- United States

- /

- Software

- /

- NYSE:DT

Dynatrace (DT) Valuation in Focus Following Strategic Move with GitHub MCP Registry Launch

Reviewed by Kshitija Bhandaru

Dynatrace (DT) is making headlines with its latest move, announcing its participation in the launch of the GitHub MCP Registry, an initiative aimed at helping developers discover and integrate AI-ready services with greater ease. This partnership, building on Dynatrace’s ongoing commitment to open, modern cloud ecosystems, comes alongside a deepening relationship with GitHub. For investors, this event matters because it exposes Dynatrace to a stream of developers seeking advanced observability and automation tools and could ultimately drive growth by embedding Dynatrace into more innovation pipelines.

Looking beyond today’s announcement, Dynatrace’s share price tells a bit of a mixed story. Over the past year, the stock has slipped by 6%, and more recently has seen losses accelerate, down 11% since the start of the year and 11% over the past three months. This moderation in momentum stands in contrast to a strong multi-year performance, with shares up 46% over three years and 17% over five, reflecting periods of brisk expansion tempered by the market’s more cautious outlook in recent months. Meanwhile, annual revenue is up 13% and net income has grown by 7%, highlighting consistent underlying growth even as the market weighs current risks and future prospects.

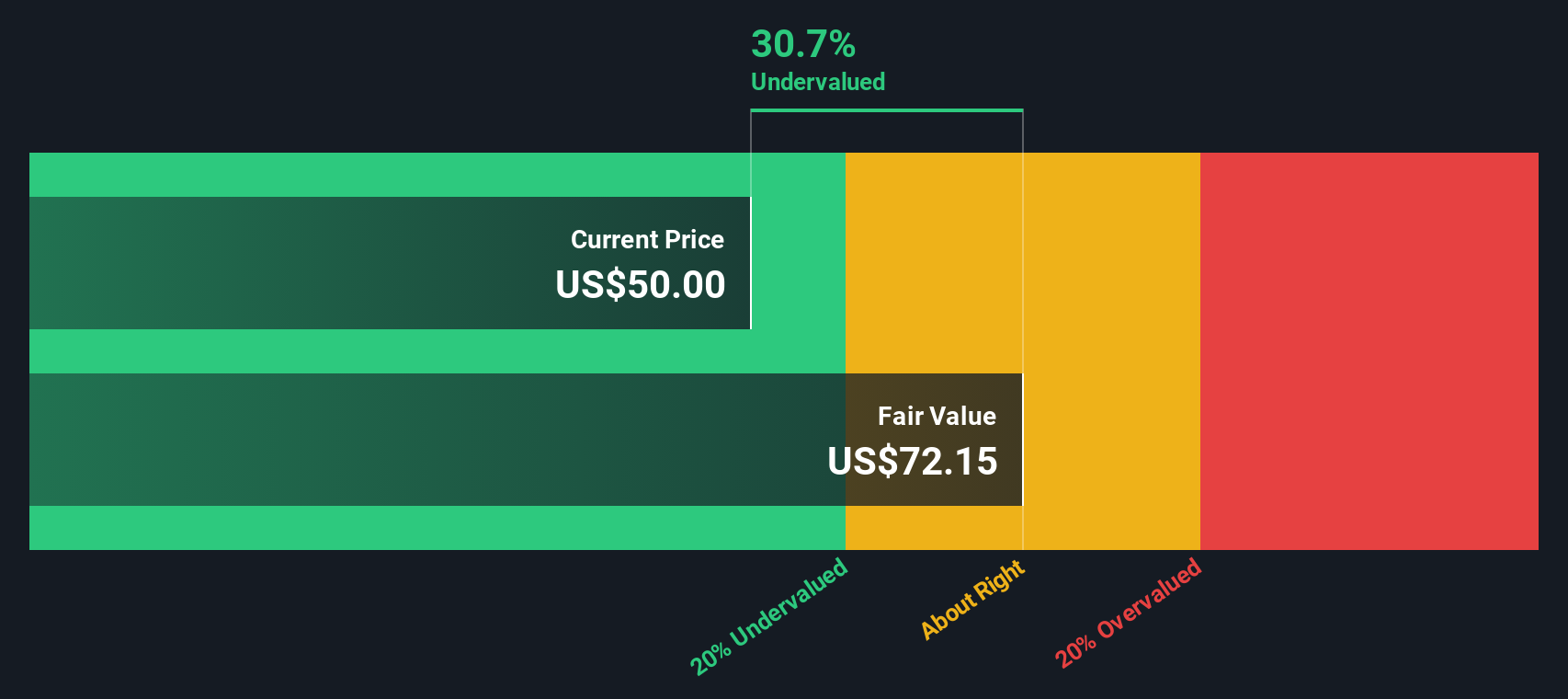

With the share price cooling off while the company pursues strategic partnerships and steady growth, there is ongoing discussion about whether Dynatrace is undervalued at these levels or if the market is already accounting for its future potential.

Most Popular Narrative: 23% Undervalued

The most widely followed narrative currently sees Dynatrace as trading at a substantial discount to its estimated fair value. This suggests the market may be underestimating its earnings power and growth story.

“Investments in AI-driven observability, including significant advancements in agentic AI and integration of predictive, causal, and generative AI, are increasing differentiation and embedding Dynatrace more deeply into enterprise IT operations. This enhances pricing power and supports gross margin stability.”

Curious how this valuation lands so much higher than the market’s? The secret sauce is an aggressive outlook: double-digit sales growth, ambitious profit targets, and a confidence in future cash flows that most companies would envy. Want to know the make-or-break assumption that underpins Dynatrace’s fair value calculation? Dig in to see which financial leap of faith this consensus leans on.

Result: Fair Value of $63.09 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.However, growing competition and the risk of delayed large contracts could challenge Dynatrace’s pace of growth. This could potentially shift the current undervalued narrative.

Find out about the key risks to this Dynatrace narrative.Another View: Discounted Cash Flow

The SWS DCF model also signals Dynatrace is undervalued, supporting that view with a cash flow-based lens rather than focusing purely on earnings multiples. However, do both methods miss something that only the market sees?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Dynatrace for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Dynatrace Narrative

If you have your own angle or want to dig deeper into Dynatrace’s story, it’s easy to craft your own view and see how it stacks up. Do it your way.

A good starting point is our analysis highlighting 5 key rewards investors are optimistic about regarding Dynatrace.

Ready for More Investment Opportunities?

Don’t miss your chance to get ahead. There are smart investment opportunities waiting beyond Dynatrace. Power up your portfolio with proven tools that connect you with the next big movers.

- Uncover untapped market gems and momentum stocks that could be tomorrow’s high flyers with our penny stocks with strong financials.

- Capitalize on the explosive potential of artificial intelligence by using our expert-curated AI penny stocks to spot innovation leaders before the crowd.

- Boost your income stream by zeroing in on reliable companies offering yields above 3% via our dividend stocks with yields > 3%.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:DT

Dynatrace

Engages in the advancement of observability for digital businesses, which transforms the complexity of modern digital ecosystems in North America, Europe, the Middle East, Africa, the Asia Pacific, and Latin America.

Very undervalued with flawless balance sheet.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

The "Molecular Pencil": Why Beam's Technology is Built to Win

ADNOC Gas future shines with a 21.4% revenue surge

Watch Pulse Seismic Outperform with 13.6% Revenue Growth in the Coming Years

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026