- United States

- /

- Communications

- /

- NasdaqGM:AAOI

Exploring High Growth Tech Stocks in February 2025

Reviewed by Simply Wall St

In the last week, the United States market has stayed flat, though it is up 23% over the past year, with earnings anticipated to grow by 15% annually over the next few years. In this context of robust growth expectations, identifying high growth tech stocks involves looking for companies that demonstrate strong innovation and adaptability within their sectors.

Top 10 High Growth Tech Companies In The United States

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Super Micro Computer | 24.36% | 24.28% | ★★★★★★ |

| Ardelyx | 21.09% | 55.29% | ★★★★★★ |

| AsiaFIN Holdings | 51.75% | 82.69% | ★★★★★★ |

| AVITA Medical | 33.20% | 51.87% | ★★★★★★ |

| Alkami Technology | 21.99% | 102.65% | ★★★★★★ |

| TG Therapeutics | 29.48% | 43.58% | ★★★★★★ |

| Clene | 61.16% | 59.11% | ★★★★★★ |

| Alnylam Pharmaceuticals | 21.62% | 56.70% | ★★★★★★ |

| Blueprint Medicines | 23.57% | 55.74% | ★★★★★★ |

| Travere Therapeutics | 30.46% | 62.05% | ★★★★★★ |

Click here to see the full list of 232 stocks from our US High Growth Tech and AI Stocks screener.

Here's a peek at a few of the choices from the screener.

Applied Optoelectronics (NasdaqGM:AAOI)

