- United States

- /

- Software

- /

- NYSE:FICO

Is FICO's Recent 10.8% Drop a Rare Opportunity or a Red Flag?

Reviewed by Bailey Pemberton

- Wondering if Fair Isaac is a hidden bargain or if its sky-high share price is actually justified? You are not alone, and today we are diving into what really drives its value.

- The stock has seen its ups and downs lately, sliding 2.1% over the last week and dropping 10.8% in the past month. This has contributed to a year-to-date decline of 17.3%. Despite the recent weakness, Fair Isaac has still delivered an impressive 277.8% return over three years.

- Market sentiment around Fair Isaac has shifted recently, with investor focus turning to industry trends and shifting competitive dynamics that have put pressure on many software stocks. Notably, several media reports have highlighted sector-wide volatility and a renewed debate around the future growth pace for key analytics players like Fair Isaac.

- For those keeping score, Fair Isaac is currently undervalued in 1 out of 6 valuation checks, giving it a score of 1/6. In the next section, we will break down what drives that score and look at classic valuation techniques. If you are looking for a smarter way to understand value, make sure to stick around for our final thoughts.

Fair Isaac scores just 1/6 on our valuation checks. See what other red flags we found in the full valuation breakdown.

Approach 1: Fair Isaac Discounted Cash Flow (DCF) Analysis

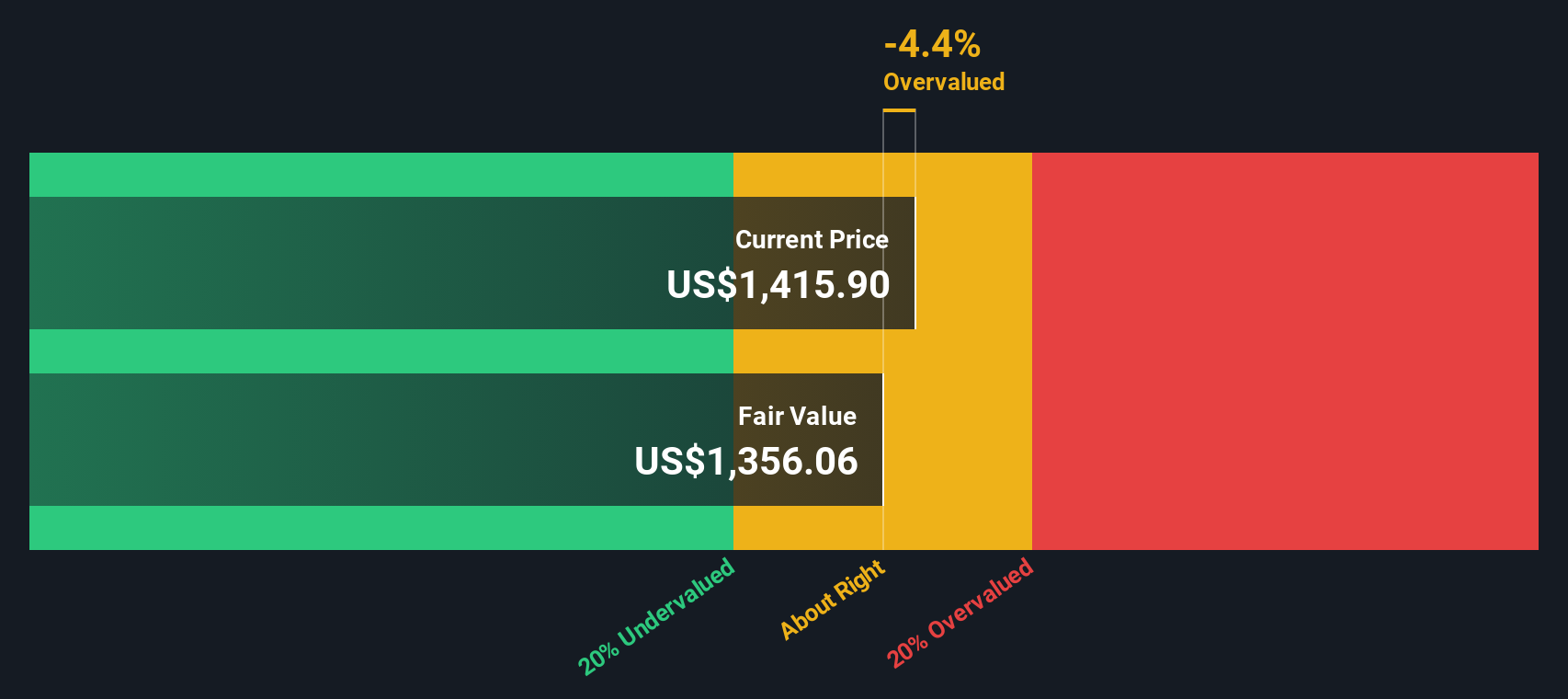

A Discounted Cash Flow (DCF) model estimates the value of a company by projecting its future cash flows and discounting them back to today's dollars. For Fair Isaac, the current Free Cash Flow stands at $772.2 million. Analysts project steady growth in the coming years, with Free Cash Flow expected to reach $1.66 billion by 2029. In addition to analyst coverage, Simply Wall St extrapolates these projections further, reflecting an optimistic outlook on Fair Isaac's cash generation abilities.

The DCF calculation uses these projected figures to estimate Fair Isaac's intrinsic value at $1,268.03 per share. However, this suggests the current share price is roughly 30.2% above this estimate, indicating that the stock is overvalued based on cash flow fundamentals.

Result: OVERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Fair Isaac may be overvalued by 30.2%. Discover 843 undervalued stocks or create your own screener to find better value opportunities.

