- United States

- /

- IT

- /

- NYSE:IBM

International Business Machines (NYSE:IBM) Amends And Extends Credit Agreements To 2028 and 2030

Reviewed by Simply Wall St

International Business Machines (NYSE:IBM) recently reshaped its debt structure through extended credit agreements, potentially providing the company with greater financial flexibility. This strategic move coincides with a 15% share price increase over the last quarter, a period that also saw market trends align with a 10% annual increase. Notably, IBM's partnerships, such as the collaboration with Deutsche Bank and the extension with Oracle, may have bolstered its position amidst these market conditions. Despite a drop in Q1 net income to $1.06 billion, the dividend increase and IBM's ongoing investments signal strong growth intentions, complementing its recent market performance.

The recent restructuring of IBM's debt could improve its financial agility, impacting the company's capacity for future investments in cloud and AI—two key growth drivers. Over the past five years, IBM's total shareholder returns, which encompass both share price appreciation and dividends, reached a significant 213.45%. This performance, when compared with the broader US IT industry benchmark over the last year, reflects IBM’s ability to secure returns despite operational challenges. Such long-term results demonstrate IBM's resilience and adaptability in a rapidly changing technological landscape.

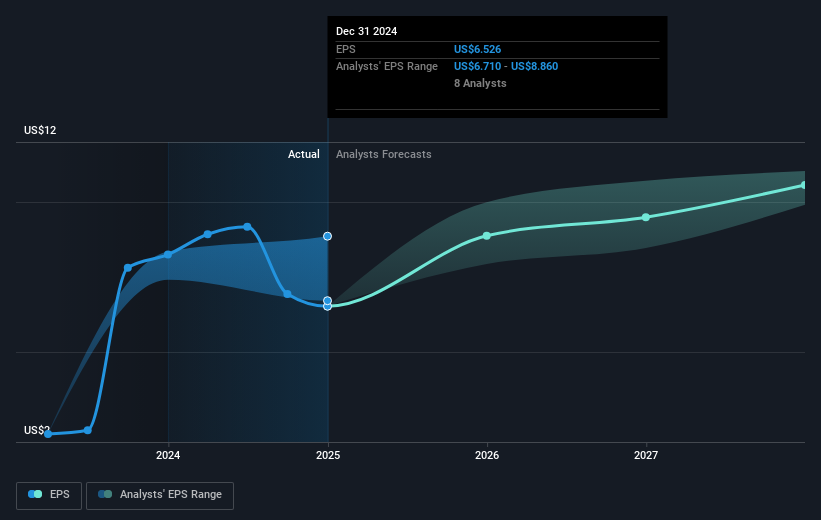

However, with the recent market activity reflecting a 15% rise in IBM's share value over the last quarter, it remains important to contextualize this relative to the current analyst price target of US$258.02. The share price, standing at US$253.37, indicates a small discount to the consensus target. Market trends influencing earnings forecasts could be shaped by the newly acquired financial flexibility from the debt realignment, allowing IBM to continue prioritizing its hybrid cloud and AI initiatives. Any positive swing in these sectors could potentially enhance IBM’s revenue and earnings forecasts, countering previous headwinds tied to economic stability issues.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:IBM

International Business Machines

Provides integrated solutions and services in the United States, Europe, the Middle East, Africa, Asia Pacific, and internationally.

Adequate balance sheet average dividend payer.

Similar Companies

Market Insights

Community Narratives