- United States

- /

- IT

- /

- NYSE:DOCN

Is DigitalOcean Set for Growth After 15% Weekly Surge and AI Expansion News?

Reviewed by Bailey Pemberton

If you’ve found yourself staring at DigitalOcean Holdings on your watchlist, wondering if now is the right moment to make a move, you’re definitely not alone. Over the last week, shares have climbed an impressive 14.8%, and the 30-day return stands at 17.5%. Even with a strong comeback in the current year, up 26.8%, DigitalOcean’s one-year performance is basically flat at -0.2%. That’s left more than a few investors wondering whether the recent surge is the beginning of something bigger, or just a blip in a choppier long-term trend.

This volatility isn’t happening in a vacuum. Recent shifts in investor sentiment toward cloud providers, paired with sector-wide optimism around AI and developer tools, have re-focused attention on companies like DigitalOcean. While some market watchers see this momentum as a sign of renewed growth potential, others point out that the company’s value score currently sits at 2 out of 6. In other words, it’s undervalued by only a couple of traditional checks, fewer than some peers, and that deserves a closer look.

So is this rally just catching up to fair value, or is DigitalOcean genuinely flying under the radar? Let’s break down how the stock stacks up under classic valuation methods. Then we’ll explore why the usual metrics may only scratch the surface of what really matters for this cloud provider’s future.

DigitalOcean Holdings scores just 2/6 on our valuation checks. See what other red flags we found in the full valuation breakdown.

Approach 1: DigitalOcean Holdings Discounted Cash Flow (DCF) Analysis

The Discounted Cash Flow (DCF) model is a widely used valuation approach that estimates a company's intrinsic value by projecting its future cash flows and discounting them back to today's dollars. It is particularly useful for evaluating companies with predictable cash generation, like DigitalOcean Holdings.

DigitalOcean's current Free Cash Flow stands at $122.3 million, according to the latest trailing twelve months report. Analysts forecast that this will rise steadily, with projections estimating $174.5 million in 2026 and $201.4 million by 2027. Beyond the next five years, Simply Wall St extrapolates potential annual cash flows and expects FCF to grow to approximately $316.8 million by 2035.

