- United States

- /

- Software

- /

- NYSE:HUBS

Is Wendt Partners’ Toronto Expansion a Sign of HubSpot’s Shifting Global Strategy (HUBS)?

Reviewed by Sasha Jovanovic

- In October 2025, Wendt Partners announced the relocation and expansion of its Toronto office to the heart of the city’s business district, aiming to enhance access to its HubSpot CRM integration services for Canadian companies.

- This move underscores the growing international demand for HubSpot’s platform and highlights the firm’s importance in enabling its partners’ global growth initiatives.

- We'll now consider how HubSpot’s strong Q2 results and increased global reach might influence its long-term growth outlook.

The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 26 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

HubSpot Investment Narrative Recap

To be a shareholder in HubSpot, you generally need to believe in the long-term global adoption of its CRM platform, the company’s ability to monetize AI-driven tools, and the resilience of its SMB and mid-market customer base even as digital marketing channels evolve. The recent news of Wendt Partners expanding its Toronto office to serve Canadian businesses highlights HubSpot’s growing international demand but does not materially change the most important near-term catalyst: accelerating recurring revenue through rapid international expansion. The biggest current risk remains the impact of structural changes in SEO and organic search, which could threaten HubSpot’s established customer acquisition strategies.

Among the recent updates, HubSpot’s strong Q2 2025 results, revenues up 19.4% year over year with reduced net losses, are directly relevant. Outperforming revenue and EBITDA estimates supports confidence in international momentum and recurring revenue catalysts, even as the market weighs potential risks from evolving digital customer acquisition patterns.

But while expansion news may inspire confidence, investors should also be aware that exposure to shifts in organic search and AI-driven SEO could…

Read the full narrative on HubSpot (it's free!)

HubSpot's narrative projects $4.6 billion revenue and $388.4 million earnings by 2028. This requires 17.1% yearly revenue growth and a $400.3 million earnings increase from -$11.9 million today.

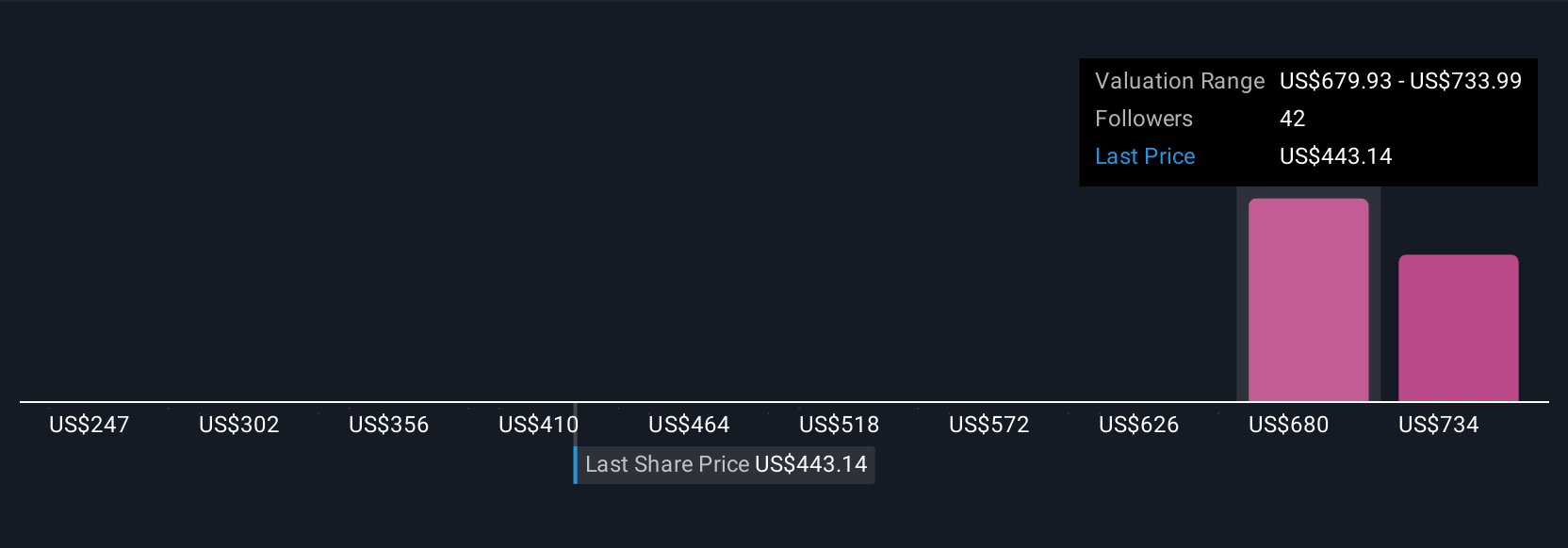

Uncover how HubSpot's forecasts yield a $687.88 fair value, a 40% upside to its current price.

Exploring Other Perspectives

Simply Wall St Community members provided nine individual fair value estimates for HubSpot between US$243.84 and US$744.28 per share, reflecting a broad mix of bullish and cautious outlooks. As international expansion gains traction, remember structural risks from the ongoing changes in organic search could influence company performance in ways the market does not yet fully see, consider reviewing multiple perspectives.

Explore 9 other fair value estimates on HubSpot - why the stock might be worth as much as 51% more than the current price!

Build Your Own HubSpot Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your HubSpot research is our analysis highlighting 4 key rewards that could impact your investment decision.

- Our free HubSpot research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate HubSpot's overall financial health at a glance.

Ready For A Different Approach?

Don't miss your shot at the next 10-bagger. Our latest stock picks just dropped:

- We've found 22 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- Rare earth metals are the new gold rush. Find out which 37 stocks are leading the charge.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if HubSpot might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:HUBS

HubSpot

Provides a cloud-based customer relationship management (CRM) platform for businesses in the Americas, Europe, and the Asia Pacific.

Flawless balance sheet with high growth potential.

Similar Companies

Market Insights

Community Narratives