- United States

- /

- IT

- /

- NYSE:DXC

How Investors Are Reacting To DXC Technology (DXC) Taking a Key Role in Enterprise AI Deployments

Reviewed by Sasha Jovanovic

- In early October 2025, Digital Realty announced a collaboration with Dell Technologies and DXC Technology to address enterprise AI challenges by enabling secure, scalable private AI deployments through the Dell AI Factory, Digital Realty’s global PlatformDIGITAL® network, and DXC’s end-to-end operational management.

- This partnership highlights DXC’s integral role in accelerating enterprise AI adoption by delivering expert implementation, validated use cases, and comprehensive transformation services tailored for complex organizational needs.

- To assess the impact on DXC’s investment case, we’ll explore how its operational role in private AI deployments could influence long-term growth prospects.

Uncover the next big thing with financially sound penny stocks that balance risk and reward.

DXC Technology Investment Narrative Recap

To justify owning DXC Technology, shareholders must have confidence in its ongoing pivot from legacy IT outsourcing to a services portfolio built around AI, cloud, and digital transformation. While the recent Dell and Digital Realty partnership demonstrates DXC’s position in next-generation AI implementation, it is unlikely to significantly shift near-term sentiment since persistent organic revenue declines and ongoing GIS erosion remain the most pressing challenges for earnings stabilization, outweighing the immediate impact of this news.

Among recent announcements, the Iberdrola cloud transformation project stands out as especially relevant, given its parallels to the new AI collaboration, it underscores DXC's capability to modernize complex enterprise infrastructure and deliver value-driven digital migrations at scale, a core theme for all near-term revenue catalysts. However, much rides on converting these wins into broad-based revenue growth as the GIS segment continues to contract.

However, while partnerships drive optimism, the stickier risk for shareholders is ongoing organic revenue declines and the potential...

Read the full narrative on DXC Technology (it's free!)

DXC Technology's narrative projects $12.1 billion in revenue and $208.6 million in earnings by 2028. This requires a 1.7% yearly revenue decline and a $170.4 million decrease in earnings from the current $379.0 million.

Uncover how DXC Technology's forecasts yield a $15.12 fair value, a 10% upside to its current price.

Exploring Other Perspectives

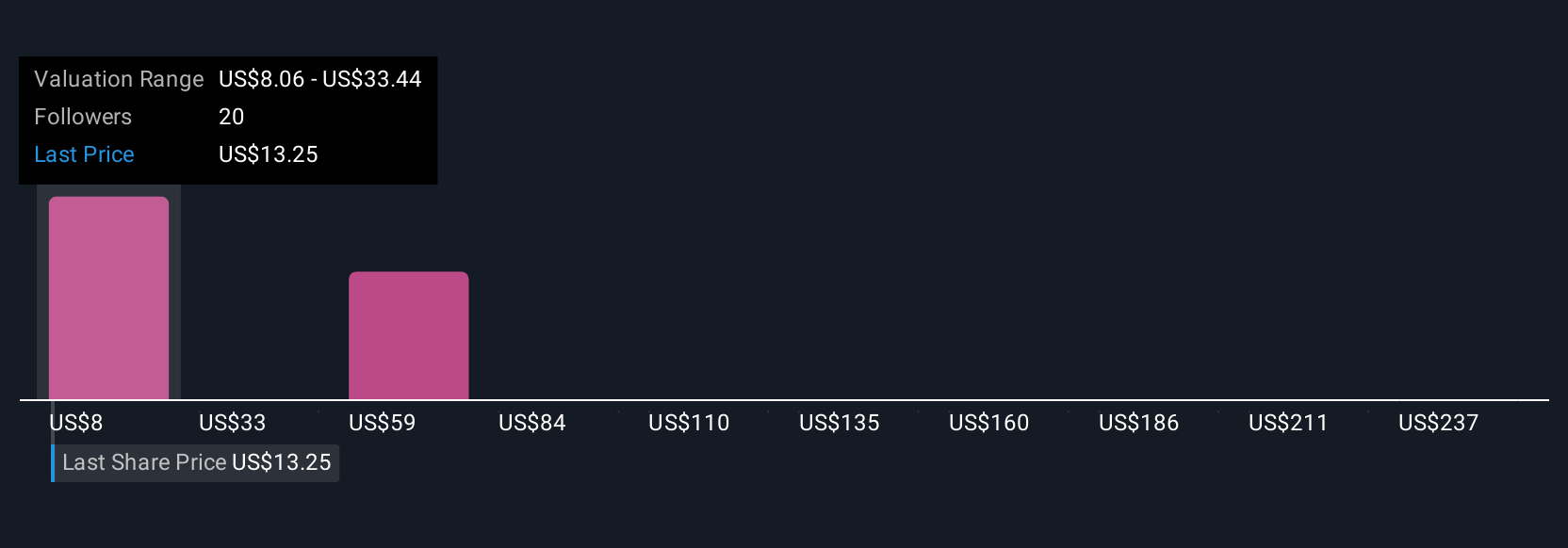

Six members of the Simply Wall St Community have modeled DXC fair value from US$8.06 up to US$261.89. As you compare these wide-ranging views, keep in mind that persistent revenue decline remains a key issue for future performance.

Explore 6 other fair value estimates on DXC Technology - why the stock might be worth 42% less than the current price!

Build Your Own DXC Technology Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your DXC Technology research is our analysis highlighting 3 key rewards and 3 important warning signs that could impact your investment decision.

- Our free DXC Technology research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate DXC Technology's overall financial health at a glance.

Searching For A Fresh Perspective?

Every day counts. These free picks are already gaining attention. See them before the crowd does:

- Rare earth metals are an input to most high-tech devices, military and defence systems and electric vehicles. The global race is on to secure supply of these critical minerals. Beat the pack to uncover the 34 best rare earth metal stocks of the very few that mine this essential strategic resource.

- Explore 26 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

- AI is about to change healthcare. These 32 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:DXC

DXC Technology

Provides information technology services and solutions in the United States, the United Kingdom, the rest of Europe, Australia, and internationally.

Undervalued with solid track record.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

TAV Havalimanlari Holding will fly high with 25.68% revenue growth

Fiducian: Compliance Clouds or Value Opportunity?

Q3 Outlook modestly optimistic

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.