Want to participate in a short research study? Help shape the future of investing tools and receive a $20 prize!

DXC Technology Company (NYSE:DXC) shareholders should be happy to see the share price up 14% in the last quarter. But that is minimal compensation for the share price under-performance over the last year. After all, the share price is down 36% in the last year, significantly under-performing the market.

View our latest analysis for DXC Technology

To paraphrase Benjamin Graham: Over the short term the market is a voting machine, but over the long term it's a weighing machine. One way to examine how market sentiment has changed over time is to look at the interaction between a company's share price and its earnings per share (EPS).

DXC Technology managed to increase earnings per share from a loss to a profit, over the last 12 months. Earnings per share growth rates aren't particularly useful for comparing with the share price, when a company has moved from loss to profit. So it makes sense to check out some other factors.

Given the yield is quite low, at 1.1%, we doubt the dividend can shed much light on the share price. DXC Technology's revenue is actually up 32% over the last year. Since the fundamental metrics don't readily explain the share price drop, there might be an opportunity if the market has overreacted.

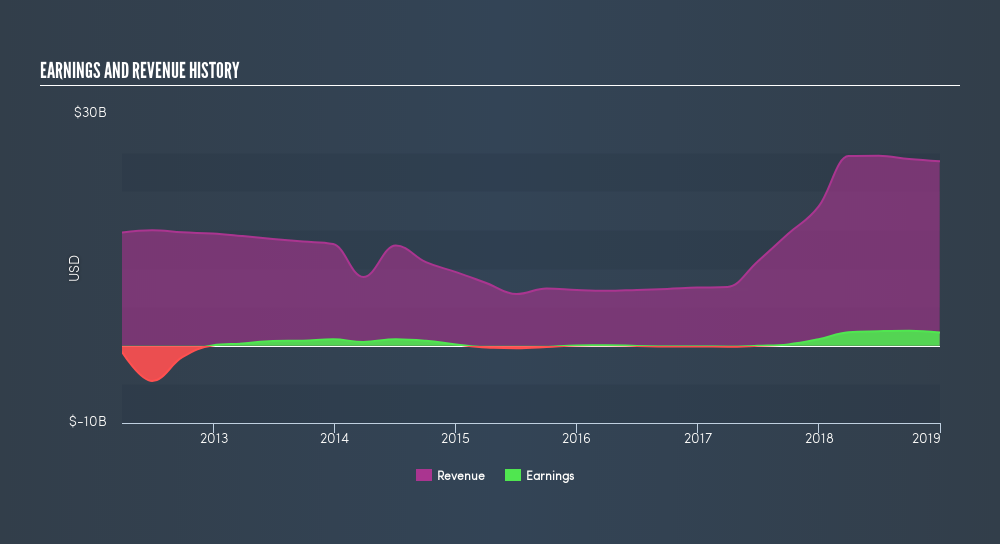

Depicted in the graphic below, you'll see revenue and earnings over time. If you want more detail, you can click on the chart itself.

DXC Technology is a well known stock, with plenty of analyst coverage, suggesting some visibility into future growth. So we recommend checking out this freereport showing consensus forecasts

What About Dividends?

It is important to consider the total shareholder return, as well as the share price return, for any given stock. The TSR incorporates the value of any discounted capital raisings, along with any dividends, based on the assumption that the dividends are reinvested. It's fair to say that the TSR gives a more complete picture for stocks that pay a dividend. As it happens, DXC Technology's TSR for the last year was -26%, which exceeds the share price return mentioned earlier. The dividends paid by the company have thusly boosted the total shareholder return.

A Different Perspective

While DXC Technology shareholders are down 26% for the year (even including dividends), the market itself is up 3.1%. While the aim is to do better than that, it's worth recalling that even great long-term investments sometimes underperform for a year or more. Putting aside the last twelve months, it's good to see the share price has rebounded by 14%, in the last ninety days. Let's just hope this isn't the widely-feared 'dead cat bounce' (which would indicate further declines to come). Before spending more time on DXC Technology it might be wise to click here to see if insiders have been buying or selling shares.

But note: DXC Technology may not be the best stock to buy. So take a peek at this freelist of interesting companies with past earnings growth (and further growth forecast).

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on US exchanges.We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.

About NYSE:DXC

DXC Technology

Provides information technology services and solutions in the United States, the United Kingdom, the rest of Europe, Australia, and internationally.

Undervalued with excellent balance sheet.

Market Insights

Community Narratives