- United States

- /

- Software

- /

- NYSE:ESTC

Elastic (ESTC) Valuation Check After Winning Major CISA SIEMaaS Cybersecurity Contract

Reviewed by Simply Wall St

Elastic (NYSE:ESTC) is back in focus after securing a multiyear agreement with the U.S. Cybersecurity and Infrastructure Security Agency to build a standardized SIEM as a Service platform for federal civilian agencies.

See our latest analysis for Elastic.

The CISA deal comes at a time when Elastic’s share price has pulled back, with a year-to-date share price return of negative 23.14 percent and a one-year total shareholder return of negative 26.55 percent. However, a three-year total shareholder return of 46.42 percent indicates momentum over the longer term even as near-term sentiment cools.

If this kind of government-focused win has you rethinking where growth could come from next, it is worth exploring other high-growth tech and AI names via high growth tech and AI stocks.

With the stock down sharply this year but still growing revenue at double-digit rates and trading at a steep discount to analyst targets and intrinsic value, is Elastic quietly undervalued or already reflecting all of its future AI-driven growth?

Most Popular Narrative Narrative: 28.3% Undervalued

Against a last close of $76.17, the most followed narrative pegs Elastic’s fair value at $106.22, framing today’s pullback as a potential mispricing.

The shift to Elastic Cloud, including the growing adoption of serverless and fully managed solutions across all major cloud providers, is supporting margin improvement and predictability in revenue streams as higher value enterprise and mid market customers migrate from self managed environments. Ongoing platform consolidation trends, where enterprises seek unified solutions for search, observability, and security, are enabling Elastic to displace legacy providers and drive cross selling of its integrated offerings, leading to deeper customer relationships and improved net dollar retention rates.

Curious how moderate growth, rising margins, and a richer earnings profile can still justify a premium valuation multiple over a multi year horizon? Unpack the full narrative to see the specific revenue paths, profitability shifts, and discount rate assumptions that turn today’s price into a projected upside story.

Result: Fair Value of $106.22 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, intensifying competition from hyperscalers and potential pricing pressure in observability could quickly erode Elastic’s growth momentum and compress margins.

Find out about the key risks to this Elastic narrative.

Another Take on Value

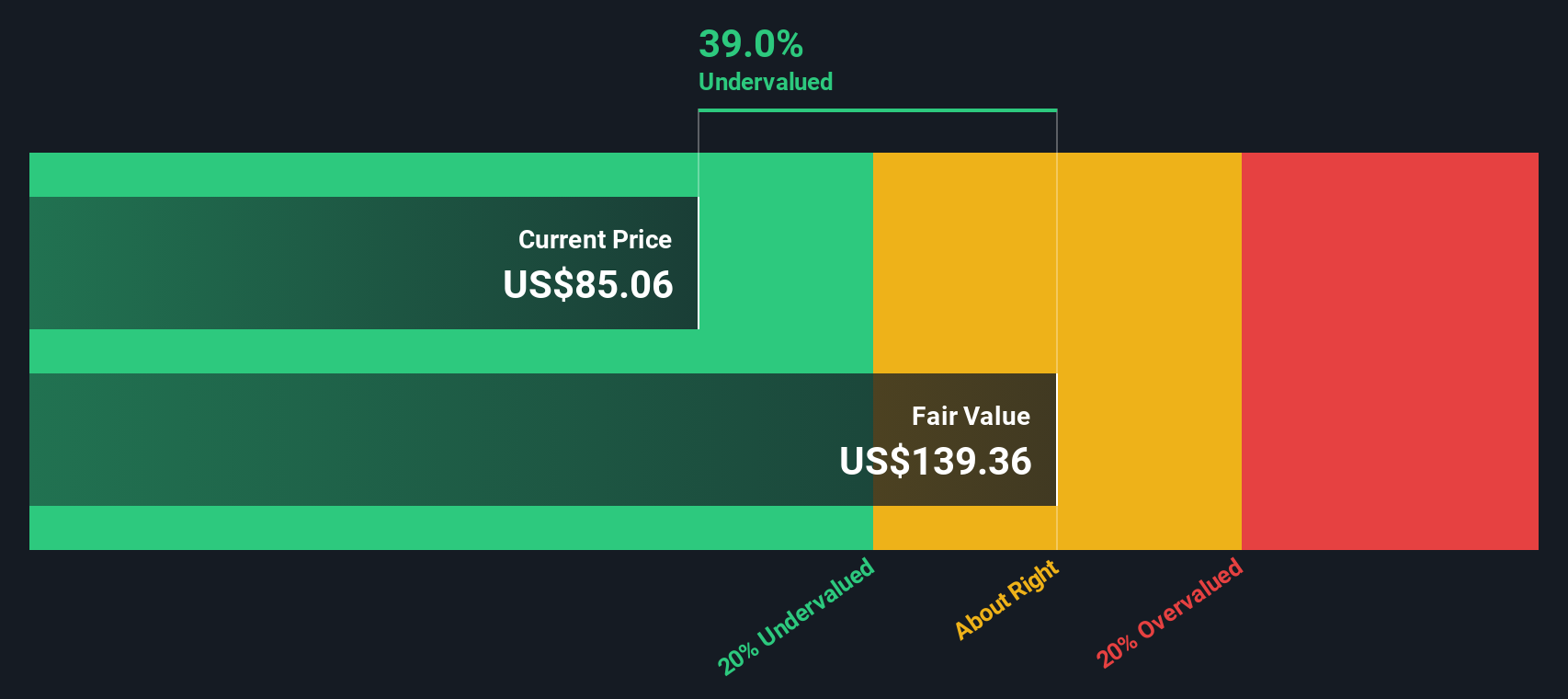

While narratives and analyst targets suggest Elastic is about 28.3 percent undervalued, our DCF model is even more optimistic. It puts fair value near $135.17, roughly 43.6 percent above the current price. Is the market underestimating long term cash flows or correctly pricing execution risk?

Look into how the SWS DCF model arrives at its fair value.

Build Your Own Elastic Narrative

And if you would rather challenge these assumptions or lean on your own research instead, you can build a personalized narrative in minutes: Do it your way.

A great starting point for your Elastic research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

If you stop at just one company, you could miss the bigger opportunities. Use the Simply Wall Street Screener to uncover ideas that truly fit your strategy.

- Capture early growth potential by reviewing these 3616 penny stocks with strong financials before the market fully wakes up to their momentum.

- Position yourself for the next wave of innovation by assessing these 25 AI penny stocks reshaping how businesses operate and compete.

- Strengthen your margin of safety by focusing on these 918 undervalued stocks based on cash flows that the market may be mispricing today.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechValuation is complex, but we're here to simplify it.

Discover if Elastic might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:ESTC

Elastic

A search artificial intelligence (AI) company, provides software platforms to run in hybrid, public or private clouds, and multi-cloud environments in the United States and internationally.

High growth potential with excellent balance sheet.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Title: Market Sentiment Is Dead Wrong — Here's Why PSEC Deserves a Second Look

An amazing opportunity to potentially get a 100 bagger

Amazon: Why the World’s Biggest Platform Still Runs on Invisible Economics

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

Trending Discussion