- United States

- /

- IT

- /

- NYSE:EPAM

Is Stronger AI and Cloud Demand Altering the Investment Case for EPAM Systems (EPAM)?

Reviewed by Sasha Jovanovic

- Earlier this month, EPAM Systems announced stronger-than-expected Q3 2025 adjusted earnings and revenue, while raising its full-year adjusted EPS and revenue guidance as demand for AI, cloud, automation, and modernization services accelerated.

- A recent decline in return on invested capital has raised questions about the profitability of new investments, even as the company reports solid free cash flow margins and upbeat outlooks.

- We'll examine how EPAM's raised annual EPS forecast, driven by robust AI and cloud demand, could influence its investment narrative.

These 12 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

EPAM Systems Investment Narrative Recap

To be a shareholder in EPAM Systems, you would need to believe in the company’s ability to leverage sustained AI and cloud demand, outpacing broader shifts in enterprise technology. While the recent beat on adjusted earnings and revenue supports this trend and gave a boost to its short-term outlook, the year-over-year decline in return on invested capital tempers enthusiasm, suggesting the main risk right now is whether new investments continue to deliver profitable growth. At present, the impact of these results appears more positive for the short-term catalyst, ongoing client demand for modernization, than for the longer-term profitability question.

Among EPAM’s recent announcements, the launch of its AI/Run™ Transform Playbook in October stands out. This integrated consulting and product suite aims to address enterprise-scale AI transformation and provides direct context for the updated annual guidance, reflecting how new solutions could support revenue growth amid heightened client interest in AI modernization initiatives.

However, investors should be aware that despite these growth drivers, the continuing decline in return on invested capital presents a contrast that...

Read the full narrative on EPAM Systems (it's free!)

EPAM Systems' narrative projects $6.5 billion in revenue and $582.4 million in earnings by 2028. This requires 8.8% yearly revenue growth and a $181.2 million earnings increase from the current $401.2 million.

Uncover how EPAM Systems' forecasts yield a $207.29 fair value, a 12% upside to its current price.

Exploring Other Perspectives

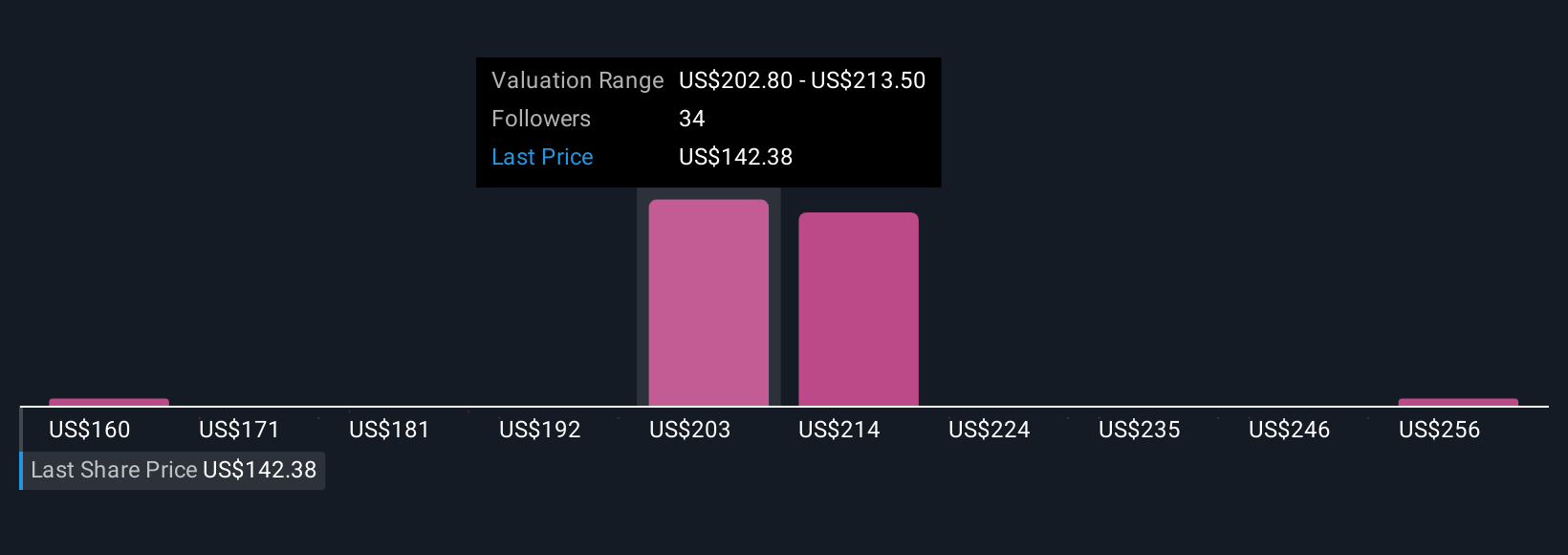

Nine fair value estimates from the Simply Wall St Community range from US$160 to US$267 per share. While AI-driven modernization remains a positive catalyst for EPAM, opinions are divided and you can explore a spectrum of alternative viewpoints.

Explore 9 other fair value estimates on EPAM Systems - why the stock might be worth as much as 45% more than the current price!

Build Your Own EPAM Systems Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your EPAM Systems research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

- Our free EPAM Systems research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate EPAM Systems' overall financial health at a glance.

Ready For A Different Approach?

Don't miss your shot at the next 10-bagger. Our latest stock picks just dropped:

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

- We've found 15 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if EPAM Systems might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:EPAM

EPAM Systems

Provides digital platform engineering and software development services worldwide.

Flawless balance sheet and fair value.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

TAV Havalimanlari Holding will fly high with 25.68% revenue growth

Fiducian: Compliance Clouds or Value Opportunity?

Q3 Outlook modestly optimistic

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.