- United States

- /

- Software

- /

- NYSE:FICO

Fair Isaac's Pricing Woes: A New Investment Thesis Awaits

Reviewed by Simply Wall St

- FICO shares dropped 8.11% following concerns over credit scorer's pricing by a federal housing official, snapping a winning streak.

- Despite analyst consensus optimism, FICO's significant price decline prompts a reassessment of its established investment narrative.

Find companies with promising cash flow potential yet trading below their fair value.

Fair Isaac Investment Narrative Recap

The recent dip in Fair Isaac's stock highlights a potential headwind, specifically questioning the company's pricing strategies in light of federal scrutiny. However, it's crucial for investors to maintain a broader perspective while evaluating the stock. The underlying growth narrative remains focused on the expansion into international markets and the introduction of the Mortgage Simulator, promising diversification beyond traditional finance sectors. Near-term catalysts like continued share repurchases may still pose rank as positive opportunities, contributing to earnings per share growth by reducing shares outstanding. The pricing concerns could lead to more cautious enthusiasm regarding mortgage origination growth, yet this issue might not substantially alter the trajectory if managed adeptly. Overall, Fair Isaac seems equipped to weather current challenges while pursuing long-term strategic growth, despite temporary dips in stock performance.

Read the full narrative on Fair Isaac (it's free!)

Exploring Other Perspectives

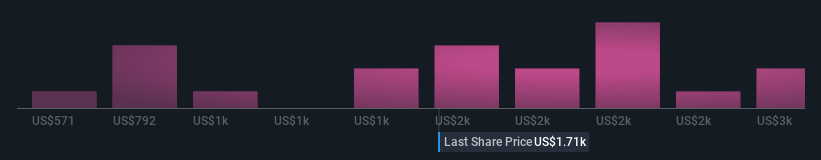

Amid recent setbacks concerning FICO’s pricing approach, some retail investors still view the stock optimistically, estimating fair values as high as $2,782.38. This underscores diverse investor perspectives, encouraging exploration of various outlooks.

Build Your Own Fair Isaac Narrative

Disagree with existing narratives? Create your own in under 3 minutes — extraordinary investment returns rarely come from following the herd.

- A great starting point for your Fair Isaac research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Fair Isaac research report provides a comprehensive fundamental analysis summarized in a single visual — the Snowflake — making it easy to evaluate Fair Isaac's overall financial health at a glance.

Looking For Alternative Opportunities?

The market won't wait. These fast-moving stocks are hot now. Grab the list before they run:

- Rare earth metals are an input to most high-tech devices, military and defence systems and electric vehicles. The global race is on to secure supply of these critical minerals. Beat the pack to uncover the 23 best rare earth metal stocks of the very few that mine this essential strategic resource.

- AI is about to change healthcare. These 21 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- Trump's oil boom is here — pipelines are primed to profit. Discover the 22 US stocks riding the wave.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:FICO

Fair Isaac

Provides analytics software in the Americas, Europe, the Middle East, Africa, and the Asia Pacific.

Solid track record with moderate growth potential.

Similar Companies

Market Insights

Community Narratives