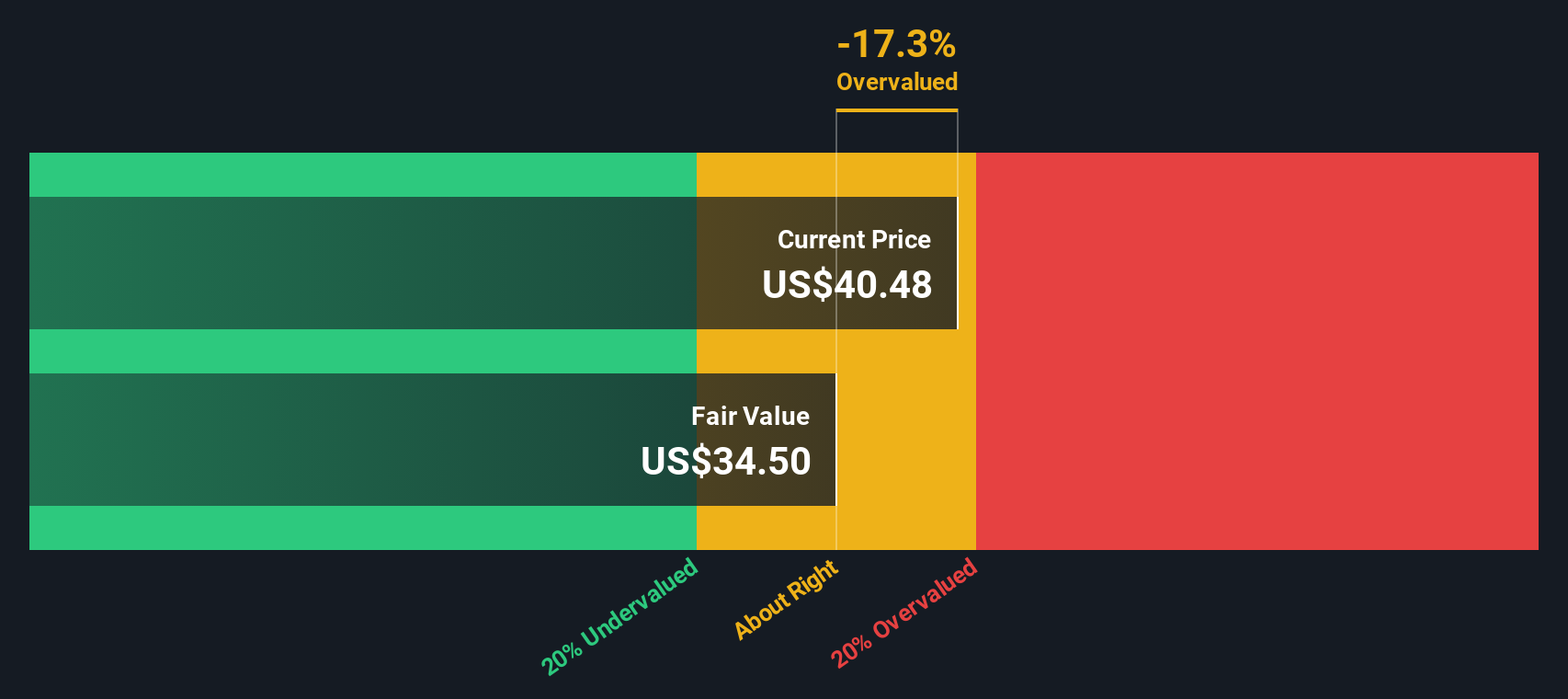

After discounting these future cash flows to the present, the DCF calculates an estimated intrinsic value of $34.73 per share. With the stock’s price trading roughly 25.1% higher than this intrinsic value, the model suggests the shares are overvalued based on fundamentals.

This means that, at least according to cash flow projections and standard DCF analysis, DigitalOcean’s recent momentum has pushed the stock price beyond what its expected earnings justify today.

Result: OVERVALUED

Our Discounted Cash Flow (DCF) analysis suggests DigitalOcean Holdings may be overvalued by 25.1%. Find undervalued stocks or create your own screener to find better value opportunities.

Approach 2: DigitalOcean Holdings Price vs Earnings

The Price-to-Earnings (PE) ratio is a popular metric for valuing profitable companies like DigitalOcean Holdings because it directly links a company’s current share price to its underlying earnings power. It is especially relevant here, as DigitalOcean generates positive profits and investors are keen to gauge whether they are paying a fair price for those earnings.

When considering what constitutes a “normal” or “fair” PE ratio, it is important to account for a company’s expected growth and risk profile. Higher anticipated earnings growth and lower risk can justify a higher PE ratio, whereas slower-growing, riskier businesses typically command a discount.