Simply Wall St Growth Rating: ★★★★★☆

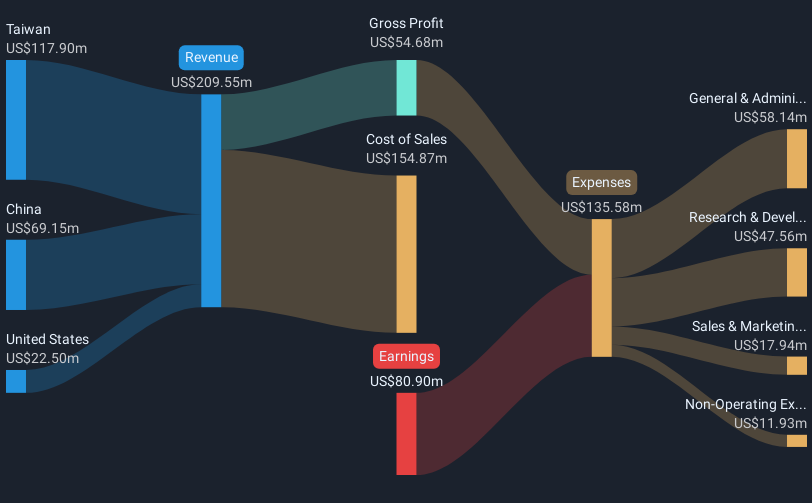

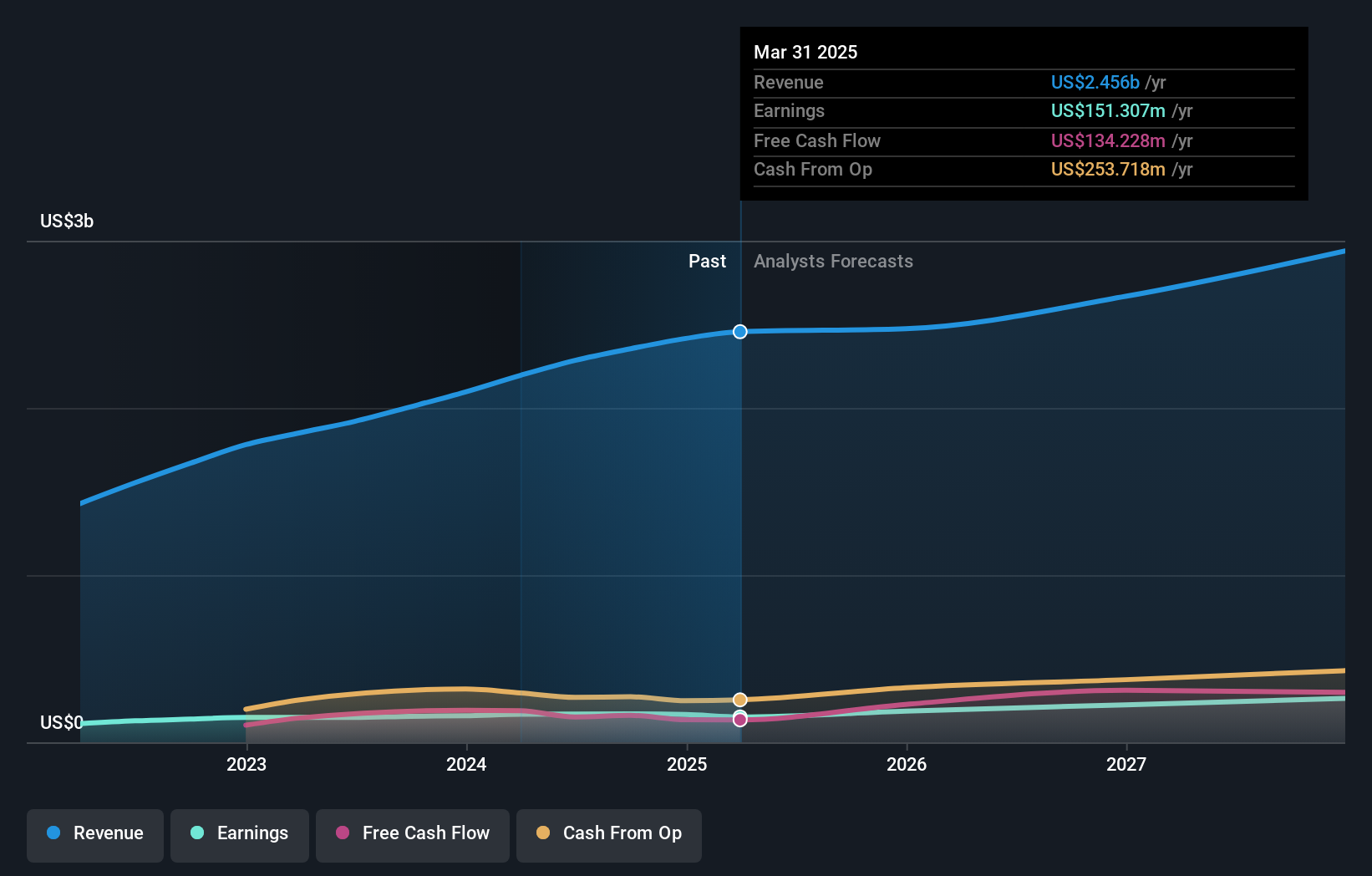

Overview: Applied Optoelectronics, Inc. designs, manufactures, and sells fiber-optic networking products in the United States, Taiwan, and China with a market capitalization of $1.38 billion.

Operations: The company's primary revenue stream is from optical networking equipment, generating $209.55 million.

Applied Optoelectronics, amid a challenging landscape marked by recent legal disputes over patent claims, continues to push forward with strategic financial actions. The company recently raised $35 million through a follow-on equity offering and anticipates revenue between $94 million and $104 million for the fourth quarter of 2024. This projection aligns with its aggressive revenue growth rate of 53.6% annually, significantly outpacing the broader U.S. market's growth. Despite facing profitability hurdles—with a notable increase in net losses to $67 million from last year—Applied Optoelectronics is expected to reverse this trend, aiming for an impressive earnings growth of 114.2% per year moving forward. These figures underscore its resilience and adaptive strategies in navigating both market demands and competitive pressures.

