- United States

- /

- Software

- /

- NYSE:HUBS

A Fresh Look at HubSpot (HUBS) Valuation Following Recent Share Price Volatility

Reviewed by Simply Wall St

See our latest analysis for HubSpot.

HubSpot’s share price has struggled to maintain momentum, with a 1-month share price return of -9.3% and year-to-date losses continuing to weigh on sentiment. However, with three- and five-year total shareholder returns still solidly positive, long-term believers have seen strong gains even as near-term volatility persists.

If this shift in momentum has you rethinking your approach, now’s a great time to discover fast growing stocks with high insider ownership

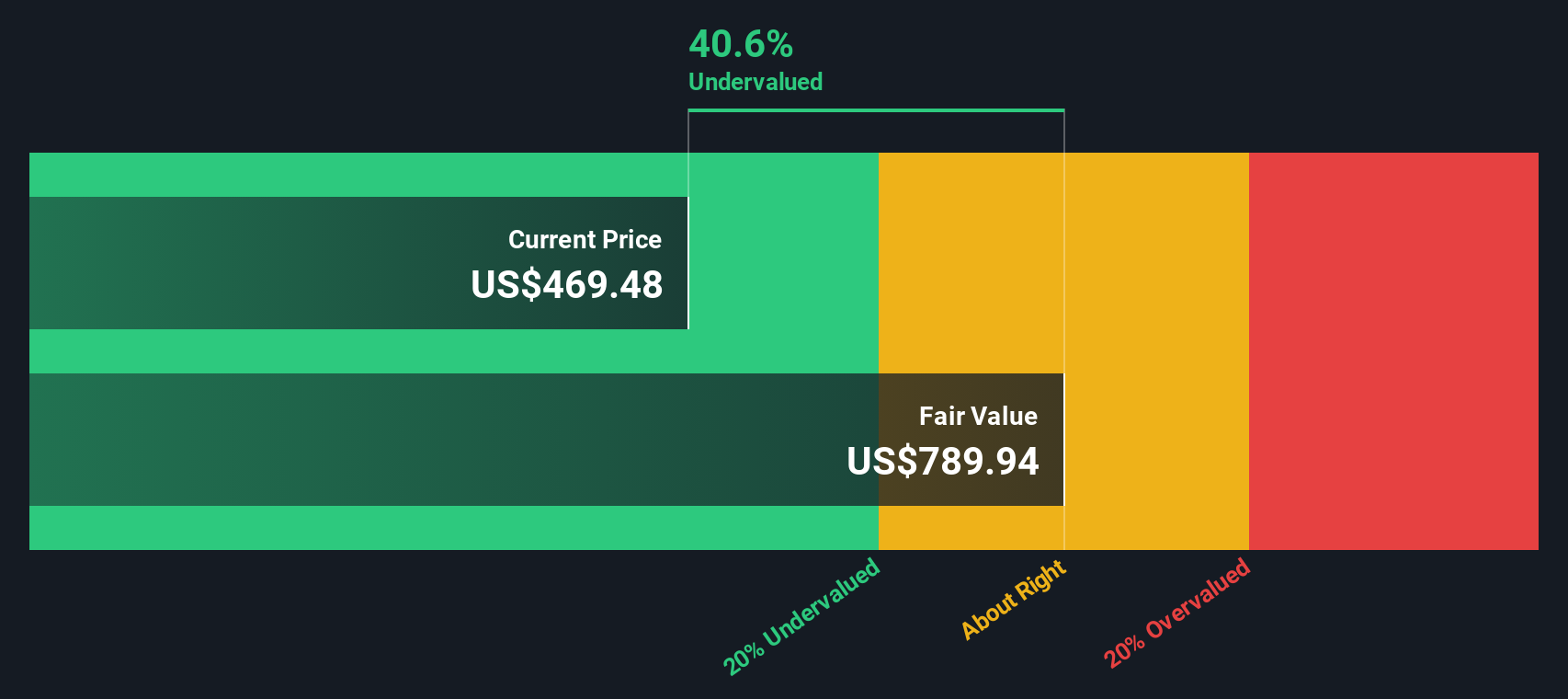

With HubSpot trading well below analyst price targets, investors have to ask themselves whether the current valuation signals untapped potential or if the market has already accounted for all future growth expectations.

Most Popular Narrative: 31.7% Undervalued

With HubSpot's narrative fair value estimate of $687.88 sitting well above its last close at $469.62, the crowd’s consensus is still seeing upside potential, even as price targets have edged slightly lower. Diverging expectations for future growth and profitability shape this view, making it worth examining the financial assumptions that drive such a wide valuation gap.

“HubSpot is a direct beneficiary of the rapid digitization of SMBs and enterprises, as more customers consolidate their marketing, sales, and service stacks onto integrated cloud platforms like HubSpot. This is evidenced by rising multi-hub adoption and seat upgrades, which should drive recurring revenue and higher average revenue per customer over time.”

Want to know the growth blueprint behind this high narrative valuation? The key catalyst here is bold projections for future earnings, revenue expansion, and improved margins. But which underlying financial assumptions really power that fair value? Dive into the full narrative to uncover the quantitative details and surprising drivers behind this target price.

Result: Fair Value of $687.88 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, shifting buyer behavior and intensifying competition from AI-powered platforms could significantly slow HubSpot’s growth story and reduce long-term performance expectations.

Find out about the key risks to this HubSpot narrative.

Another View: Our DCF Model Challenges the Narrative

While the fair value narrative leans heavily on crowd expectations and analyst targets, our SWS DCF model puts HubSpot’s fair value closer to $574.32. This figure is still above today’s price but is less optimistic compared to some multiple-based views. This raises a question: Is the market overly bullish, or are growth assumptions too cautious?

Look into how the SWS DCF model arrives at its fair value.

Build Your Own HubSpot Narrative

Prefer your own research or think you could craft a different story around HubSpot’s future? You can quickly build your perspective in under three minutes. Do it your way

A good starting point is our analysis highlighting 4 key rewards investors are optimistic about regarding HubSpot.

Looking for more investment ideas?

You deserve to spot the best opportunities before everyone else. Don’t just watch the market move; take smart action by using these handpicked tools:

- Capture the next wave of disruptive innovation by tapping into these 26 AI penny stocks, forging advances in artificial intelligence and transforming entire industries.

- Power up your income strategy with steady streams from these 21 dividend stocks with yields > 3% that consistently deliver attractive yields above 3%.

- Get ahead of the crowd and seize growth hidden in plain sight by reviewing these 867 undervalued stocks based on cash flows, poised for big moves based on their cash flows.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if HubSpot might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:HUBS

HubSpot

Provides a cloud-based customer relationship management (CRM) platform for businesses in the Americas, Europe, and the Asia Pacific.

Flawless balance sheet and undervalued.

Similar Companies

Market Insights

Community Narratives