Approach 2: Fair Isaac Price vs Earnings

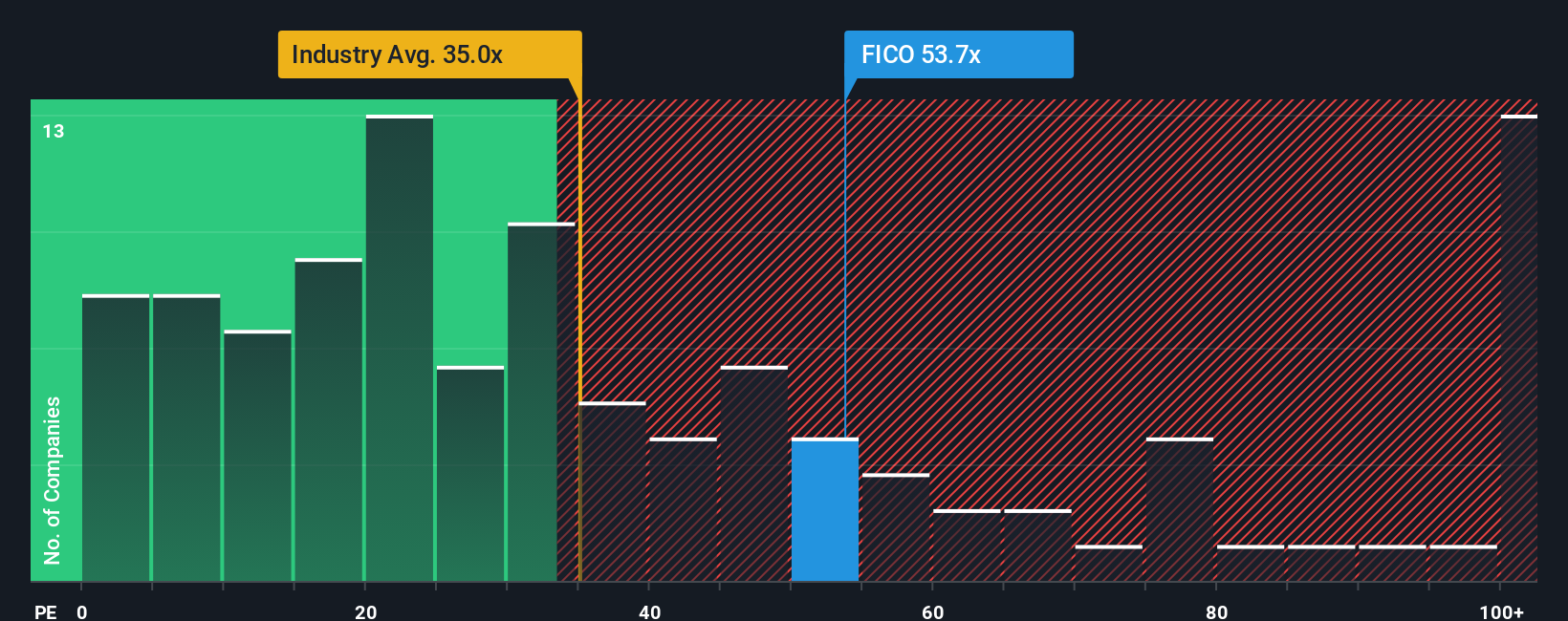

When a company is profitable, the Price-to-Earnings (PE) ratio is a straightforward and commonly used valuation tool. It relates a company’s share price to the earnings it generates, making it a meaningful benchmark, especially for established businesses like Fair Isaac.

A typical "fair" PE ratio varies depending on market expectations for growth and the perceived risks. Higher growth prospects often justify higher PE ratios, while greater risks or slower earnings growth usually mean investors are willing to pay less for each dollar of profit.

Currently, Fair Isaac trades at a PE ratio of 62.6x. This sits slightly above its peer group average of 61.9x and is considerably above the broader software industry’s average of 35.9x. At face value, this would suggest an expensive stock. However, context matters; rapid earnings growth or unique competitive positioning can warrant such a premium.

Simply Wall St’s proprietary “Fair Ratio” adjusts the conventional benchmark by factoring in Fair Isaac’s own earnings growth, profitability, industry setting, scale and risks. This metric aims to answer what a truly reasonable PE should be for this specific company, rather than making a simple industry comparison.

For Fair Isaac, the Fair Ratio sits at 42.3x. Since this is notably lower than the current PE, the stock appears to be overvalued using this lens.

Result: OVERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1410 companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Fair Isaac Narrative

