- United States

- /

- IT

- /

- NYSE:FSLY

Fastly (FSLY): Assessing Valuation as Customer Accolades Fuel Investor Interest

Reviewed by Kshitija Bhandaru

Fastly (FSLY) is in the spotlight after being named a 2025 Gartner Peer Insights Customers’ Choice for Cloud Web Application and API Protection, a distinction it has now earned for seven years in a row.

This recognition, which is driven by positive enterprise customer reviews for Fastly’s Web Application Firewall, comes at a time when investor attention is increasingly focused on product strength and customer satisfaction in the crowded cloud security space.

See our latest analysis for Fastly.

Fastly’s string of customer-driven accolades seems to be perking up investor sentiment. A strong rally in its share price over the last quarter has pushed it above perceived intrinsic value. While the 1-year total shareholder return is positive at 15.7% and the 90-day share price return is also notable, longer-term shareholders are still waiting for a sustained turnaround. Momentum appears to be building, helped by the company’s high customer ratings and product recognition.

If cloud and cyber momentum in stocks like Fastly has caught your interest, this is the perfect time to discover See the full list for free.

The recent surge in Fastly’s share price and its strong customer recognition raise an important question: Has the stock already run ahead of its fundamentals, or is there room for further upside if future growth materializes?

Most Popular Narrative: 15% Overvalued

With Fastly trading around $8.83 and the most-followed narrative assigning fair value near $7.67, the current share price sits noticeably above what analysts believe is justified today. This sets the stage for a closer look at the drivers behind that narrative valuation.

Ongoing adoption of advanced security solutions, including next-generation WAF, DDoS, and bot mitigation, positions Fastly to capitalize on rising enterprise demand for resilient edge security as cyber threats escalate. This supports future revenue growth and higher-margin service lines.

Want to know the math backing this premium? The narrative leans on bold revenue expansion and a step-change in profitability. Intrigued by what’s fueling sky-high future earnings assumptions? See how ambitious growth projections shape this valuation outlook.

Result: Fair Value of $7.67 (OVERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, ongoing competition from hyperscalers and heavy reliance on a few large customers could limit Fastly’s growth, despite its strengths.

Find out about the key risks to this Fastly narrative.

Another View: Multiples Point to Value

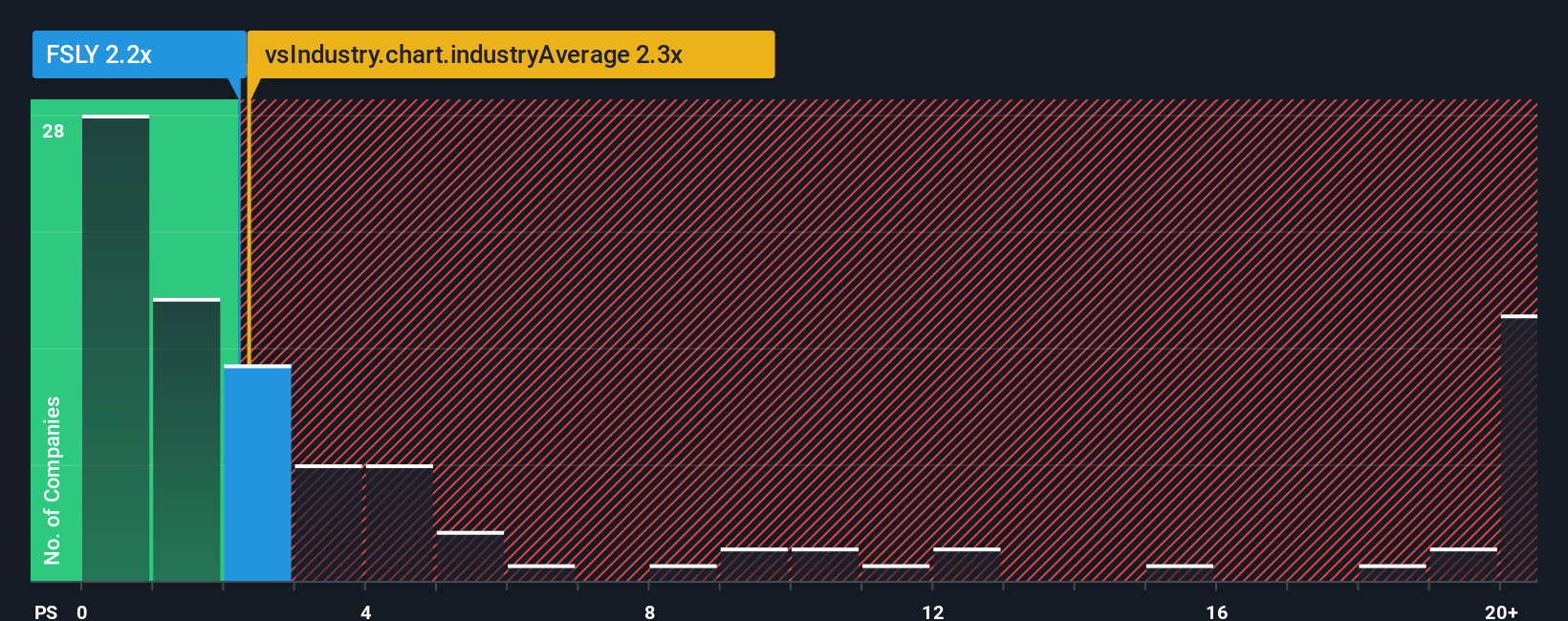

Switching gears to valuation ratios, Fastly's price-to-sales ratio stands at 2.3x. This is noticeably lower than its closest peers at 7.2x and just under the IT industry average of 2.4x. The ratio also sits below the so-called fair ratio of 2.5x, suggesting that Fastly might actually offer value, despite its lack of consistent profits. Could cautious optimism from the market be a sign of untapped opportunity?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Fastly Narrative

If you have your own perspective to add or want to dive deeper into Fastly’s data, you can shape your own view in just a few minutes. Do it your way.

A great starting point for your Fastly research is our analysis highlighting 1 key reward and 2 important warning signs that could impact your investment decision.

Looking for More Smart Investment Ideas?

Want to stay ahead of the market? Tap into under-the-radar opportunities and track tomorrow’s leaders with these powerful tools built for savvy investors.

- Uncover fresh value plays and seek out tomorrow’s winners by evaluating companies that stand out for being these 896 undervalued stocks based on cash flows on cash flow potential.

- Target growth themes in healthcare and maximize your exposure by checking out these 32 healthcare AI stocks addressing real-world medical challenges.

- Capture rapid innovation and see which trailblazers could disrupt entire industries by starting with these 24 AI penny stocks now.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:FSLY

Fastly

Operates an edge cloud platform for processing, serving, and securing its customer’s applications in the United States, the Asia Pacific, Europe, and internationally.

Excellent balance sheet and fair value.

Similar Companies

Market Insights

Community Narratives