- United States

- /

- IT

- /

- NYSE:IBM

IBM (IBM): Exploring Valuation as Shares Approach Recent Highs Without Major News

Reviewed by Kshitija Bhandaru

Most Popular Narrative: 5.3% Undervalued

The prevailing narrative asserts that IBM is trading at a modest discount to its calculated fair value, supported by forward-looking projections for growth and profitability.

"IBM's focused strategy on hybrid cloud and AI is driving solid revenue growth, providing cost savings, productivity gains, and scalability for clients. This is expected to continue supporting their revenue trajectory."

Curious about how IBM's roadmap in cutting-edge tech could reshape its entire value story? Discover which assumptions about future growth, margins and financial multiples are built into this surprisingly bullish fair value estimate. The numbers behind this target might just challenge your expectations.

Result: Fair Value of $281.32 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.However, shifts in macroeconomic conditions or delays in client decision-making could quickly dampen IBM's growth momentum and challenge these optimistic projections.

Find out about the key risks to this International Business Machines narrative.Another View: Market-Based Comparison

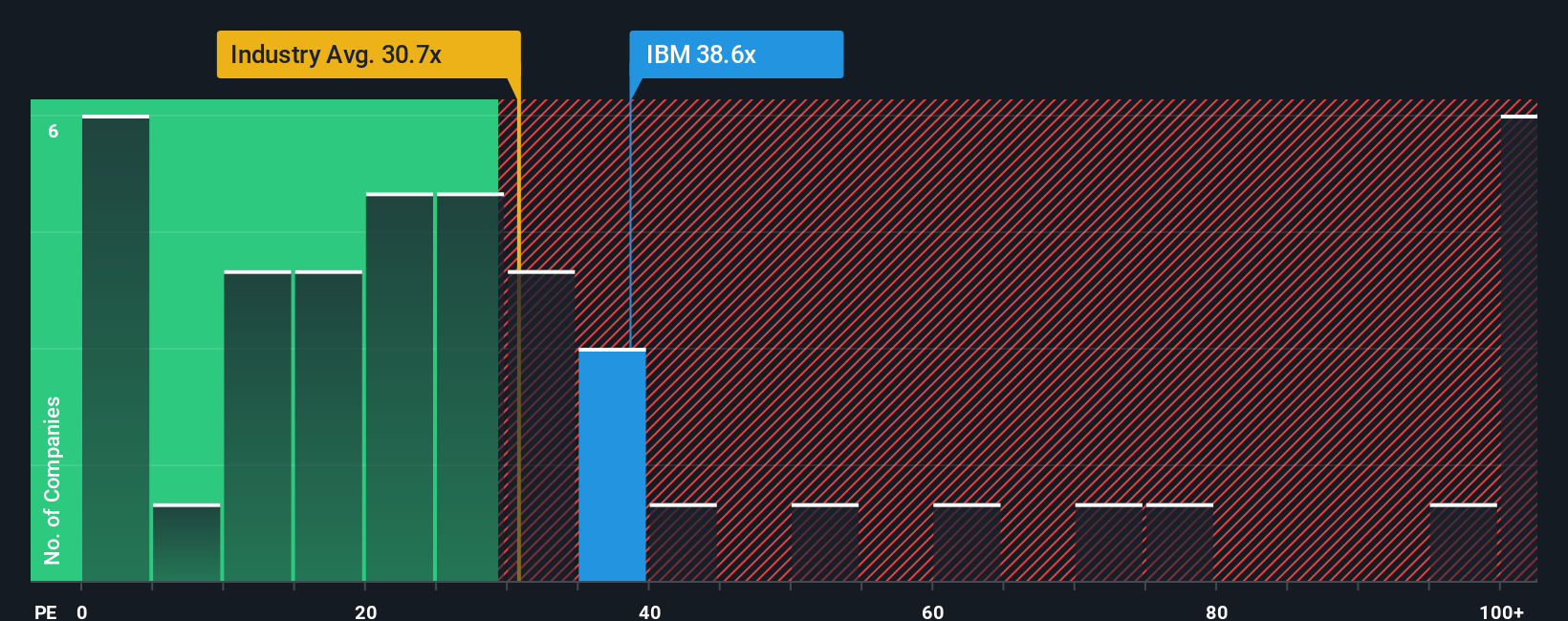

Switching lens, a look at IBM's valuation using a common market metric shows the company currently trades much higher than the overall industry. Does that mean optimism is running too hot, or is there more beneath the surface?

See what the numbers say about this price — find out in our valuation breakdown.

Stay updated when valuation signals shift by adding International Business Machines to your watchlist or portfolio. Alternatively, explore our screener to discover other companies that fit your criteria.

Build Your Own International Business Machines Narrative

If you see things differently or want to dig deeper into the data yourself, you can put together your own perspective in just a few minutes. Do it your way.

A great starting point for your International Business Machines research is our analysis highlighting 2 key rewards and 4 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Unlock the most promising opportunities by using the Simply Wall Street Screener. Make your next smart move before the crowd catches on. These unique screens could be your edge.

- Uncover early-stage potential with penny stocks showing exceptional financial strength through our curated list of penny stocks with strong financials.

- Earn stronger passive income by tapping into companies with robust payouts, all handpicked in our exclusive dividend stocks with yields > 3% selection.

- Capitalize on powerful AI innovation by checking out fast-growing companies driving the future in the world of AI penny stocks.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:IBM

International Business Machines

Provides integrated solutions and services in the Americas, Europe, the Middle East, Africa, and the Asia Pacific.

Solid track record established dividend payer.

Similar Companies

Market Insights

Community Narratives