Earlier we mentioned that there is an even better way to understand valuation, so let's introduce you to Narratives. A Narrative is your story about a company—your perspective on where Fair Isaac is headed, backed by your own expectations for revenue growth, margins, and risks. Narratives link these business assumptions to a concrete financial forecast, and then to an estimate of fair value, showing you how your thesis stacks up against the current market price.

Available on the Simply Wall St Community page, Narratives are a simple, interactive tool used by millions of investors to make smarter, more personalized decisions. They help you decide whether to buy or sell, not just by looking at the numbers, but by connecting your view of the company with up-to-date financial estimates.

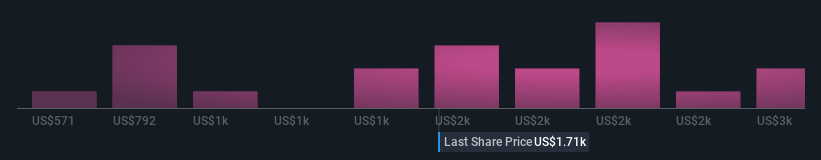

Narratives are dynamic. They update automatically when new news or earnings come in, keeping your investment thinking current. For example, the most optimistic Narrative on Fair Isaac currently forecasts a price target of $2,300 per share, reflecting expectations for rapid SaaS expansion and new product adoption. In contrast, the most cautious Narrative sees fair value at $1,230, emphasizing regulatory risk and slower platform growth.

Do you think there's more to the story for Fair Isaac? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:FICO

Fair Isaac

Develops software with analytics and digital decisioning technologies that enable businesses to automate, enhance, and connect decisions in the Americas, Europe, the Middle East, Africa, and the Asia Pacific.

Solid track record with moderate growth potential.

Similar Companies

Market Insights

Community Narratives