- United States

- /

- IT

- /

- NYSE:GDDY

GoDaddy (GDDY): Exploring Current Valuation as Market Reassesses Long-Term Growth Potential

Reviewed by Simply Wall St

If you’ve been following GoDaddy (GDDY), you might have noticed the recent movement in its stock price and found yourself wondering whether something significant is happening behind the scenes. There has not been a single headline-driving event, yet the market seems to be quietly reassessing the company’s long-term prospects. These kinds of shifts can give investors pause. Is it just volatility, or is there a deeper signal in the numbers?

Over the past year, GoDaddy’s share price has declined 6%, with momentum weakening further in recent months. The slide has been steady rather than sudden, with a 3% drop this month and nearly 28% lost year-to-date. Still, the bigger picture shows the stock has nearly doubled over the past three and five years, suggesting long-term value creation, but uncertainty about future growth is now weighing more heavily on the price.

With the stock losing altitude this year despite GoDaddy’s positive earnings growth, investors may wonder if there is an opportunity here for those willing to look past short-term weakness, or if the market has already priced in the next phase of growth.

Most Popular Narrative: 25.1% Undervalued

The prevailing narrative values GoDaddy as significantly undervalued, with analysts projecting a substantial upside for shares based on strong future earnings and revenue growth assumptions.

The increasing need for online presence among small and medium businesses, coupled with greater global internet adoption, is driving expansion in GoDaddy's addressable market. This is reflected in double-digit growth for high-margin Applications & Commerce (A&C) revenue and bookings. This trend is likely to support sustained top-line growth.

Curious about why analysts see so much untapped potential here? This narrative hints at a bold financial transformation powered by new technology and a shift in customer behavior. There is a quantitative playbook driving the fair value calculation, one you need to see for yourself. Think impressive growth forecasts and ambitious profit margin targets. What market assumptions are baked into this big valuation gap?

Result: Fair Value of $192.53 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.However, intensifying competition from integrated platforms and the risk of rising customer churn could quickly challenge these bullish assumptions about GoDaddy’s future.

Find out about the key risks to this GoDaddy narrative.Another View: Discounted Cash Flow Model

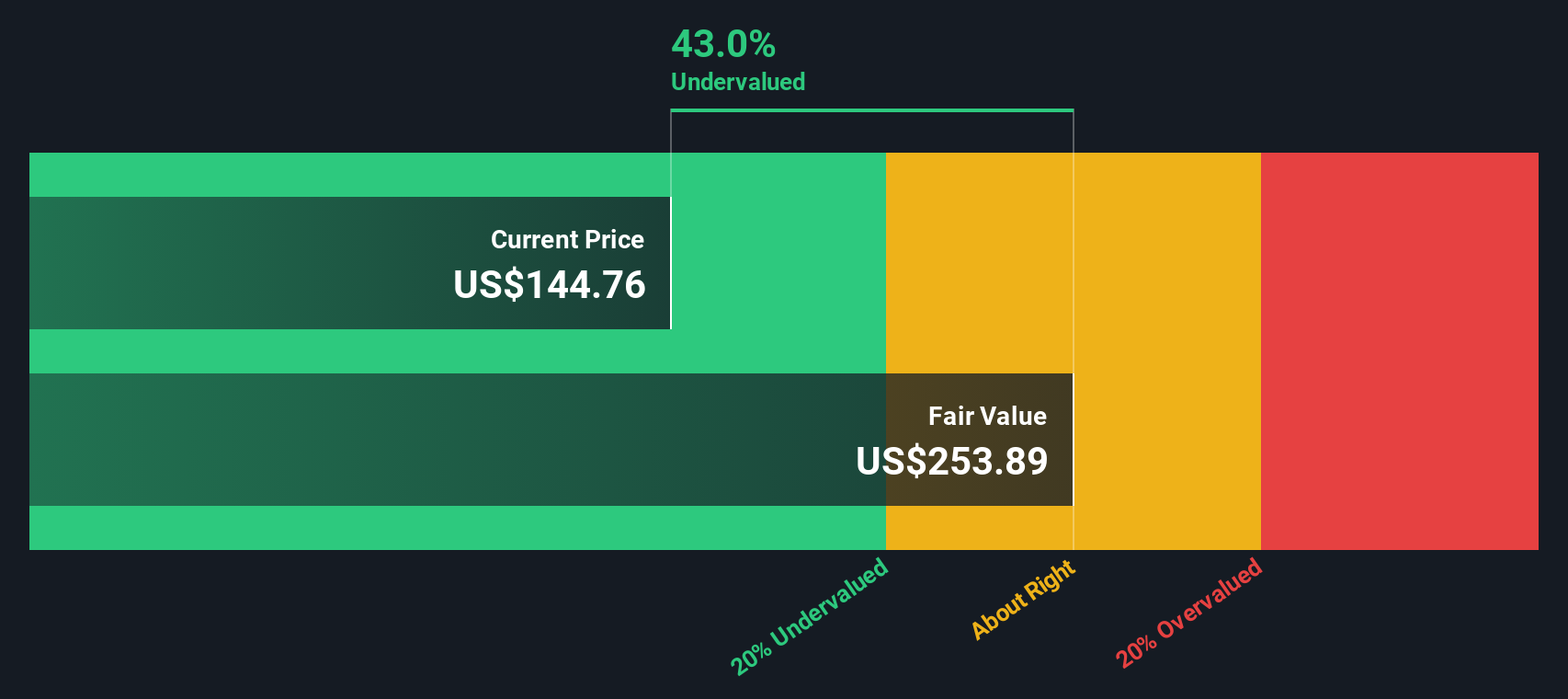

Taking a step back from analyst price targets, our DCF model offers a similar perspective and also sees GoDaddy as trading below its fair value. Does this provide you with extra confidence, or does it raise more questions?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out GoDaddy for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own GoDaddy Narrative

If you have your own view on GoDaddy’s story, or want to test your own assumptions against the numbers, you can shape a personalized narrative in under three minutes. Do it your way.

A great starting point for your GoDaddy research is our analysis highlighting 4 key rewards and 3 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Don’t let great opportunities slip by while you focus on just one stock. Use the screener to quickly spot the markets and trends where your next winner could be hiding.

- Uncover high-yield opportunities that may boost your income with select dividend stocks with yields > 3%, offering attractive returns above 3%.

- Follow the momentum surging through companies shaping tomorrow’s economy with innovative AI penny stocks, at the heart of artificial intelligence breakthroughs.

- Get ahead with quality picks currently trading below their intrinsic value. Check out some compelling undervalued stocks based on cash flows for your next strategic move.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:GDDY

GoDaddy

Engages in the design and development of cloud-based products in the United States and internationally.

Very undervalued with mediocre balance sheet.

Similar Companies

Market Insights

Community Narratives