Exelixis (NasdaqGS:EXEL)

Simply Wall St Growth Rating: ★★★★★☆

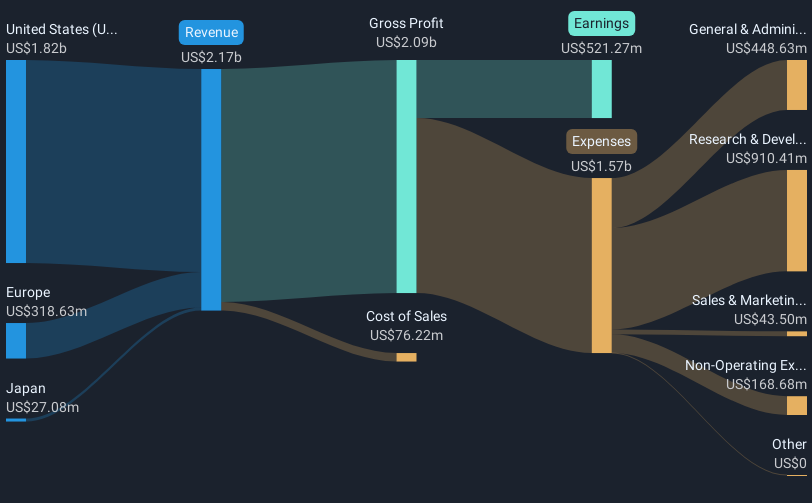

Overview: Exelixis, Inc. is an oncology company dedicated to discovering, developing, and commercializing new medicines for difficult-to-treat cancers in the United States, with a market capitalization of approximately $9.47 billion.

Operations: The company generates revenue primarily from the discovery, development, and commercialization of new medicines for difficult-to-treat cancers, amounting to $2.08 billion. Its operations are centered in the United States.

Exelixis, with its recent STELLAR-001 and CABINET study updates, underscores a robust pipeline in oncology treatments, notably in metastatic colorectal and neuroendocrine tumors. The company's strategic focus on advanced solid tumors through innovations like zanzalintinib—a third-generation tyrosine kinase inhibitor—highlights its commitment to enhancing pharmacokinetic profiles and treatment efficacy. Financially, Exelixis is poised for growth with projected 2025 revenues between $2.15 billion and $2.25 billion, reflecting a solid uptick driven by both existing products and potential new approvals. Additionally, the recent repurchase of shares worth approximately $205.6 million signals confidence in long-term value creation amidst expanding clinical trials and FDA engagements set for mid-2025 decisions.

Globant (NYSE:GLOB)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Globant S.A., along with its subsidiaries, delivers technology services on a global scale and has a market capitalization of approximately $9.20 billion.

Operations: Globant generates revenue primarily from its Software & Programming segment, amounting to $2.35 billion. The company operates on a global scale, providing a range of technology services to various industries.

Globant stands out in the tech landscape, not just for its solid financial performance with a notable 12.7% annual revenue growth and an impressive 21.7% expected earnings growth per year, but also for its strategic initiatives that align with industry trends. The company's recent partnership with Faros AI exemplifies this by enhancing software development cycles through advanced AI analytics, which is critical as businesses increasingly rely on digital transformation to drive growth. This collaboration is set to improve productivity and software quality significantly, positioning Globant to capitalize on the growing demand for efficient and innovative tech solutions. Moreover, their involvement in high-profile projects like Qiddiya City underscores their pivotal role in global digital transformations, leveraging AI and cloud technologies to redefine user interactions within smart city ecosystems.

- Click here to discover the nuances of Globant with our detailed analytical health report.

Understand Globant's track record by examining our Past report.

Next Steps

- Unlock our comprehensive list of 232 US High Growth Tech and AI Stocks by clicking here.

- Hold shares in these firms? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

- Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGM:AAOI

Applied Optoelectronics

Designs, manufactures, and sells fiber-optic networking products in the United States, Taiwan, and China.

Flawless balance sheet with high growth potential.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

ADNOC Gas future shines with a 21.4% revenue surge

Watch Pulse Seismic Outperform with 13.6% Revenue Growth in the Coming Years

Significantly undervalued gold explorer in Timmins, finally getting traction

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026