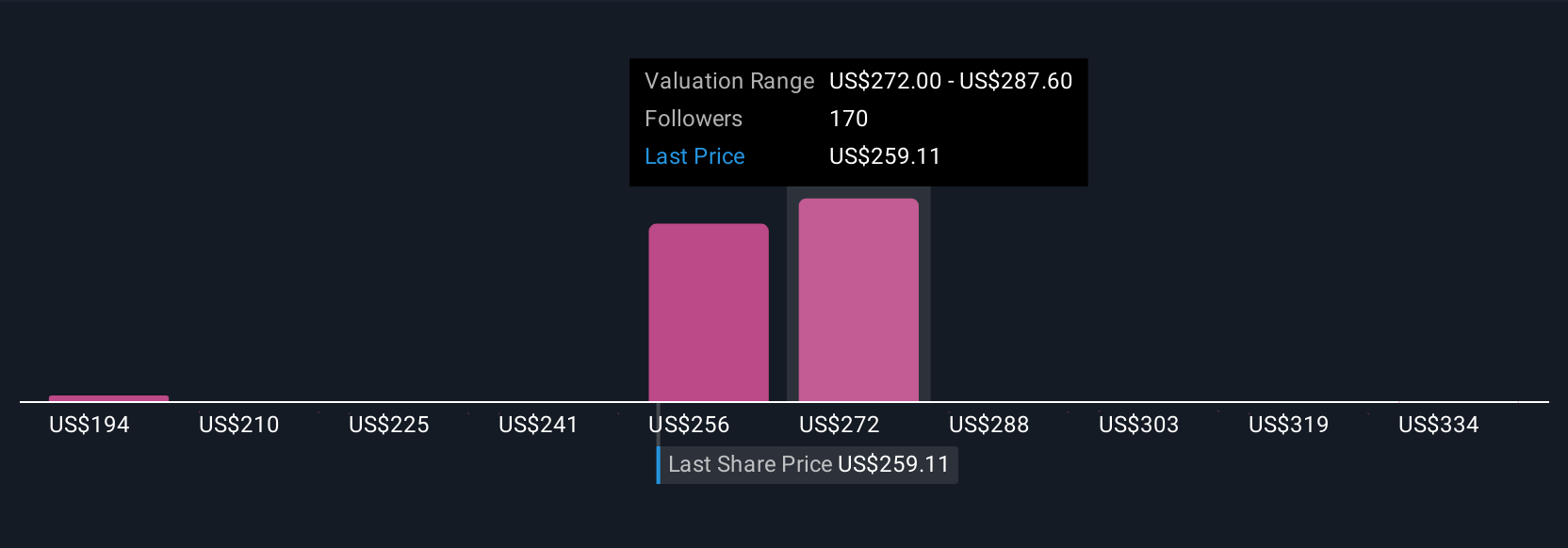

Uncover how International Business Machines' forecasts yield a $281.32 fair value, in line with its current price.

Exploring Other Perspectives

Some analysts see much bigger upside, projecting IBM earnings to reach US$12.1 billion by 2028 and forecasting stronger recurring revenue from AI and hybrid cloud partnerships like the Airtel deal. These more optimistic forecasts assume IBM's ability to rapidly grow in regulated and international markets, highlighting that views differ widely and it is worth exploring more than one perspective before making up your mind.

Explore 16 other fair value estimates on International Business Machines - why the stock might be worth 29% less than the current price!

Build Your Own International Business Machines Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your International Business Machines research is our analysis highlighting 2 key rewards and 4 important warning signs that could impact your investment decision.

- Our free International Business Machines research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate International Business Machines' overall financial health at a glance.

Seeking Other Investments?

Markets shift fast. These stocks won't stay hidden for long. Get the list while it matters:

- These 9 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- The end of cancer? These 28 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- This technology could replace computers: discover 26 stocks that are working to make quantum computing a reality.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:IBM

International Business Machines

Provides integrated solutions and services in the Americas, Europe, the Middle East, Africa, and the Asia Pacific.

Solid track record established dividend payer.

Similar Companies

Market Insights

Community Narratives