- United States

- /

- IT

- /

- NYSE:IBM

How Investors May Respond To IBM's Quantum Nighthawk Breakthrough and Its Impact on Long-Term Growth (IBM)

Reviewed by Sasha Jovanovic

- Earlier this month, IBM announced breakthroughs in quantum computing at the Quantum Developer Conference, unveiling the new Quantum Nighthawk processor, which is equipped to handle circuits with 30% greater complexity and is expected to launch by late 2025. These advancements reflect IBM's accelerated roadmap toward quantum advantage and fault-tolerant computing, with milestones being achieved ahead of prior projections and signaling growing activity within the sector.

- We'll examine how IBM's latest quantum computing breakthrough could reshape its long-term earnings narrative and competitive positioning.

The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

International Business Machines Investment Narrative Recap

IBM’s investment appeal hinges on belief in its transformation through AI, hybrid cloud, and now, quantum computing. The recent unveiling of the Quantum Nighthawk processor, capable of handling 30% more complex circuits and targeting commercial launch by late 2025, marks progress but is unlikely to immediately change the most critical near-term catalyst: robust enterprise AI and cloud adoption. Near-term risks tied to macroeconomic pressures and consulting demand remain unaffected by these quantum milestones for now.

Among recent announcements, IBM's selection for Stage B of the DARPA Quantum Benchmarking Initiative is highly relevant. This signals recognition of IBM’s progress in quantum technology from key public sector stakeholders, which may influence perceptions regarding IBM's competitive positioning and innovation pipeline, factors underpinning longer-term catalysts.

However, investors should be aware that, despite technological advances, currency volatility still poses a risk to IBM’s revenue and free cash flow projections...

Read the full narrative on International Business Machines (it's free!)

International Business Machines' outlook anticipates $74.4 billion in revenue and $10.5 billion in earnings by 2028. Achieving this would require 5.1% annual revenue growth and a $4.6 billion increase in earnings from the current $5.9 billion.

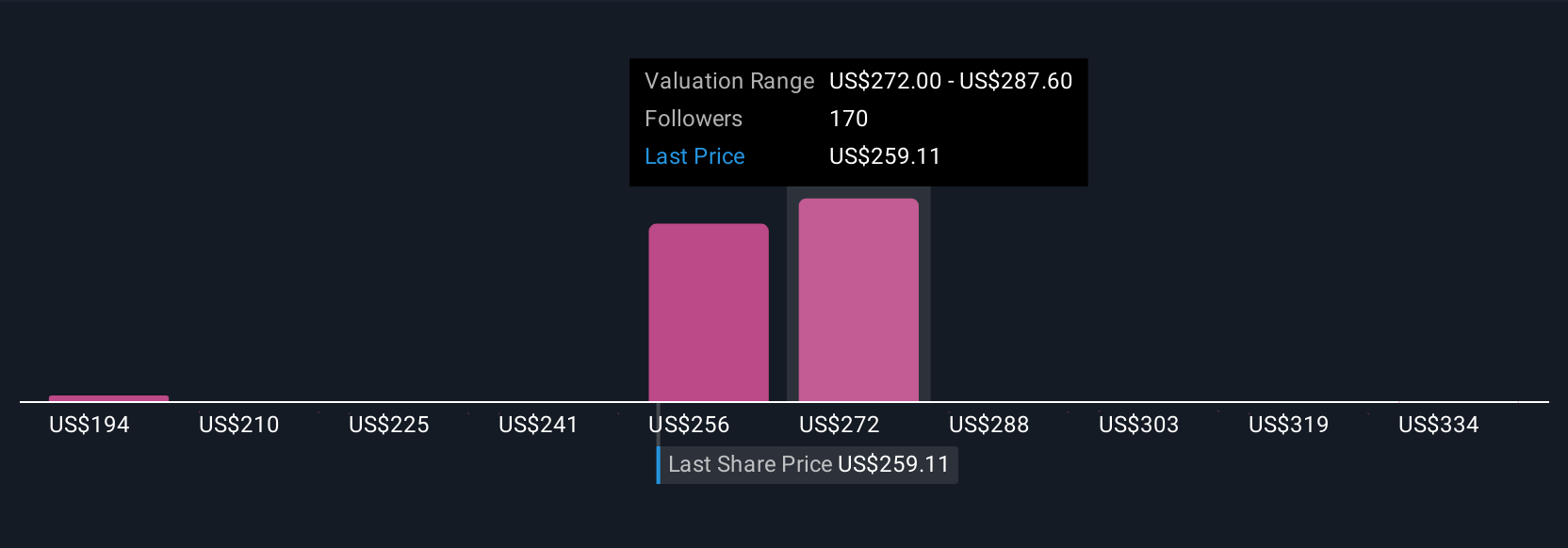

Uncover how International Business Machines' forecasts yield a $287.09 fair value, a 6% downside to its current price.

Exploring Other Perspectives

While the baseline view sees IBM on track for steady growth, the most pessimistic analysts were forecasting just 4.6 percent annual revenue growth and US$8.8 billion earnings by 2028. These low-end projections highlight a much more cautious perspective about IBM’s challenges as a cloud provider. Keep in mind, these estimates were made before recent news, so now may be a good time to see how your outlook stacks up.

Explore 17 other fair value estimates on International Business Machines - why the stock might be worth 35% less than the current price!

Build Your Own International Business Machines Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your International Business Machines research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

- Our free International Business Machines research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate International Business Machines' overall financial health at a glance.

Interested In Other Possibilities?

Opportunities like this don't last. These are today's most promising picks. Check them out now:

- This technology could replace computers: discover 26 stocks that are working to make quantum computing a reality.

- AI is about to change healthcare. These 31 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:IBM

International Business Machines

Provides integrated solutions and services in the Americas, Europe, the Middle East, Africa, and the Asia Pacific.

Solid track record established dividend payer.

Similar Companies

Market Insights

Community Narratives