- United States

- /

- Software

- /

- NYSE:FICO

How FICO’s AI and Open Banking Partnerships Could Shape Long-Term Growth for Investors (FICO)

Reviewed by Sasha Jovanovic

- On November 20, 2025, GFT Technologies and FICO announced a global partnership to deliver AI-driven real-time fraud prevention and risk management for banks and insurers, alongside a new FICO collaboration with Plaid to launch an enhanced UltraFICO Score utilizing real-time cash flow data.

- These alliances signal FICO’s expansion into advanced analytics and open banking solutions, integrating generative AI and consumer-permissioned data to support faster, more accurate risk and credit decisions for financial institutions worldwide.

- We'll explore how FICO’s integration of generative AI and Plaid’s real-time data infrastructure could reshape its long-term growth outlook.

Outshine the giants: these 26 early-stage AI stocks could fund your retirement.

Fair Isaac Investment Narrative Recap

To invest in Fair Isaac, you need to believe that the company’s expertise in credit scoring, fraud prevention, and analytics will remain essential as the financial sector evolves. The new alliances with GFT Technologies and Plaid support FICO’s shift into advanced AI and real-time data analytics, which could reinforce its role as a trusted partner to financial institutions. However, the main short-term catalyst remains lender adoption of FICO’s platform upgrades, and the primary risk is regulatory changes introducing more competition; this news modestly eases, but does not erase, those concerns.

Among recent announcements, the FICO-Plaid partnership stands out. By combining FICO’s scoring system with Plaid’s expansive real-time data, FICO offers lenders a more comprehensive view of consumer creditworthiness alongside quicker, more seamless implementation, helping address ongoing pressures from alternative data providers and regulatory shifts in the credit market.

Yet, investors should also weigh how increased lender choice and potential regulatory moves affecting GSE mortgage scoring could threaten FICO’s market share and pricing power…

Read the full narrative on Fair Isaac (it's free!)

Fair Isaac's narrative projects $2.9 billion in revenue and $1.1 billion in earnings by 2028. This requires 14.3% annual revenue growth and a $467.4 million earnings increase from $632.6 million currently.

Uncover how Fair Isaac's forecasts yield a $2016 fair value, a 11% upside to its current price.

Exploring Other Perspectives

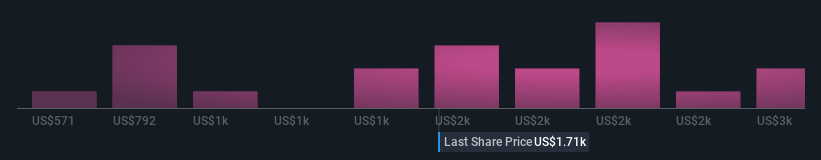

Eighteen members of the Simply Wall St Community estimate FICO’s fair value from US$966 to US$2,627. While expectations for platform growth are high, regulatory risks around FICO Score alternatives may reshape future outcomes. Explore these distinct viewpoints to see how your assessment compares.

Explore 18 other fair value estimates on Fair Isaac - why the stock might be worth as much as 45% more than the current price!

Build Your Own Fair Isaac Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Fair Isaac research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Fair Isaac research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Fair Isaac's overall financial health at a glance.

No Opportunity In Fair Isaac?

Every day counts. These free picks are already gaining attention. See them before the crowd does:

- AI is about to change healthcare. These 30 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

- These 12 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:FICO

Fair Isaac

Provides analytics software in the Americas, Europe, the Middle East, Africa, and the Asia Pacific.

Solid track record with moderate growth potential.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

The Quiet Giant That Became AI’s Power Grid

Nova Ljubljanska Banka d.d will expect a 11.2% revenue boost driving future growth

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success