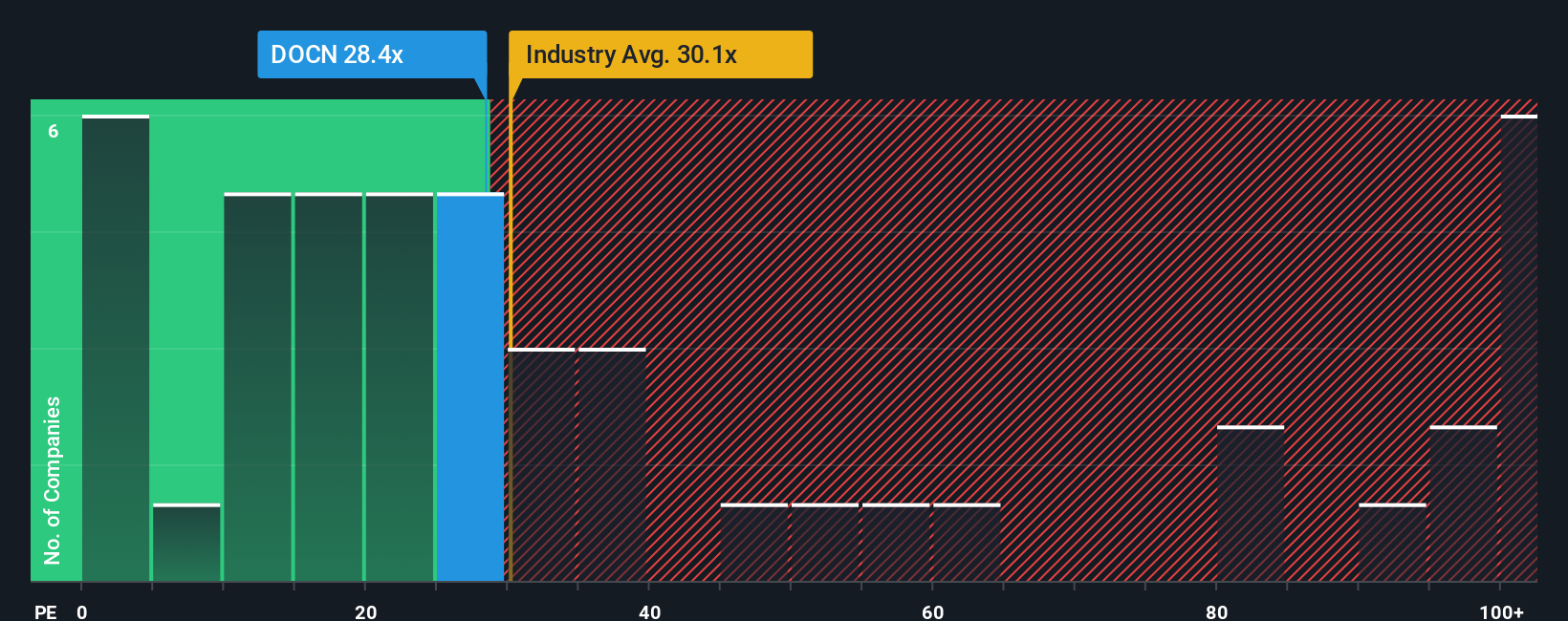

Currently, DigitalOcean Holdings trades at a PE of 31.3x. This is very close to the IT sector’s average of 32.7x and notably lower than the average of its closest peers, which sits at 80.4x. At first glance, this suggests the stock is not overpriced compared to similar companies or the broader industry.

However, Simply Wall St’s proprietary Fair Ratio takes the analysis a step further. This custom benchmark considers not just industry norms and peer valuations, but also DigitalOcean’s unique earnings growth prospects, risk factors, profit margins, and market capitalization. As a result, it provides a more tailored view of what a reasonable PE should be for this specific business.

With a Fair Ratio of 30.3x, DigitalOcean’s actual PE ratio of 31.3x is nearly identical, signaling the shares are trading at a price in line with the company’s true fundamentals, rather than at a steep discount or premium.

Result: ABOUT RIGHT

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your DigitalOcean Holdings Narrative

Earlier we mentioned that there's an even better way to understand valuation. Let's introduce you to Narratives. A Narrative is a simple and powerful tool that connects your personal story about a company, including your beliefs about its future products, growth, and risks, to a forecast for revenue, earnings, and margins. This ultimately drives your estimate of its fair value.

Instead of relying on a single static number, Narratives let you articulate your unique perspective, show how changes in the business could impact its value, and transparently see how your assumptions stack up. Using Simply Wall St’s Community page, where millions interact, you can create or browse Narratives. Each Narrative links a company's story and rationale directly to a detailed financial outlook and fair value calculation.

This approach helps you decide when to buy or sell by comparing your Narrative's fair value to today’s share price, making it clear if you think the stock is a bargain or overhyped. Narratives also stay current because whenever news, earnings releases, or forecasts change, the story and numbers update dynamically to keep your investment decisions relevant.

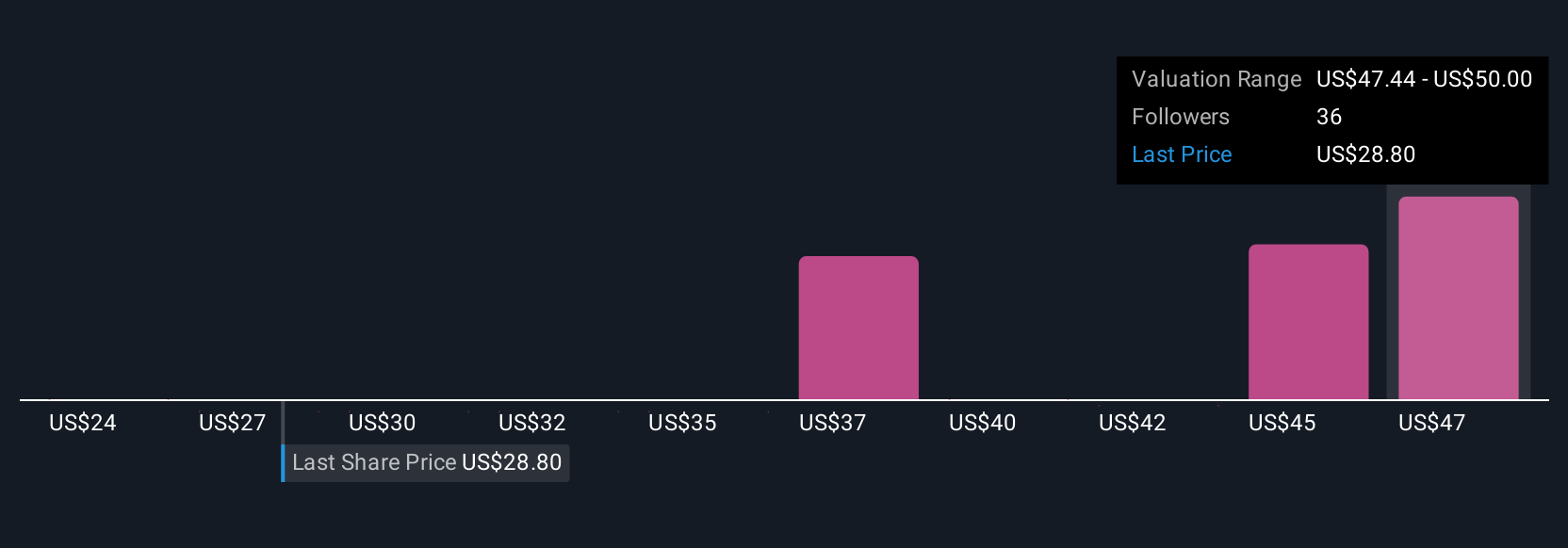

For example, bullish investors might believe new AI tools will drive revenue acceleration and assign DigitalOcean Holdings a fair value of $55. More cautious investors, noting intense competition, could arrive at a fair value as low as $32.

For DigitalOcean Holdings, we’ll make it really easy for you with previews of two leading DigitalOcean Holdings Narratives:

- 🐂 DigitalOcean Holdings Bull Case

Fair Value: $50.00

Current Price is 13.1% below fair value

Revenue Growth Rate: 18.6%

- Focuses on simplicity, transparent pricing, and developer community to serve SMBs and startups. The Paperspace acquisition is set to drive expansion into AI/ML services.

- Growth strategy targets global SMB cloud adoption, AI-driven product upsell, and higher customer monetization while maintaining strong free cash flow.

- Key risks include increased competition, potential customer churn, integration challenges with AI/ML offerings, and economic uncertainty affecting SMB spending.

- 🐻 DigitalOcean Holdings Bear Case

Fair Value: $41.60

Current Price is 4.4% above fair value

Revenue Growth Rate: 14.6%

- Broad AI and product innovation are driving market expansion and revenue growth, but competition and execution risks threaten long-term differentiation and stability.

- Sustained growth is based on scaling AI/ML services, direct sales improvements, and operational leverage, but profit margins are expected to decline modestly over the next 3 years.

- Risks include competition from hyperscalers, challenges in AI/ML scaling, uncertain customer retention, and rapid technological changes that could lead to margin compression.

Do you think there's more to the story for DigitalOcean Holdings? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:DOCN

DigitalOcean Holdings

Through its subsidiaries, operates a cloud computing platform in North America, Europe, Asia, and internationally.

Good value with proven track record.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

The Great Strategy Swap – Selling "Old Auto" to Buy "Future Light"

Not a Bubble, But the "Industrial Revolution 4.0" Engine

The "David vs. Goliath" AI Trade – Why Second Place is Worth Billions

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026